Definition

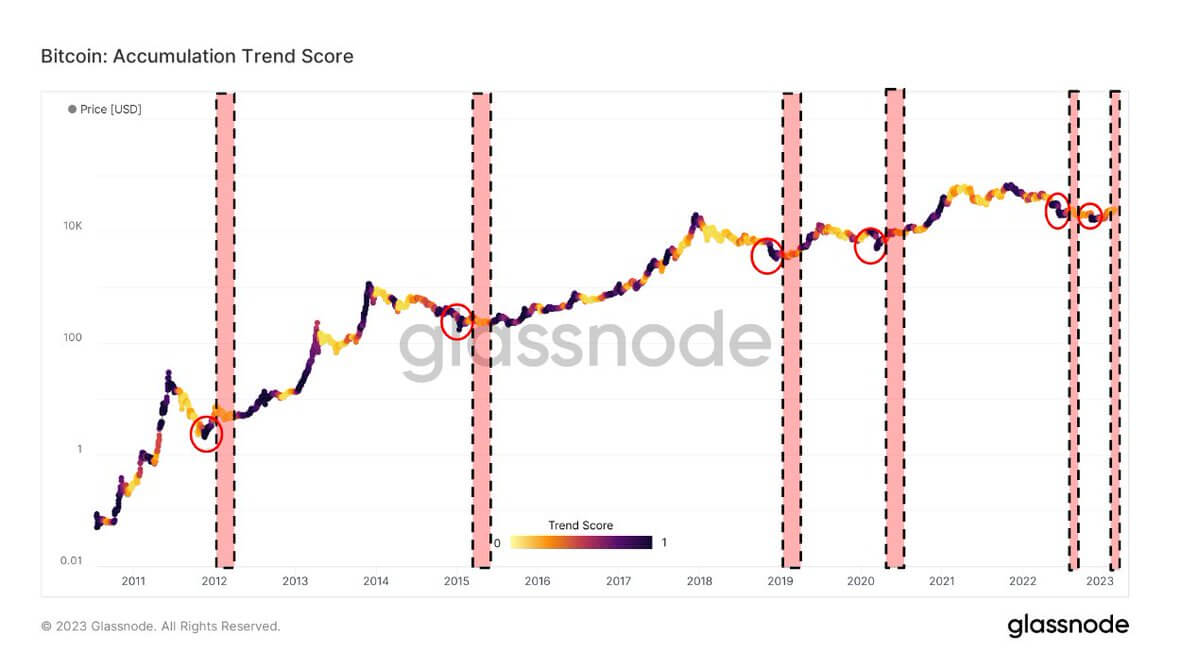

The Accumulation Trend Score is an indicator that reflects the relative size of entities that are actively accumulating coins on-chain in terms of their BTC holdings.

While the relative strength of the accumulation for each entity’s balance size is measured by the entities’ size and the number of coins they have acquired over the last 15 days.

- A value closer to 1 indicates that participants in that cohort are accumulating coins.

- A value closer to 0 indicates that participants in that cohort are distributing coins.

- A list of entities, including exchanges and miners, is excluded from the calculation.

Quick Take

- The accumulation trend score flashes 0, suggests no buyers from any cohort within the Bitcoin ecosystem, and suggests distribution.

- Each time Bitcoin hits a low in a bear market cycle, it tends to see significant accumulation (highlighted by the red circle) as investors see great value in buying Bitcoin.

- However, shortly after, a lack of accumulation occurs due to perhaps disbelief in the cycle, highlighted by the red box.

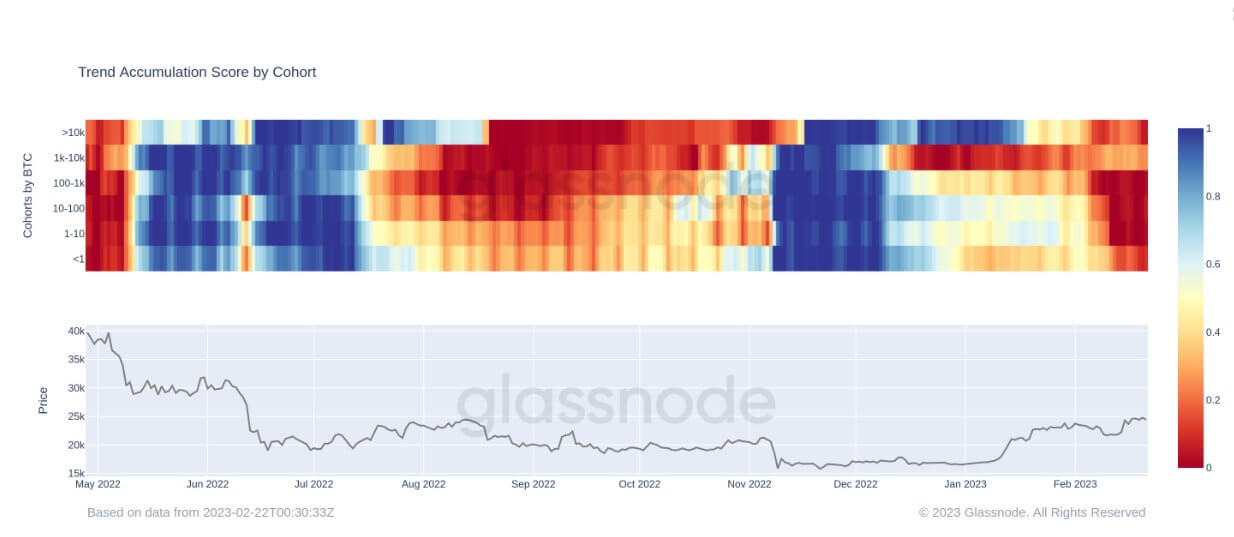

- In addition, Bitcoin is seeing the longest streak of profit-taking since November 2021.

- The accumulation trend score by cohort also shows a clear appetite for accumulation since the collapse of FTX back in November.

The post Accumulation Trend Score flashes 0, suggesting no Bitcoin buyers from all cohorts appeared first on CryptoSlate.