Eight days ago, Paxos announced that the company would no longer mint the stablecoin BUSD. Since then, the coin’s market capitalization has been sliding lower as redemptions have become more prominent. Meanwhile, a data researcher from Nansen has discovered that Binance, the largest cryptocurrency exchange by trade volume, has increased its usd coin holdings by $1.5 billion over the last seven days.

Nansen Researcher Discovers Binance Stacking Circle’s Stablecoin

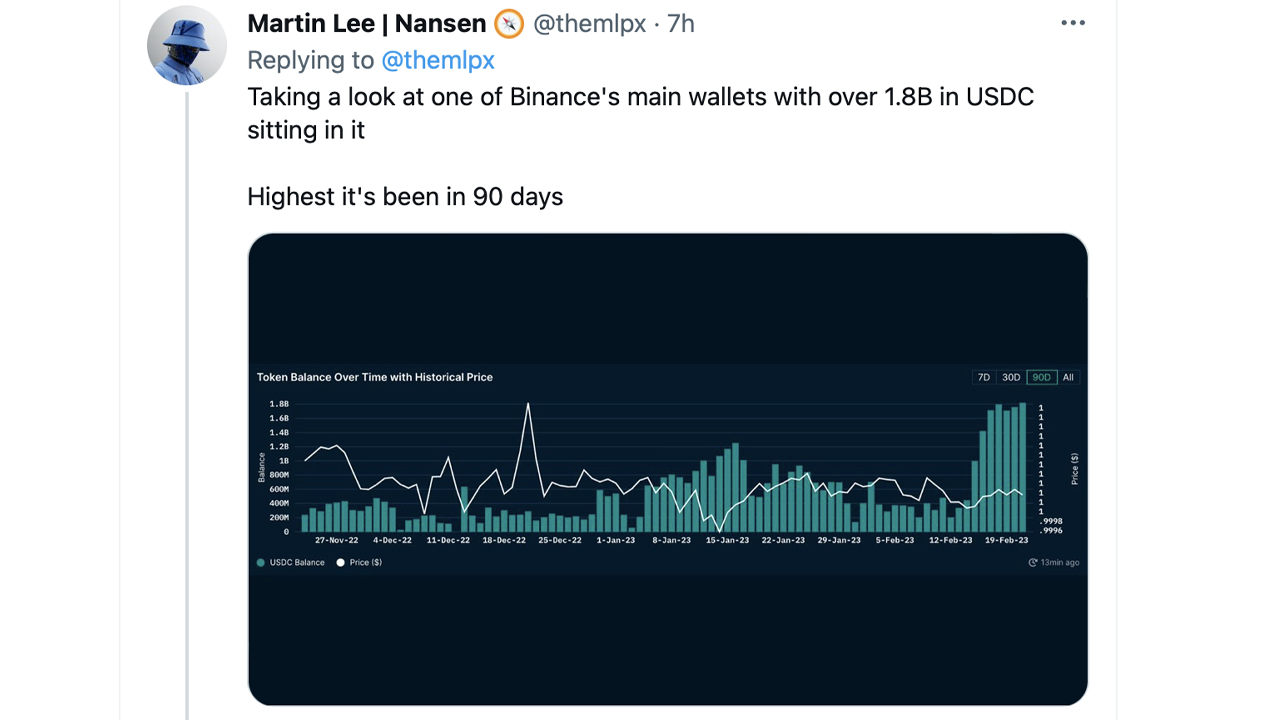

According to Nansen’s data journalist Martin Lee, the amount of usd coin (USDC) held on Binance has been steadily climbing this week. “Interesting to see the amount of USDC on Binance increase so much since the BUSD news,” Lee tweeted on Tuesday. Lee further detailed that Binance saw a $1.5 billion increase in USDC in the last seven days.

He also noted that he would have expected the supply of tether (USDT) to increase on Binance more than USDC, “given that you can’t trade using USDC” on Binance. On Sept. 5, 2022, Binance dropped usd coin (USDC) trading pairs and auto-converted customer balances to BUSD. Two weeks later, Wazirx followed Binance’s move, delisting usd coin (USDC) and a couple of other stablecoins to auto-convert balances to BUSD.

On Feb. 19, Bitcoin.com News reported that close to 3 billion BUSD had been removed from the market, and today, that number is up to 3.55 billion since Paxos revealed it would no longer mint BUSD. The Paxos-managed stablecoin is still the third-largest stablecoin by market capitalization until it drops below DAI’s market valuation of $5 billion. BUSD, which was once a prominent top-ten crypto asset by market capitalization, is getting awfully close to being knocked out of the top ten standings.

The Nansen researcher also noted that there’s $1.8 billion USDC in Binance’s main wallet today, and it’s the highest it has been in 90 days. At the time of writing, 2:00 p.m. (ET) on Feb. 21, 2023, there’s $1.821 billion USDC held in Binance’s wallet. It’s worth noting that Nansen’s portfolio viewer only looks at ERC20-based balances, and Binance has just over 100 million Tether (USDT) in the same wallet. The Binance wallet also holds 79.24 million trueusd (TUSD) and 5.34 million DAI.

What do you think about Binance stacking usd coin following regulators cracking down on BUSD? Share your thoughts in the comments section below.