Quick Take

- Bitcoin was strongly correlated to traditional assets during 2022 due to uncertainty in the unprecedented speed of rate hikes from the federal reserve.

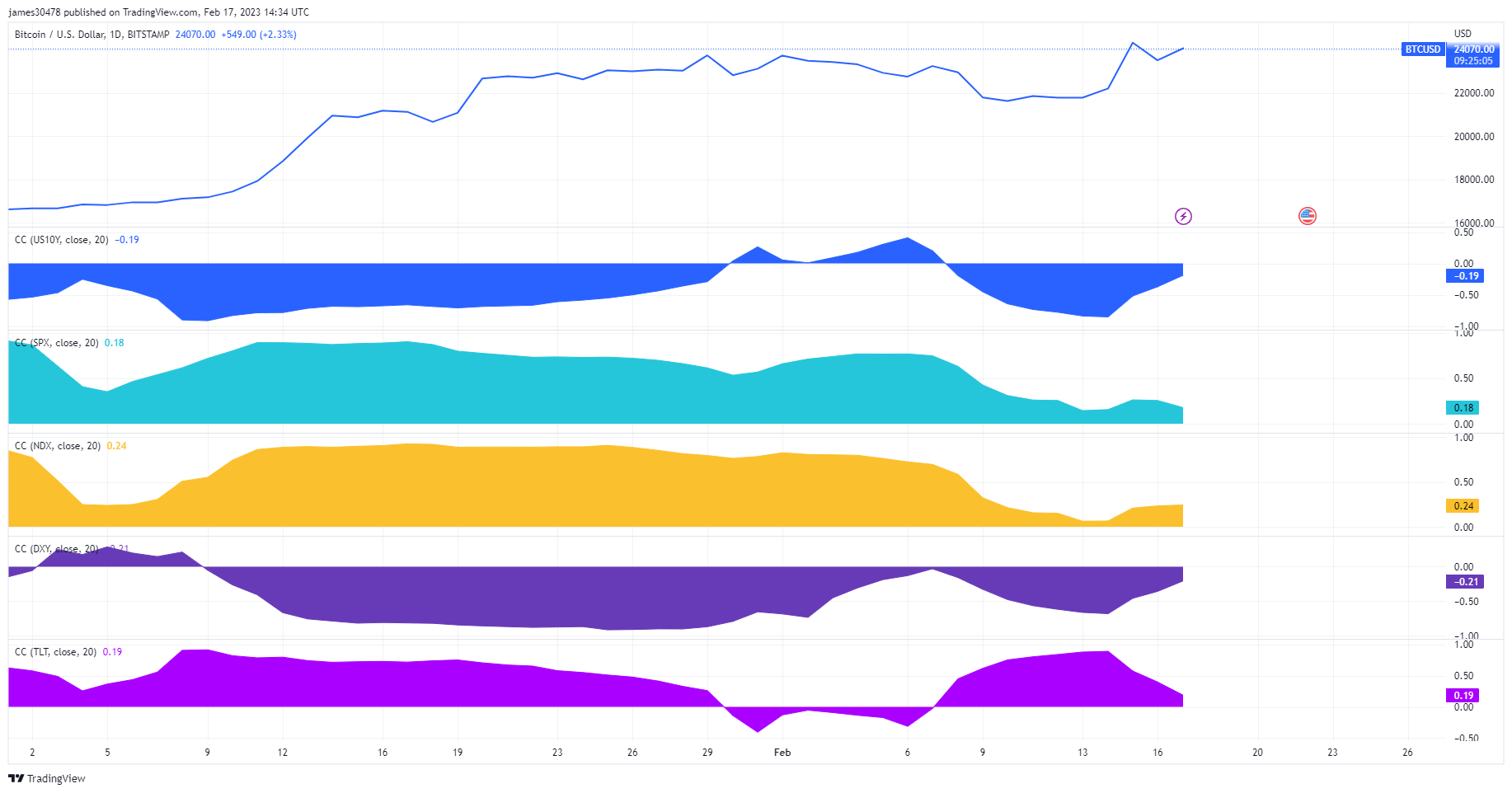

- However, as 2023 continues to unfold, Bitcoin seems to be decoupling from traditional assets and going into a class of its own — roughly 50% up year-to-date.

On a YTD view;

- BTC is -0.17% correlated to the US 10-year government bond yield.

- BTC is 0.15% correlated to the S&P 500 (YTD low).

- BTC is 0.24% correlated to the Nasdaq.

- BTC is -0.19% correlated to the DXY.

- BTC is 0.17% correlated to TLT.

The post Bitcoin breaks $24k – correlation seen with traditional assets trending downwards YTD appeared first on CryptoSlate.