Former FTX CEO Sam Bankman-Fried (SBF) launched a Substack report in which he detailed his version of accounts of what happened at FTX.

SBF claimed that “no funds were stolen” and attributed the collapse to Alameda’s inability to hedge against a market crash adequately.

SBF recovery plan for FTX

SBF took to Twitter earlier on Jan. 12 to argue that FTX could still recover — SBF’s Substack report supports these claims.

The former CEO — who is currently confined to his parent’s house according to the terms of his bail — aligned the failure of FTX to “somewhere between that of Voyager and Celsius.”

He gave three reasons for the “implosion,” stating Alameda had $100 billion in assets, which we subjected to both a market crash and “an extreme, quick, targeted crash precipitated by the CEO of Binance.”

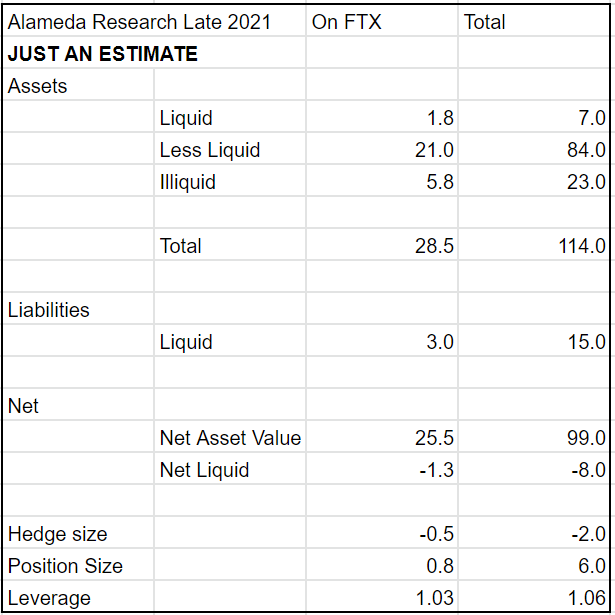

“a) Over the course of 2021, Alameda’s balance sheet grew to roughly $100b of Net Asset Value, $8b of net borrowing (leverage), and $7b of liquidity on hand.

b) Alameda failed to sufficiently hedge its market exposure. Over the course of 2022, a series of large broad market crashes came–in stocks and in crypto–leading to a ~80% decrease in the market value of its assets.

c) In November 2022, an extreme, quick, targeted crash precipitated by the CEO of Binance made Alameda insolvent.”

Similarities to the impact of the Three Arrows Capital (3AC) collapse on exchanges such as Celsius and Voyager were made to Alameda’s role in the downfall of FTX.

However, SBF did not directly address the argument that Alameda should never have had access to customer funds in the first place when making the comparison.

FTX.US solvency

SBF made a strong statement regarding the state of FTX.US, claiming that:

“It’s ridiculous that FTX US users haven’t been made whole and gotten their funds back yet.”

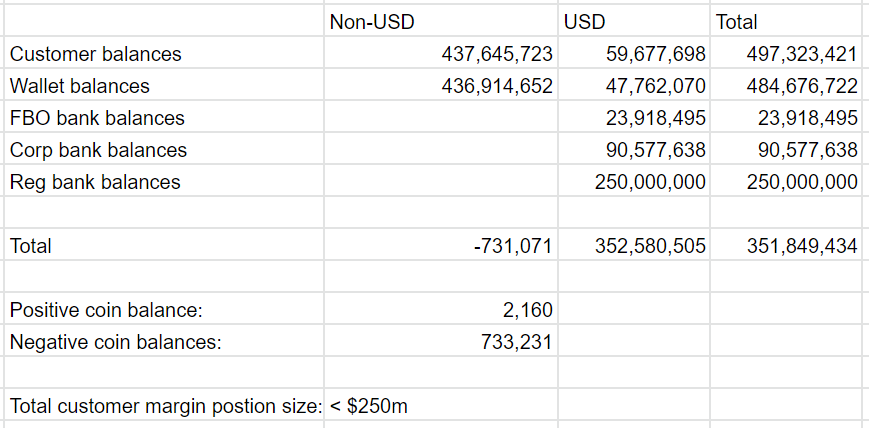

FTX.US allegedly had over $350 million cash “beyond customer balances,” according to SBF.

Below is a copy of the spreadsheet shared by the former CEO in the report. The figures represent the company’s state at the time of SBF’s removal.

The potential for FTX.US customers to be made whole has been consistently backed by SBF, as he claimed the U.S. arm of the company has never been insolvent.

Legal conspiracy

SBF continued his narrative that the legal firms involved in the insolvency have conspired to force through bankruptcy proceedings to garner legal fees.

“[Sullivan & Crowell] and the [General Council] were the primary parties strong-arming and threatening me into naming the candidate they themselves chose as CEO of FTX.”

While legal firm Sullivan & Crowell maintained that it “had a limited and largely transactional relationship with FTX,” SBF revealed that he was close enough to the firm to work out of its offices when he was in New York.

U.S. Senators — including Sen. Elizabeth Warren — have publicized their concerns over Sullivan & Crowell’s involvement in the case going forward.

A letter published by a group of Senators stated there were “concerns about the impartiality” of the firm.

“Put bluntly, the firm is simply not in a position to uncover the information needed to ensure confidence in any investigation or findings.”

SBF denies stealing from customers

In the report, SBF backed his ‘not guilty’ plea by publicly stating that he did not steal user funds and is willing to use his Robinhood shares to make customers whole.

“I didn’t steal funds, and I certainly didn’t stash billions away. Nearly all of my assets were and still are utilizable to backstop FTX customers.”

In contradiction to the claims that SBF appropriated user deposits to fund risky bets by Alameda Research, the former CEO pointed to global market conditions as the root cause of the collapse.

The table below showcases Alameda’s balance sheet in billions, according to SBF.

Based on the information, SBF alleges that its holdings of “SOL alone was enough to cover the net borrowing.”

SBF argued that Alameda’s “~$8b illiquid position… seemed reasonable and not very risky.” However, after a 94% decline in net asset value during 2022, “the hundred billion of assets had only a few billion dollars of hedges,” which was insufficient to support its needs.

Instead of taking any actual ownership of the events, SBF recounted a list of macro factors that affected Alameda’s position, including taking a shot at former Alameda co-CEO, Sam Trabucco.

“–BTC crashed 30%

–BTC crashed another 30%

–BTC crashed another 30%

–rising interest rates curtailed global financial liquidity

–Luna went to $0

–3AC blew out

–Alameda’s co-CEO quit

–Voyager blew out

–BlockFi almost blew out

–Celsius blew out

–Genesis started shutting down

–Alameda’s borrow/lending liquidity went from ~$20b in late 2021 to ~$2b by late 2022”

Alongside these events, SBF cited liquidity issues in the crypto markets as responsible for Alameda’s troubles.

“Liquidity dried up–in borrow-lending markets, public markets, credit, private equity, venture, and pretty much everything else. Nearly every liquidity source in crypto–including nearly all of the borrow-lending desks–blew out over the course of the year.”

With the scene set to showcase Alameda’s strong position of roughly $10 billion in net asset value in October 2022 in a turbulent bear market, SBF continued the article to go on the offensive against Binance CEO CZ.

November 2022

SBF began a section titled ‘The November Crash’ by singling out C.Z.’s tweets and P.R. campaign against FTX.

“Then came CZ’s fateful tweet, following an extremely effective months-long PR campaign against FTX–and the crash.”

Until November 2022, SBF claimed that Alameda’s hedges “to the extent they existed, had worked.” However, what happened next was allegedly targeted directly at FTX and Alameda.

“The November crash was a targeted attack on assets held by Alameda, not a broad market move.”

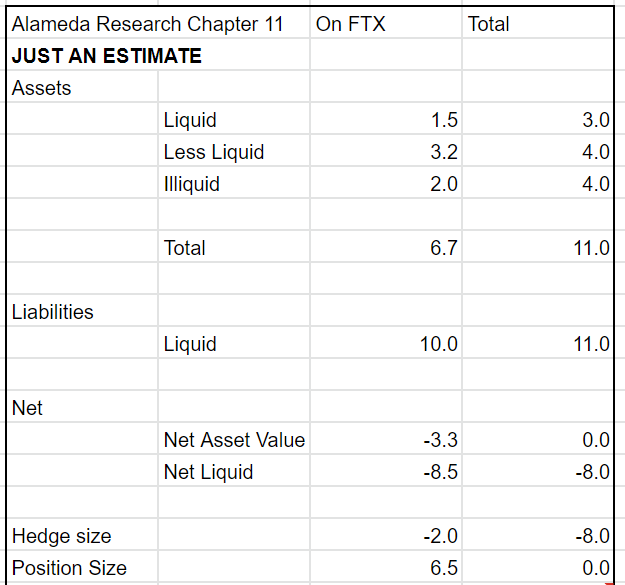

It was on Nov. 7, 2022 and Nov. 8, 2022 that SBF believes that Alameda first became “clearly insolvent.” The table below details Alameda’s balance sheet at the time of the Chapter 11 filing, according to SBF.

Once Alameda became insolvent, SBF argued that the pursuing bank run tipped the balance causing the group to collapse. At this point in the report, SBF finally acknowledges the direct link between Alameda and FTX as he confirmed that “Alameda had a margin position open on FTX; and the run on the bank turned that illiquidity into insolvency.”

However, SBF failed to address whether the Alameda margin position was related to customer funds or FTX-owned assets. In fact, SBF appears to be positioning the event to make comparisons with 3AC, against which no criminal charges have been filed. SBF is facing up to 100 years in jail for his involvement in the collapse.

“No funds were stolen. Alameda lost money due to a market crash it was not adequately hedged for–as Three Arrows and others have this year. And FTX was impacted, as Voyager and others were earlier.”

SBF ended the report by stating that he had intended to detail the report’s content at the U.S. House Financial Services Committee on Dec. 13, 2022, but was unable due to his arrest.

SBF has promised more information in the future. In addition, updates will likely be made to the new substack account, which can be found here.

The post SBF reveals his side of the FTX story, blames CZ, targeted attack against FTX appeared first on CryptoSlate.