The year 2022 marked the start of a new crypto winter, with major crypto companies collapsing and digital currency prices plummeting, including Bitcoin.

In addition, interest rate increases and general economic negativity are causing investors to worry.

The fundamentals of Bitcoin remain strong despite all of these. Let’s take a look at some of the Bitcoin metrics for the year 2022:

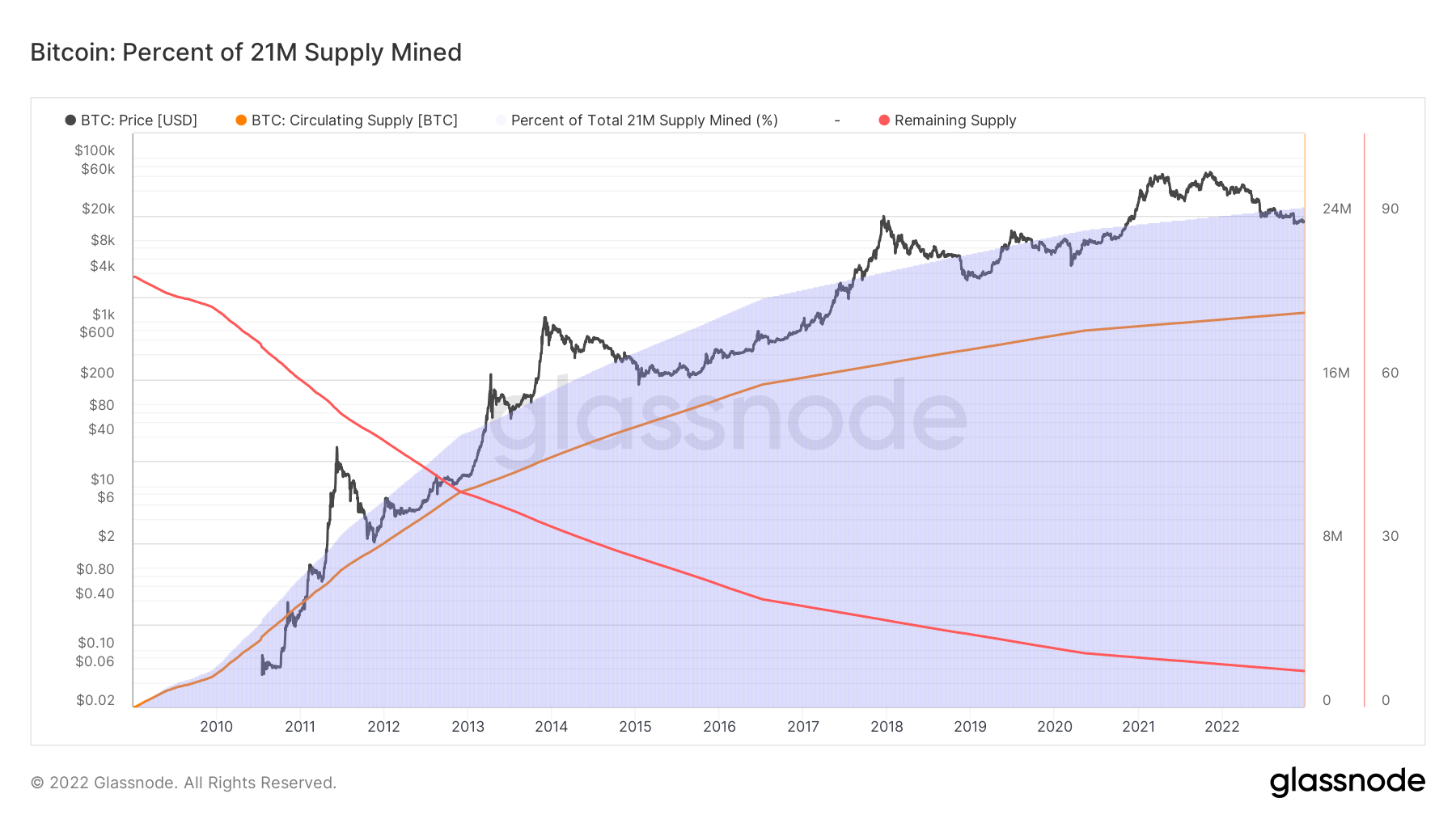

Bitcoin Circulating Supply

The circulating supply of Bitcoin currently stands at 19,257,175 – 91.7% of the capped maximum supply of 21 million coins. Now, there are 1,742,825 left to be mined before the limit of 21 million bitcoins is reached.

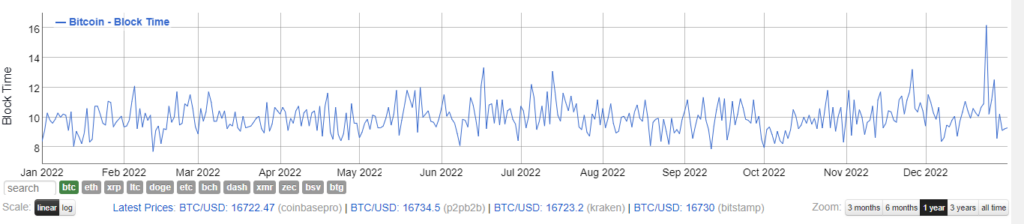

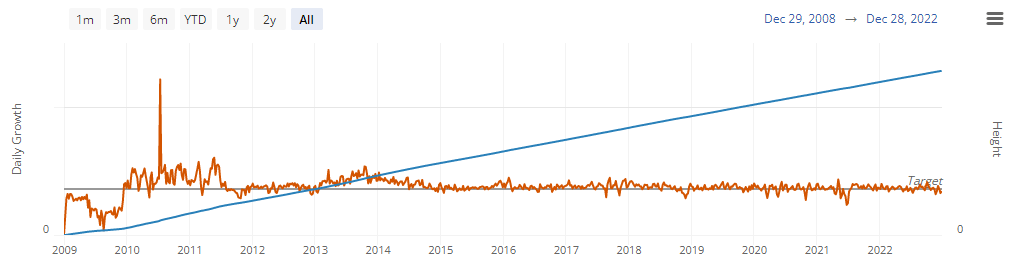

An average of one bitcoin block is created every 10 minutes, so Bitcoin’s supply is increasing approximately every 10 minutes.

However, despite a severe market downturn, including miner capitulation and forced liquidation, defi platform hacks, Bitcoin has largely maintained consistent 10-minute block times IN 2022.

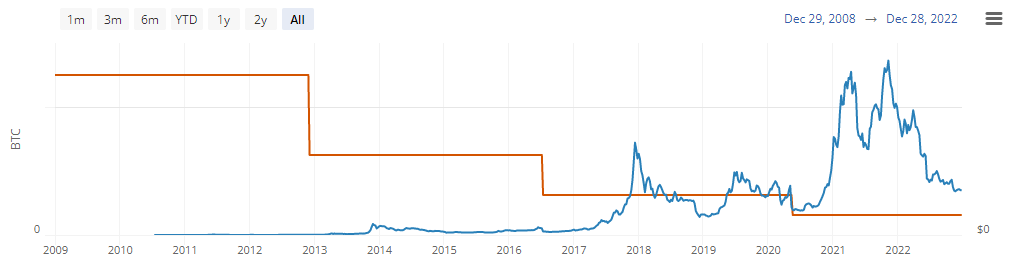

Bitcoin miner’s block reward

Two components constitute bitcoin block rewards: newly created coins and transaction fees. When they successfully validate blocks on the network, the reward is given to miners.

The number of newly generated coins is regulated by a halving event that occurs roughly every four years. The Bitcoin halving event reduces the supply of new bitcoins by half and aims to ensure that all 21 million bitcoins have been mined.

Despite moving all their BTC to different addresses, the newly generated Bitcoin currently stands at 900/day this halving, and the reward for each block is $6.3 BTC.

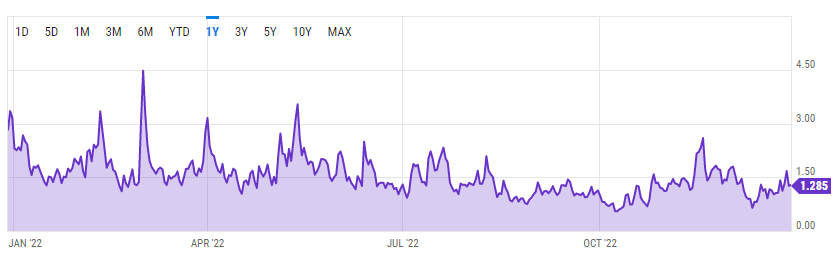

While block rewards are stable and predictable, transaction fees can fluctuate depending on multiple factors, such as network activity and transaction size.

Bitcoin’s Average Transaction Fee was $0.834 on Dec.31, a decrease from last year’s high of 2.829 – a change of 70.5%.

This fall is primarily due to increasing network difficulty, heavy computational demand, and poor market performance.

Block height

The block height stood at 573.296k as of December 31. The blocks created per day remained constant despite the miner’s revenue touching new lows.

Every blockchain consists of a series of sequential blocks, with the first block referred to as the genesis block. The genesis block is considered to be in block height zero. As a general rule, the blockchain’s total height equals the height of the most recent block.

As the block height continues, Bitcoin still has more than 99% uptime, currently sitting at 99.987%.

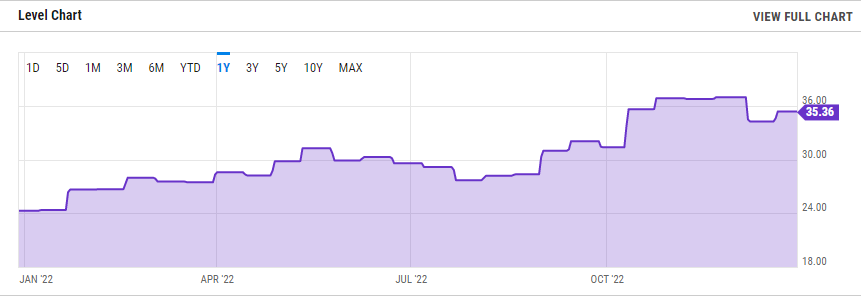

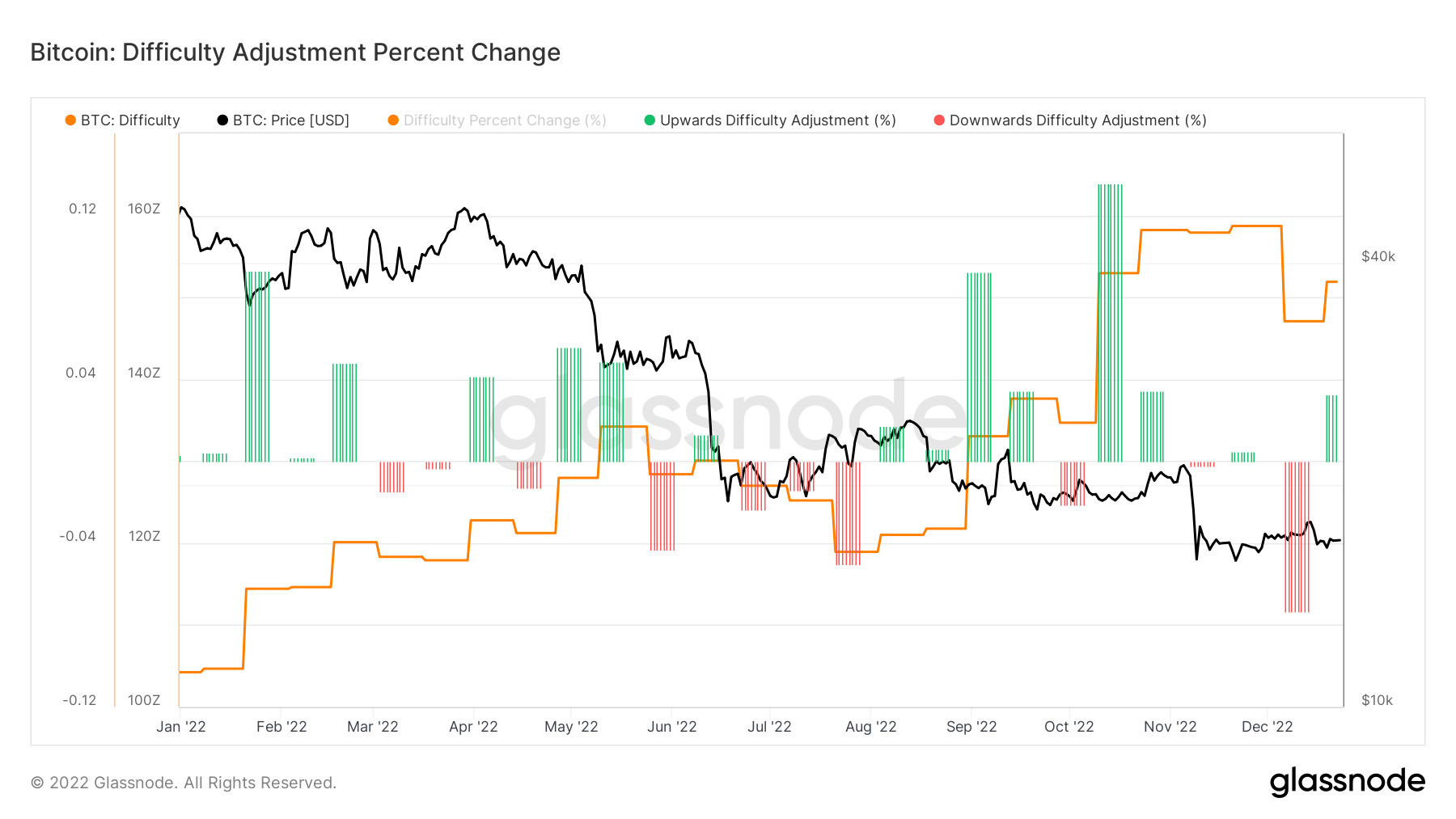

Bitcoin mining difficulty

As of December 31, 2022, Bitcoin mining difficulty stood at 35.36 trillion, up from 24.27 trillion one year back.

This figure represents the amount of computing power applied to mining this particular cryptocurrency every 14 days based on the amount of hashing power competing for rewards on the network.

A greater mining difficulty indicates that more miners are trying to obtain this cryptocurrency. Hashing refers to the amount of processing power that PCs use to build the blockchain: the more blocks of verified transactions are processed, the more bitcoin is mined. Despite a volatile market and a blizzard last month, mining difficulty adjusted every 2016 block.

The post Bitcoin fundamentals remain unchanged despite the significant events in 2022 appeared first on CryptoSlate.