Popular BTC proponent Lyn Alden took to Twitter to explain how the Bitcoin (BTC) network will become more efficient with increasing adoption.

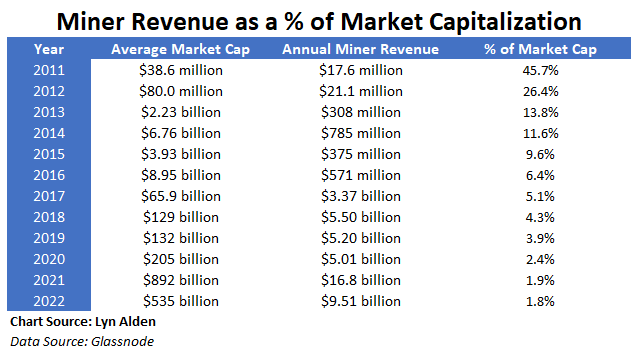

Alden shared data sourced from Glassnode to indicate that BTC mining revenue grows more slowly than BTC market cap and transaction volume.

In 2022, annual BTC mining revenue stood at $9.51 billion — 1.8% of the average BTC market cap of $535 billion. Even with mining revenue reaching $16.8 billion in 2021, it accounted for only 1.9% of the $892 billion BTC market cap.

Between 2011 and 2022, mining revenue steadily decreased in proportion to the BTC market cap, as the above chart indicates.

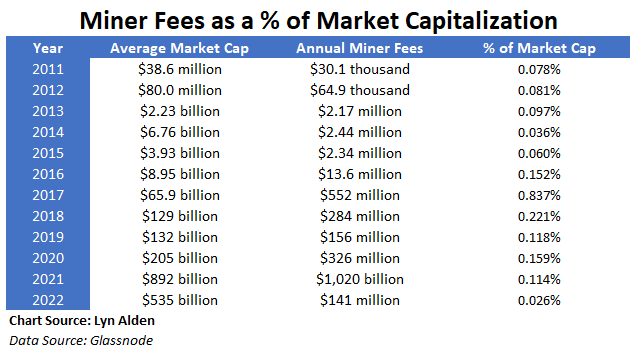

Miner fees amounted to $141 million in 2022 — 0.026% of the BTC market cap. Although miner fees as a percentage of BTC market cap fluctuated significantly over the past 12 years, it has stayed well below 1%, as the chart indicates.

Similarly, mining revenue and fees accounted for only 0.064% and 0.0010% of BTC transaction volume of $14.86 trillion in 2022. However, BTC’s monetary velocity — or how quickly BTC is circulating, not accounting for sudden spikes from mixers and exchange shuffling — stood at 7.7 in 2022, compared to 5.2 in 2021.

Overall, BTC market cap and transaction volume growth have continued to outpace growth in mining revenue and fees over the past 12 years.

For and Against

Many critics argue that Bitcoin not only uses too much energy at present but will continue to do so in the future. On the flip side, critics also argue that the network will not use enough energy to remain secure, as BTC’s block subsidy moves towards only fees.

However, critics who doubt BTC security — due to a lack of fees — fail to take SegWit adoption into account because they think volume is stagnant, according to Alden.

“Ever since the Segwit soft fork was introduced, whenever bitcoin fees get high, it results in a new spike of Segwit adoption — the network gets more efficient over time.”

Alden said, explaining that if BTC transaction volume keeps increasing, it will create upward fee pressure. When the upward fee pressure occurs, it will incentivize new development across layers of the Bitcoin stack, like the Lightning Network, and drive their adoption.

The post Bitcoin’s energy efficiency will increase with adoption – proponent says appeared first on CryptoSlate.