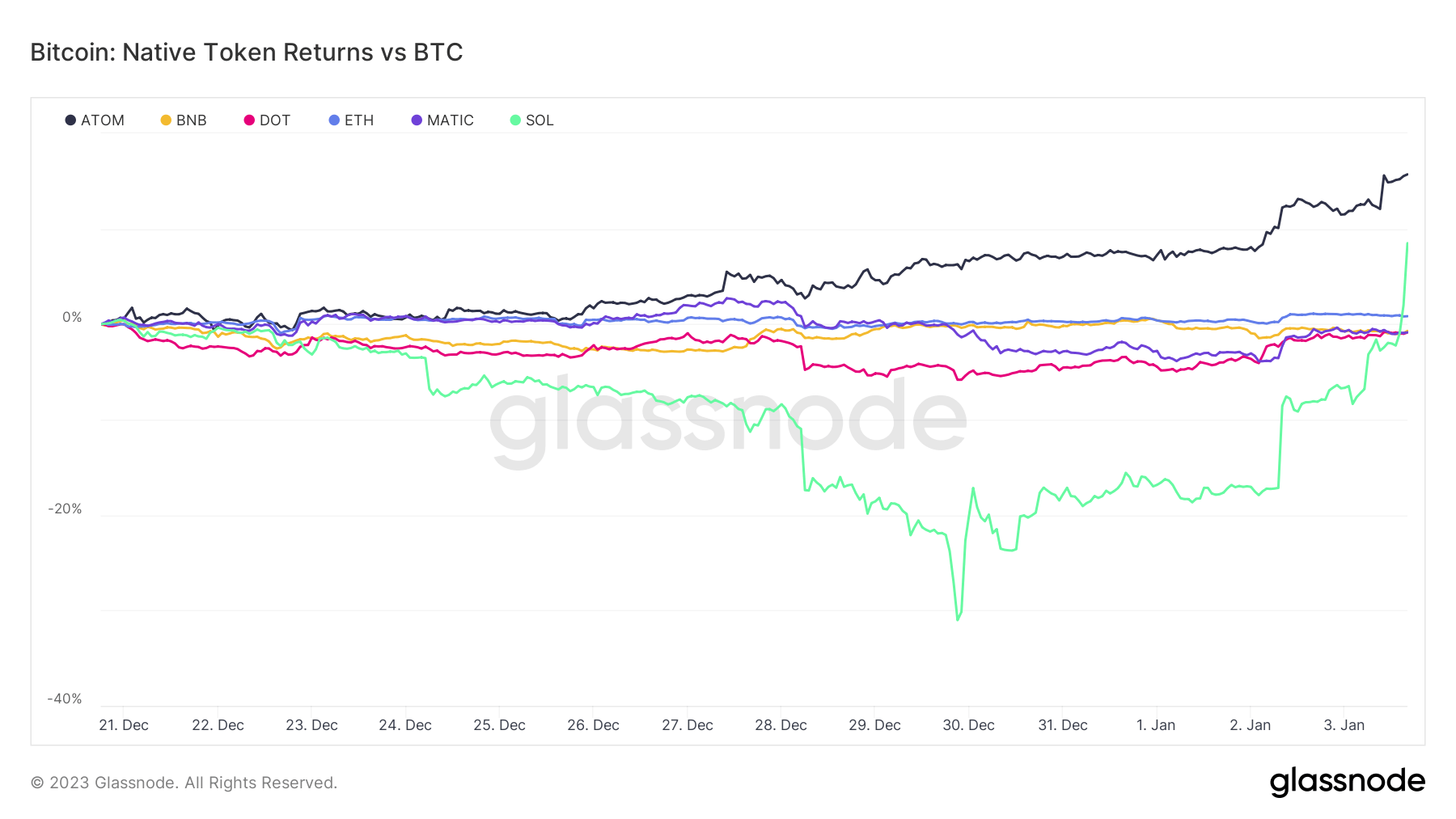

Altcoins often mirror the price movements of Bitcoin (BTC), the largest cryptocurrency by market capitalization. However, Cosmos (ATOM) and Solana (SOL), over the past two weeks, managed to outperform BTC.

Cosmos is up nearly 15% compared to BTC over the past two weeks, Glassnode data indicates. On the other hand, SOL beat BTC by almost 8% over the past 14 days, despite seeing a significant dip on Dec. 29, 2022.

An analysis of the Glassnode chart indicates that Cosmos returns closely followed that of BTC until 26 Dec. The following day, ATOM returns began rising compared to BTC and experienced little volatility on its journey upwards. At the time of writing, ATOM was trading at around $10.09 — up 9.52% over the past week, while BTC is down 0.23%.

SOL price tanked significantly since early November, owing to its ties with FTX and its founder Sam Bankman-Fried (SBF) — SBF and his hedge fund Alameda Research were early backers of Solana. The token lost around 55% of its value in November following the bankruptcy filing of FTX and Alameda Research.

Solana continued its descent through most of December. The above Glassnode chart indicates that SOL price declined by more than 30% compared to BTC on Dec. 29, hitting a low of around $8.26.

However, over the past five days, the SOL price jumped considerably to around $13.02 at the time of writing, CryptoSlate data shows. Solana is up 18.91% over the past seven days, according to CryptoSlate data.

Ethereum (ETH), the second-largest cryptocurrency by market cap, has closely followed Bitcoin since Dec. 21. Over the past two weeks, ETH returns have been slightly better than Bitcoin’s. ETH was trading at around $1,207.66 at the time of writing, down 0.11% over the past week.

BNB (BNB), Polygon (MATIC), and Polkadot (DOT) gave similar returns — slightly lower than that of BTC over the past two weeks.

The post ATOM and SOL beat BTC returns over the past 2 weeks appeared first on CryptoSlate.