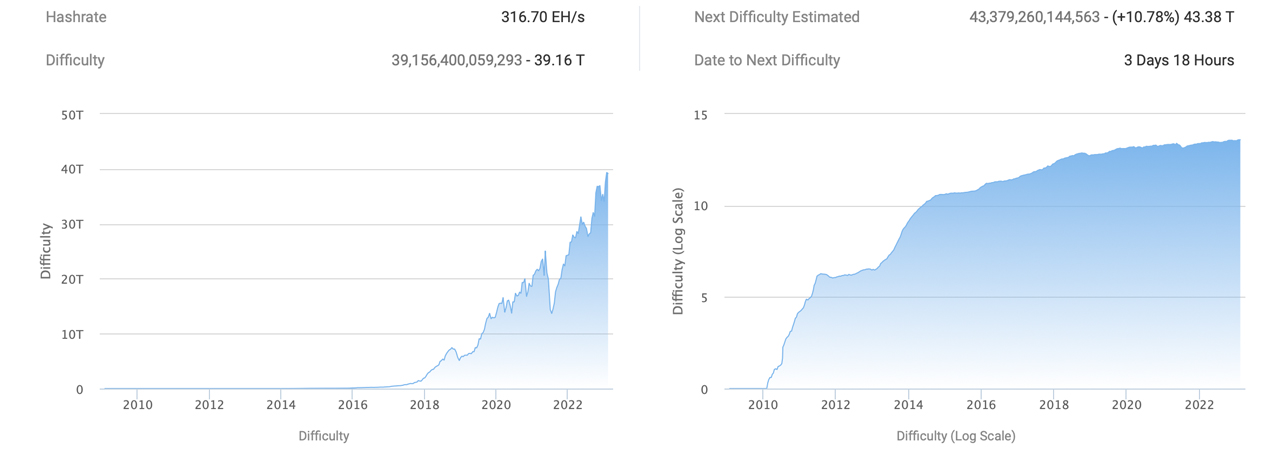

After a small decrease of 0.49% on Feb. 12, 2023, Bitcoin’s network difficulty is expected to experience a significant increase in three days on Feb. 24. Estimates indicate the difficulty could see the largest rise of the year, surpassing the 10.26% increase that occurred on Jan. 15 at block height 772,128.

Next Bitcoin Difficulty Change Estimated to Jump 10.78% to 11.5% Higher

In 2022, Bitcoin’s hashrate remained above the 200-exahash-per-second (EH/s) range. However, in 2023, 300 EH/s seems to be the new norm. According to statistics, over the last 2,016 blocks, Bitcoin’s hashrate has averaged around 310.5 EH/s. Additionally, bitcoin block times have ranged from 8 minutes and 55 seconds to 8 minutes and 68 seconds, which is faster than the 10-minute average. The high hashrate and quicker block times indicate a significant increase in difficulty, which is expected to occur on Feb. 24.

Statistics indicate that the upcoming difficulty adjustment, scheduled for Friday, will be the largest of the year, surpassing the previous record set on Jan. 15. The estimated increase for the Feb. 24 adjustment is expected to be between 10.78% and 11.5%. The current difficulty is approximately 39.16 trillion hashes, and the next difficulty adjustment is likely to push it above 40 trillion. A 10.78% increase would result in a difficulty rating of approximately 43.35 trillion hashes. Regardless of the final outcome, an increase in difficulty will make it more challenging for bitcoin miners to discover new blocks.

At the time of writing, the mining pool Foundry USA commands 33.33% of the network hashrate, or 105.37 EH/s. Antpool accounts for around 18.66% of the global hashrate, dedicating 58.98 EH/s to the Bitcoin blockchain. Together, these two pools captured more than 51% of the pie comprising 13 known pools and 11.93 EH/s of unknown hashpower. Following Foundry and Antpool are F2Pool, Binance Pool, and Viabtc, which collectively control 33.54% of the global hashrate. These top five pools contribute a combined 84.54% of the total hashrate that provides security to the Bitcoin blockchain.

What do you think about the expected significant increase in Bitcoin’s network difficulty? Let us know what you think about this subject in the comments section below.