The market is nearly unanimous in expecting a 0.25% rate hike during February’s FOMC meeting, yet many expect a “pause” shortly thereafter. We beg to differ.

The below is an excerpt from a recent edition of Bitcoin Magazine PRO, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

The next FOMC meeting is on February 1, where the Federal Reserve will determine their next policy decision regarding interest rates. This article covers how the market expects the Fed to respond, what readers should watch for regarding changes in the expected path and the potential second-order effects of said changes.

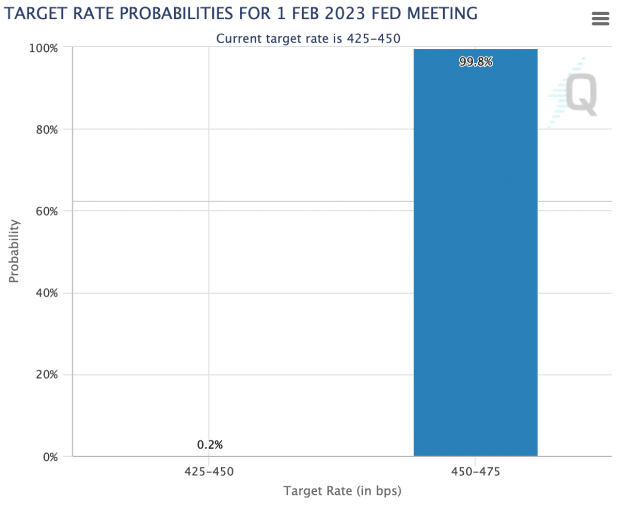

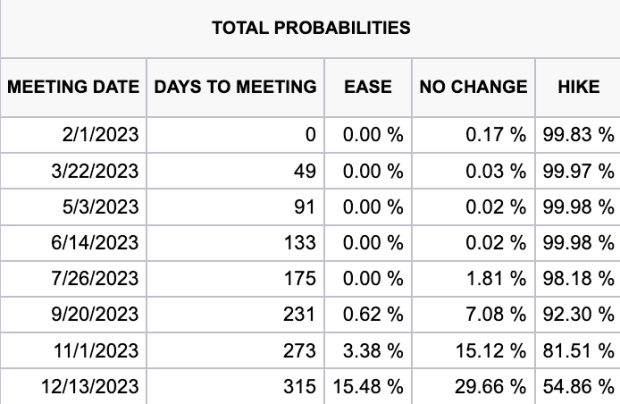

The current expectation is an interest rate hike of +0.25%, with the market assigning a near 100% certainty of this outcome, setting the policy rate to 4.5%-4.75%.

The Fed’s expected course for 2023 is to keep rates elevated, with several Fed Governors recently stressing the need to keep policy rates sufficiently restrictive in order to make sure inflation does not stage a comeback after initial signs of slowing, like it did in the 1970s.

In Jerome Powell’s December 14 press conference, he said the following (emphasis added):

“So, as I mentioned, it is important that overall financial conditions continue to reflect the policy restraint that we’re putting in place to bring inflation down to 2 percent. We think that financial conditions have tightened significantly in the past year. But our policy actions work through financial conditions. And those, in turn, affect economic activity, the labor market, and inflation. So what we control is our policy moves in the communications that we make. Financial conditions both anticipate, and react to, our actions.

“I would add that our focus is not on short-term moves, but on persistent moves. And many, many things, of course, move financial conditions over time. I would say it’s our judgment today that we’re not at a sufficiently restrictive policy stance yet, which is why we say that we would expect that ongoing hikes would be appropriate.”

Pricing In The Transitory Inflation

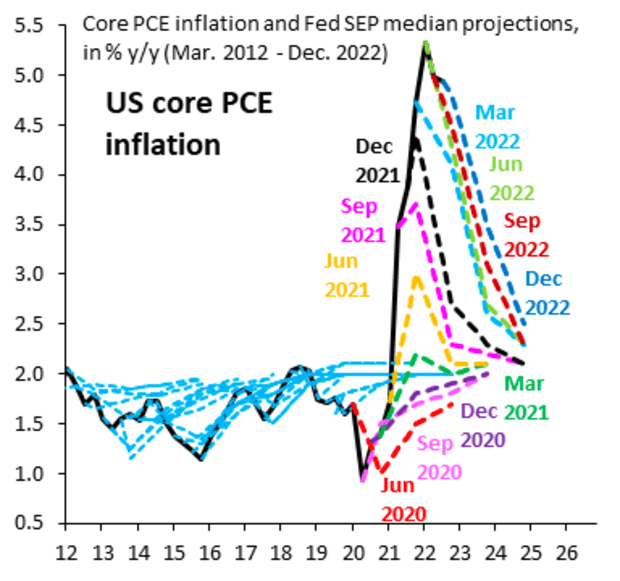

Global risk assets have been in rally mode to start the year, as market participants increasingly expect the inflationary scare that rattled financial assets in 2022 to abate in 2023 and beyond. While the optimistic expectations for abating inflation would certainly be bullish for risk-assets — given that it would lead to the return of lower interest rates — one would be wise to keep in mind the frivolous nature of inflation forecasting from the Fed, as shown below. A return to the 2% target is nearly always the expectation.

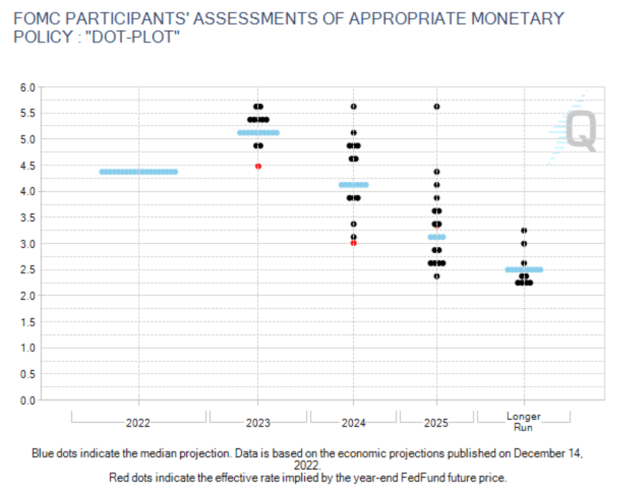

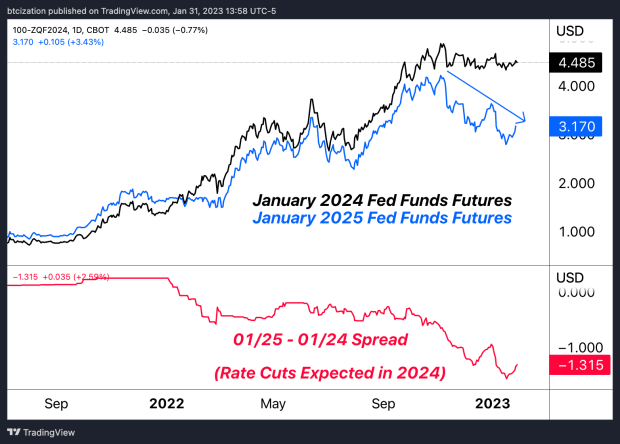

With inflation abating and policy rates staying elevated, the market believes that a “sufficiently restrictive” policy will manifest in 2023, with 1.31% worth of cuts coming in 2024.

Once inflation becomes entrenched into consumer expectations and labor markets, history has shown that it takes a monumental effort from central banks tightening policy rates in order to squash the inflation.

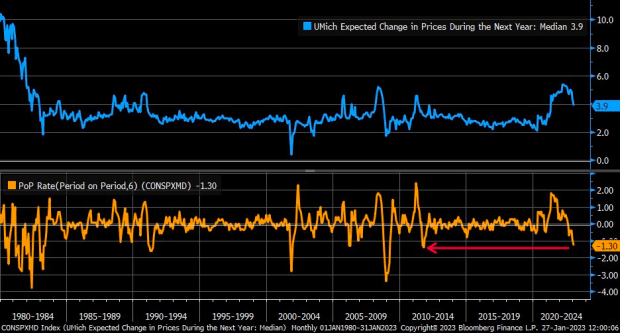

As noted by Liz Ann Sonders of Charles Schwab, the 6-month change in inflation expectations is the largest it’s been since 2011, an indication that monetary tightening has begun to work its way into the real economy.

With a rate hike of 25 basis points all but confirmed tomorrow, the market will pay close attention to the content and tone of Chairman Powell’s speech in regards to the future path of policy rates. We believe that “higher for longer” is a tone that the Fed will continue to communicate with the market.

However, on a long enough timeline, the inevitable outcome is clear. Just ask the U.S. Treasury for their projections…

Source: U.S. Treasury

Like this content? Subscribe now to receive PRO articles directly in your inbox.