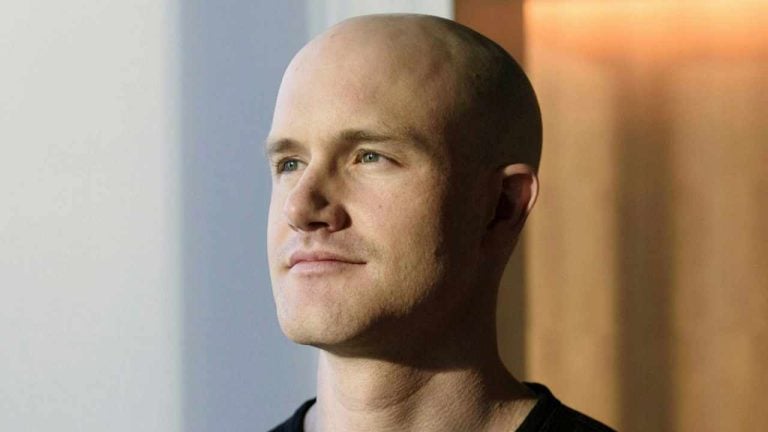

Coinbase CEO Brian Armstrong has called on Congress to pass clear crypto legislation, warning that the U.S. risks losing its status as a financial hub. “Crypto is open to everyone in the world and others are leading,” the executive stressed.

Coinbase’s CEO on Cryptocurrency Regulation

The CEO of the Nasdaq-listed cryptocurrency exchange Coinbase (Nasdaq: COIN), Brian Armstrong, has called on Congress to pass clear crypto legislation. He tweeted Wednesday:

America risks losing its status as a financial hub long term, with no clear regs on crypto, and a hostile environment from regulators. Congress should act soon to pass clear legislation.

“Crypto is open to everyone in the world and others are leading,” he added, mentioning the EU, the U.K., and Hong Kong.

Besides Armstrong, many people have complained that crypto regulation in the U.S. is not clear, making it difficult for companies to comply. However, the chairman of the U.S. Securities and Exchange Commission (SEC), Gary Gensler, has insisted that the law is clear and that most crypto tokens are securities.

Gensler has been criticized for taking an enforcement-centric approach to regulating the crypto industry. Recently, the securities watchdog took action against crypto exchange Kraken over its taking program. The commission also sent a Wells Notice to Paxos over stablecoin Binance USD (BUSD). On Thursday, it charged Terraform Labs and CEO Do Kwon with defrauding investors.

Coinbase has insisted that its staking services are not securities. Armstrong tweeted on Feb. 12: “Coinbase’s staking services are not securities. We will happily defend this in court if needed.” Moreover, Coinbase tweeted on Feb. 14:

We don’t know what aspects of BUSD might be of interest to the SEC. What we do know: stablecoins are not securities.

While the U.S. is tightening its regulation on crypto, several other jurisdictions are striving to become a cryptocurrency hub, including Singapore, Hong Kong, and South Korea’s second-largest city, Busan.

The CEO of Kraken, Jesse Powell, also called on Congress to pass legislation on cryptocurrency after his exchange settled with the SEC and agreed to pay $30 million. “Congress must act to protect the domestic crypto industry and U.S. consumers who will now be going offshore to obtain services no longer available in the U.S.,” Powell wrote.

Do you agree with Coinbase CEO Brian Armstrong that the U.S. needs clear crypto regulation or the country risks losing its status as a financial hub? Let us know in the comments section below.