According to the Jan. 5, 2023 All Core Devs (ACD) meeting, Ethereum developers are preparing to deploy a public testnet for the highly anticipated Shanghai hard fork in February 2023, with the mainnet implementation tentatively scheduled for March. Ethereum’s core developers emphasized that staked withdrawals are a priority and code related to EVM Object Format changes, or EOF, was removed from Shanghai to ensure that the focus remains on staked withdrawals.

Staked Withdrawal Priority: Shanghai Public Testnet Deployment Scheduled for February, Hard Fork Tentatively Set for March

During the first week of December 2022, Bitcoin.com News reported on the 151st Ethereum developers meeting, and the programmers recently finished the 152nd meeting on Jan. 5, 2023. The meeting mostly focused on the removal of EOF implementation from Shanghai, and developers decided not to review any Ethereum Improvement Proposals (EIPs) related to EOF until the Shanghai hard fork has completed.

Both Galaxy Digital’s research associate Christine Kim and Ethereum core developer Tim Beiko summarized the ACD meeting. “On the Shanghai front, a first devnet was set up with all client combinations right before Christmas,” Beiko said after the meeting. “While they are all running, some pairs have more issues than others.”

Galaxy’s research associate explained that Devops programmer Barnabus Busa updated the team on the testing of staked ETH withdrawals. “He said that the current developer test network for Shanghai, which was launched just before Christmas, has already progressed to block 4,000,” Kim said. “All EL and CL client combinations are currently running on this testnet. A few client combinations such as Teku-Erigon and Lighthouse-Erigon are experiencing issues.”

Withdrawing staked ether has been a major concern for the community, and many want to know when it will happen. The Ethereum developers suggested that a new testnet will be deployed next month, with the Shanghai hard fork tentatively scheduled to go live by March.

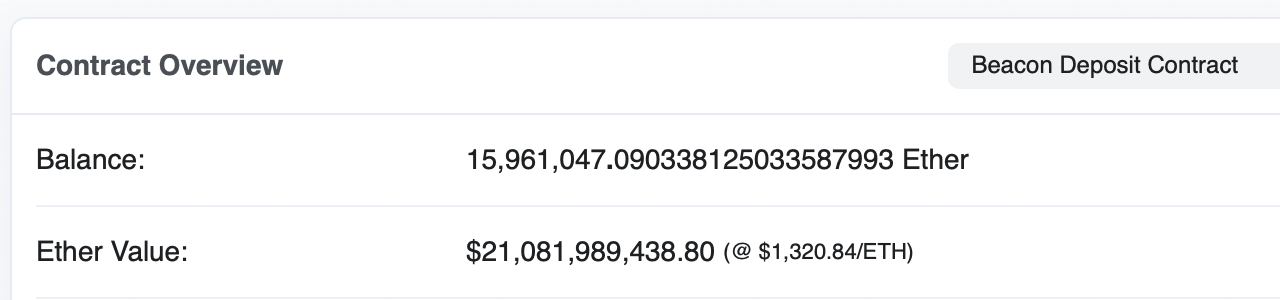

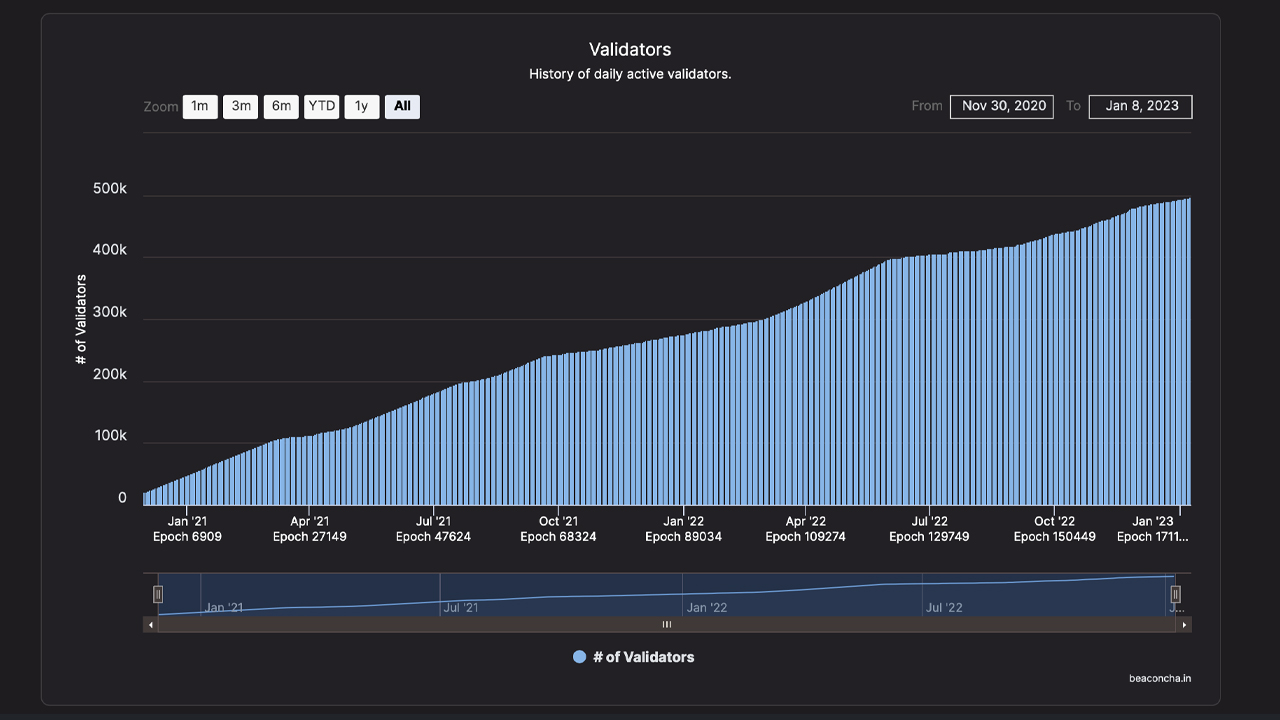

At the time of writing, there is 15.96 million ether locked into the Beacon deposit contract. Additionally, the network is just days away from reaching 500,000 validators. The Shanghai fork will be the next major upgrade for the Ethereum development team since The Merge.

What do you think about the latest Ethereum developer meeting and discussions revolving around the upcoming Shanghai fork? Let us know your thoughts about this subject in the comments section below.