Europe’s largest digital asset investment group Coinshares believes there is only “minor negative sentiment” within the crypto markets now following a grueling 2022 bear market.

As Bitcoin threatens to touch $18,000 for the first time since mid-December, Coinshares analysis reveals that outflows from global crypto funds are starting to wane. According to a recent blog post, Bitcoin saw just $6.5 million in outflows, indicating that sentiment “remains negative,” but only just.

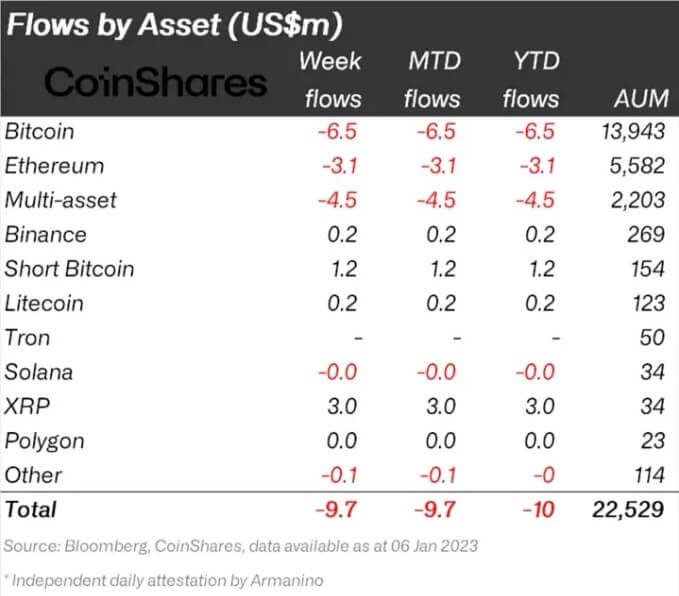

“Digital asset investment products saw outflows totaling US$9.7m, highlighting continued mild negative sentiment that has persisted for the last 3 weeks.”

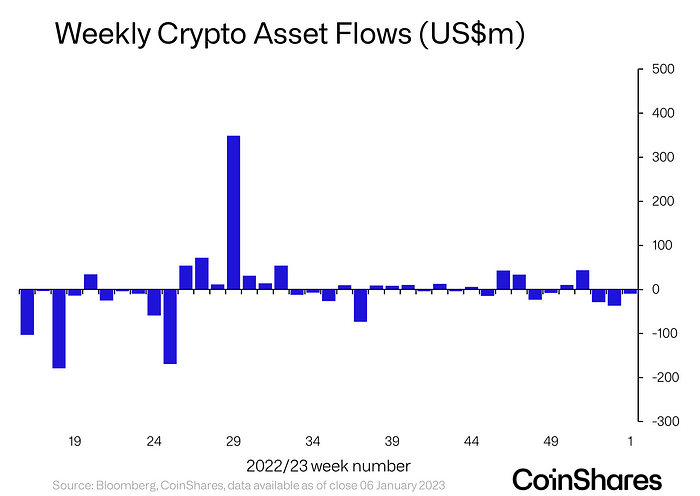

The chart below showcases the persistent outflows from crypto funds, consistent over the past six months, with only five weeks of inflows throughout the period. However, outflows have failed to amass any substantial volume, as figures suggest inflows and outflows canceled out to remain reasonably flat.

The largest weekly outflow over the past 52-week period reached roughly $175 million, while the most significant inflow hit around $350 million.

Eighteen weeks of outflows compare to seventeen weeks of inflows throughout a challenging bear market across the past 52 weeks.

However, Ripple’s XRP “bucked the trend,” as it saw $3 million in inflows over the last week, which Coinshares attributed to “the improving clarity on its legal case with the SEC.”

Alongside XRP, other assets that avoided positive outflows included Binance (BNB Chain,) Litecoin, and Polygon. These assets had either nominal inflows or remained flat across the week.

The bearish trend within crypto has yet to be broken, as highlighted by the $1.2 million inflows into “Short Bitcoin” funds.

Coinshares referred to the trend as “continued mild negative sentiment that has persisted for the last three weeks.” However, the first chart clearly shows that the increased outflows seen during the FTX crisis have abated in the first week of 2023.

According to Coinshares disclosure, it currently has $1.4 billion in assets under management. Its crypt funds look to serve those seeking exposure to crypto through traditional financial Exchange Traded Products (ETPs.)

Such investment vehicles may no longer be fully representative of the overall crypto market sentiment as investors move toward cold storage following the collapse of BlockFi, Voyager, Celsius, and FTX.

While crypto exchanges differ from ETPs in many aspects, the custodial nature of the offering brings similar risks, given that ownership of the underlying crypto assets does not belong to the investors.

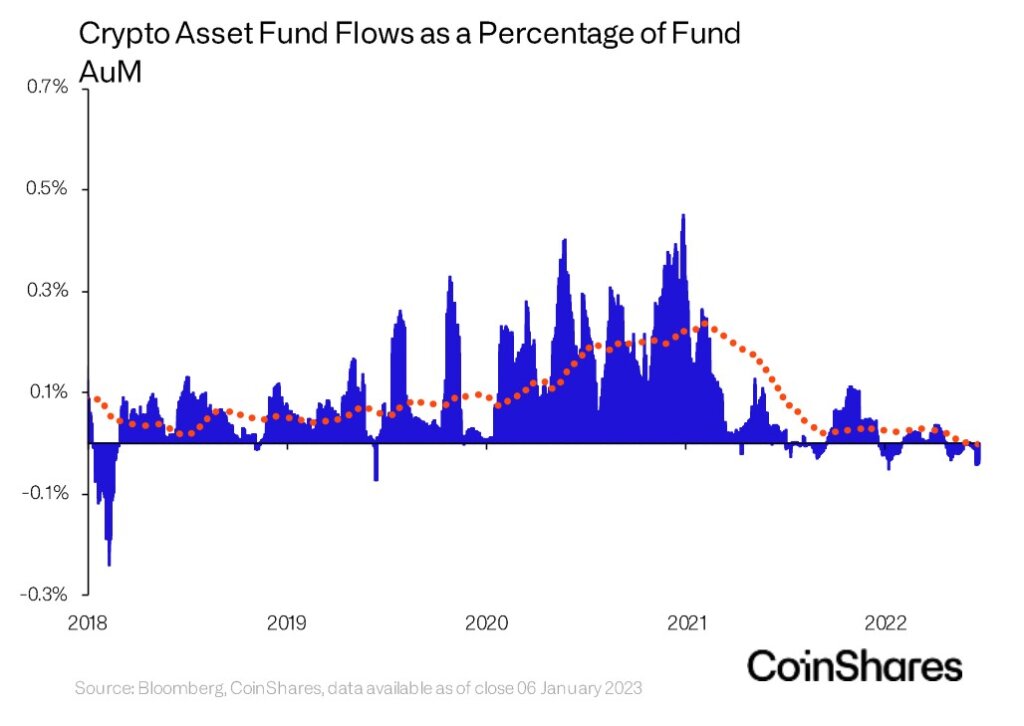

The flow of money across crypto asset funds has fallen negative as a percentage of the global assets under management within investment funds. Crypto asset funds peaked at roughly 0.25% of global fund flows at the end of 2020 before experiencing a drastic sell-off throughout the 2021 bull market.

Funds such as the Grayscale Bitcoin Trust have been watched closely by crypto investors over recent weeks due to it trading at an extreme discount amid turmoil within its parent company Digital Currency Group.

However, on Jan. 10, GBTC jumped 12%, causing the discount to drop by over 20% in 2023. Whether the price action is indicative of the fund securing its position as a critical investment vehicle for those with limited access to crypto is still up in the air.

Regardless, the minimal impact of crypto ETPs across the broader ETP market showcases how little institutional crypto exposure exists in the markets compared to traditional assets.

The total crypto assets under management across funds currently sit at $22.5 billion, with $14.9 billion being held with Grayscale.

In comparison, U.S. ETFs lost $596.9 billion in 2022, which is 72x greater than the total value assets under management for crypto products. The total value of ETPs globally reached $9.3 trillion in 2022 despite the net outflows.

The crypto market is still well behind traditional financial assets in terms of its impact on the global economy. However, unlike legacy financial products, self-custody is a core tenet of crypto, and the move away from ETPs could become a familiar trend as the crypto industry matures.

The post Minor negative sentiment in crypto markets as fund outflows drop to $9.7M appeared first on CryptoSlate.