New data suggests that the bankrupt lender Voyager Digital is moving large amounts of Shiba Inu (SHIB) tokens to Coinbase.

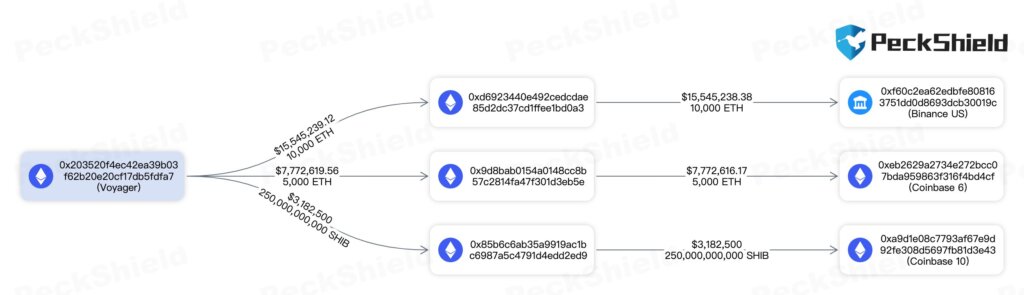

According to Peckshield, a blockchain cybersecurity firm, Voyager Digital has transferred $28.7 million worth of digital assets to various crypto exchange platforms.

The distressed crypto firm has moved 250 billion SHIB tokens, worth approximately $3.4 million, to Coinbase, while also transferring 15,000 Ethereum (ETH) worth $25.3 million to both Coinbase and Binance, the largest crypto exchange platform in the world by trading volume.

This significant move has raised questions among industry experts about the future of Voyager Digital and its potential impact on the crypto market, as numerous entities and wallets associated with the bankrupt exchange move funds on and off different exchanges.

“Voyager has transferred $28.7M worth of crypto [assets] to crypto exchanges, including 15,000 ETH ($25.3 million) to Binance.US and Coinbase (ETH at 1,675) and 250 billion SHIB ($3.4 million). Coinbase Voyager received 105,000 ETH (ETH at $1,559 on the day of transfer) from FTX on 7th Sep. 2022.”

Fall of Voyager Digital

The fall of Voyager Digital, once a titan in the cryptocurrency industry, has been a long and painful one. It began last July when the company was forced to suspend customer withdrawals and deposits, citing the failure of Three Arrows Capital, another crypto firm, to repay a loan worth hundreds of millions of dollars. This move spelled the beginning of the end for Voyager as it struggled to stay afloat amid mounting legal and regulatory issues.

In Sept. 2022, the now defunct exchange, FTX, agreed to buy Voyager’s assets, a deal that ultimately fell through after a Texas regulator objected to FTX’s purchase.

Finally, in a last ditch attempt to stave off total collapse and calamity for retail investors who held money on the site, Voyager was forced to file for bankruptcy, but it made a deal with Binance who agreed to purchase Voyager’s remaining assets at a discount, bringing an ignoble end to a once-promising enterprise.

As part of the deal, Binance is set to pay a handsome $20 million in cash to Voyager, in addition to taking over the company’s customer base. The customers, who have been left in limbo since July without the ability to withdraw their funds, will finally be able to do so by transferring to Binance.US’s crypto exchange, assuming the deal passes a U.S. national security review of the deal, which a judge in Jan. ordered to be expedited.

Shiba Inu is currently trading at $0.000013, with a market capitalization of $7,281,876,226.

The post Bankrupt Voyager transfers 250 billion Shiba Inu to Coinbase appeared first on CryptoSlate.