Stacks (STX) continues to outperform other cryptocurrencies in the top 100 list of CoinMarketCap and Coingecko, as the Bitcoin Layer 2 project advances to profit from the Ordinals buzz.

Since rebounding from the 20-day EMA on February 17, the cryptocurrency continues its strong ascent through the weekend.

On Monday, STX kicks off a 20% daily increase, causing the price to break out of the $0.3381 to $0.3440 and $0.4020 to $0.4123 resistance levels.

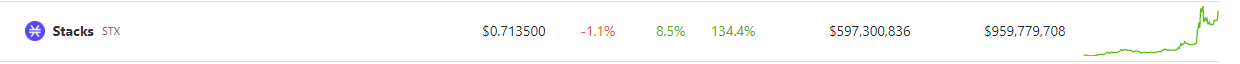

At the time of writing, STX is trading at $0.7135, increasing 134.4% in the last seven days, data from crypto market tracker Coingecko shows. The crypto is up 8.5 in the last 24 hours.

Optimistic Sentiment Toward Stacks Increasing

STX prices reach as high as $0.84 on Monday morning, the highest level since May. In contrast, Bitcoin (BTC), the market leader, has only increased by 6% in the last 30 days.

Since the beginning of 2023, CoinMarketCap statistics indicates that optimistic sentiment towards STX has increased.

In the previous four weeks, the token’s value has grown by close to 120%, placing it among the best-performing cryptocurrencies to date.

Experts attribute the recent price increase in STX to the rising narrative of non-fungible tokens (NFTs) existing in a Bitcoin-focused cryptocurrency ecosystem.

Last year’s introduction of the Ordinal protocol, which enables users to mint NFTs directly on the Bitcoin blockchain, has been a tremendous success.

In an article published on Yahoo Finance, there have been more than 100,000 Ordinal NFTs mined directly onto the Bitcoin network at this point.

According to Muneeb Ali, co-founder of Stacks, Ordinals’ popularity would provide a significant boost to Layer 2 solutions:

“Ordinals on Bitcoin L1 are complementary to Bitcoin NFTs on L2s like Stacks. Ordinals have a natural limit on the L1 scale, and L2s provide a clear scalability path. Wallets like Xverse and & Hiro are amongst the first to release or work on Ordinals.”

STX: Robust Development Expansion

The value of stacks has more than doubled as a result of strong development expansion. The fact that many more developers are creating solutions for this project may have helped to the price increase.

Stacks has been used to deploy more than 35,000 smart contracts, indicating a promising future.

STX is currently valued at $830,635,784 with a market valuation of $929,658,328 and a 24-hour trading volume that has increased by 497.62%. CMC data shows the current circulating supply is around 1,360,896,768 STX.

Activity in NFTs on Stacks has expanded as a result of the rising popularity of Ordinals.

The trading volume on Gamma.io, a Stack-based Bitcoin NFT marketplace, has surged by more than 1,000% over the past four weeks, according to data from DappRadar.

On the other side, Megapont’s volume has surged by 125%. Ali tweeted that there is a strong community of artists and makers on Stacks and that over 650k Bitcoin NFTs have been created using the layer 2 approach.

-Featured image by Xverse Wallet