Glassnode data analyzed by CryptoSlate indicates that Ethereum’s (ETH) dominance over stablecoins has been increasing and reached its highest in the last three months.

Ethereum’s dominance over stablecoins strengthens as the ETH price surpasses $1,600.

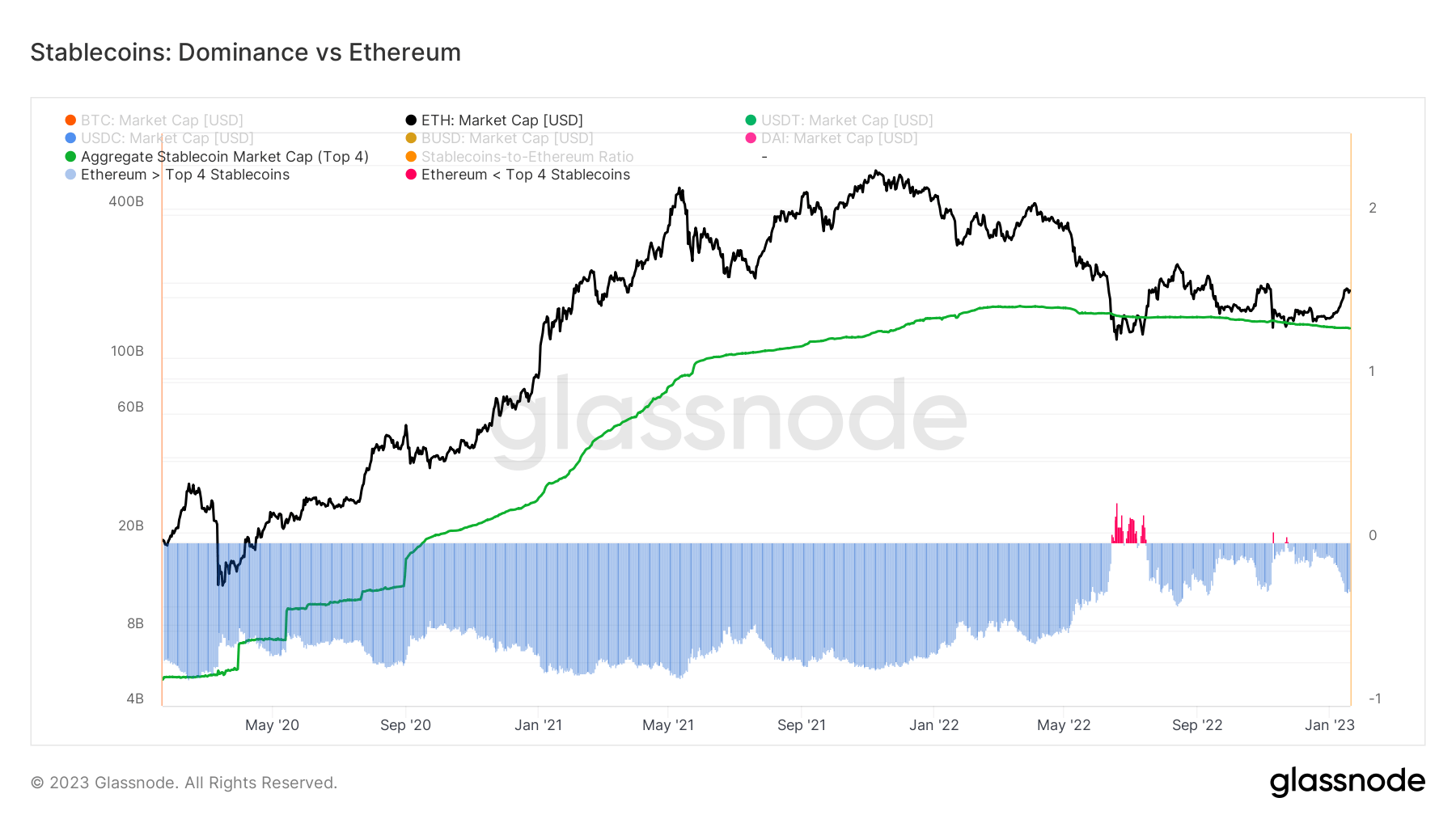

The analysis includes the top four stablecoins: Tether (USDT), USD Coin (USDC), Binance USD (BUSD), and DAI (DAI).

The chart below represents a comparison of the ETH market cap to the aggregate value of these stablecoins since the beginning of 2020. The green line reflects the combined value of the stablecoins, while the black one shows the ETH market cap.

ETH held an unquestionable dominance over stablecoins between the beginning of 2020 and mid-2022. In the summer of 2022, stablecoins’ aggregate value surpassed ETHs, marking a first in the history of ETH.

Even though ETH recovered its dominance by the end of July 2022, stablecoins triumphed over ETH dominance once more for a short while in November 2022. Current data shows that ETH’s dominance over stablecoins has been strengthened since then.

Exchanges’ stablecoin reserves have been shrinking since the FTX collapse. A recent CryptoSlate analysis revealed that a total of 3.93 billion stablecoins had left the exchanges since the FTX crash.

In the meantime, the ETH price has been on an upwards trajectory. ETH is being traded for around $1,623 at the time of writing, reflecting a 33.23% increase in the last 30 days.

The post Ethereum stablecoin dominance reaches 3-month high appeared first on CryptoSlate.