Definition

Implied volatility is the market’s expectation of volatility. Given the price of an option, we can solve for the expected volatility of the underlying asset.

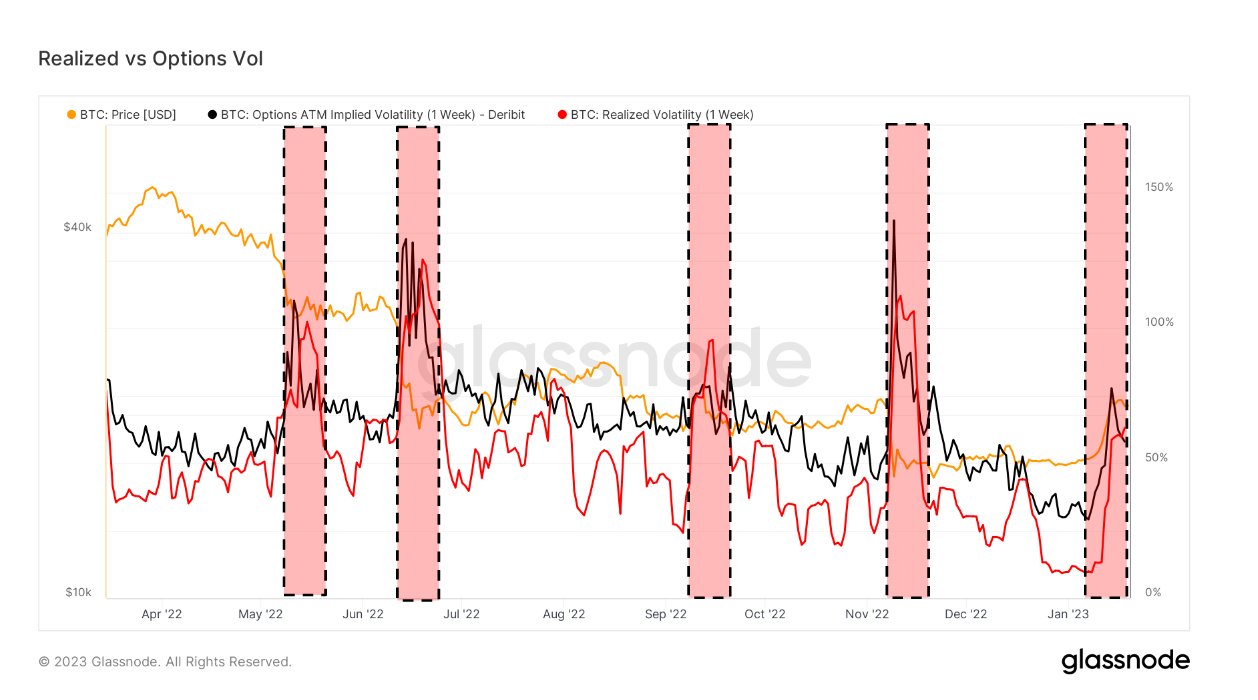

Viewing At-The-Money (ATM) IV over time gives a normalized view of volatility expectations which will often rise and fall with realized volatility and market sentiment. This metric shows the ATM implied volatility for options contracts that expire one week from today.

Realized volatility is the standard deviation of returns from the mean return of a market. High values in realized volatility indicate a phase of high risk in that market rolling window of 1 week.

Quick Take

- Realized volatility has just gone above options volatility for the first since FTX collapsed back in November.

- Each time this occurs, Bitcoin tends to tumble down in price

- Realized volatility exceeded 60%, while options volatility is at 59%

- At the beginning of 2023, volatility was multi-year lows for Bitcoin before Bitcoin surged to $21k.

The post Realized volatility surges above options volatility for the first time since FTX collapse appeared first on CryptoSlate.