Crypto journalist Tiffany Fong has named five crypto firms, including Binance, Bank to the Future, and Galaxy Digital, as secret bidders of bankrupt Celsius Network’s assets.

In a Jan. 26 substack post, Fong said she had obtained leaked documents of Celsius bidding proposals which were submitted in November 2022. However, the bidding process seems to have been halted.

As revealed in the leaked documents, Binance, Bank to the Future, Galaxy Digital, Cumberland DRW, and Novawulf had submitted their bidding proposals for Celsius’ assets.

Highlights of the bidding sheet show that Binance had proposed to pay about $15 million for all Celsius liquid assets and certain non-liquid assets, excluding FTT and CEL tokens.

Specifically, about $12 million will be reserved for Celsius, while the remaining $3 million will be distributed to Celsius users who migrate to Binance.

On the other hand, investment firm Bank to the Future proposed to have all liquid assets and collateral returned to Celsius creditors on a pro-rata basis under the management of Bank to the Future.

Furthermore, Galaxy Digital’s proposal revealed it intends to acquire all illiquid and staked ETH assets of Celsius for approximately $67 million, while Cumberland said it would purchase Celsius assets, excluding CEL tokens, for approximately $1.8 billion.

On the other hand, investment firm Novawulf proposed to transfer all Celsius assets to NewCo. The new company will be owned 100% by creditors who have access to the company’s Asset and Revenue sharing tokens.

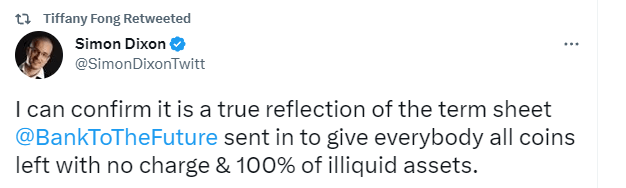

Bank to the Future CEO confirms leaked report

Bank to the Future CEO Simon Dixon confirmed via Twitter that Fong’s report was a true reflection of the proposal submitted by his company for Celsius assets.

Celsius’ restructuring plan

Celsius Network seems to have abandoned the bidding proposals as it looks to restructure its business.

On Jan. 24, Celsius lawyer Ross Kwasteniet disclosed that the crypto lender was looking to restructure into a publicly-traded company with proper licensing.

Additionally, Celsius could issue a new cryptocurrency to compensate its creditors instead of selling the company’s crypto assets.

The post Binance, Bank to the Future among secret bidders of Celsius assets – Tiffany Fong appeared first on CryptoSlate.