The sale of the remaining crypto assets of bankrupt crypto lender Voyager continues to be a hot topic for Shiba Inu (SHIB) investors. Already over the last few weeks, several million US dollars in SHIB have been liquidated, while the holdings remain high.

Voyager seems to want to slowly reduce its holdings with as little impact as possible on the market price of the cryptocurrencies affected. This would at least explain the latest sale of Voyager assets.

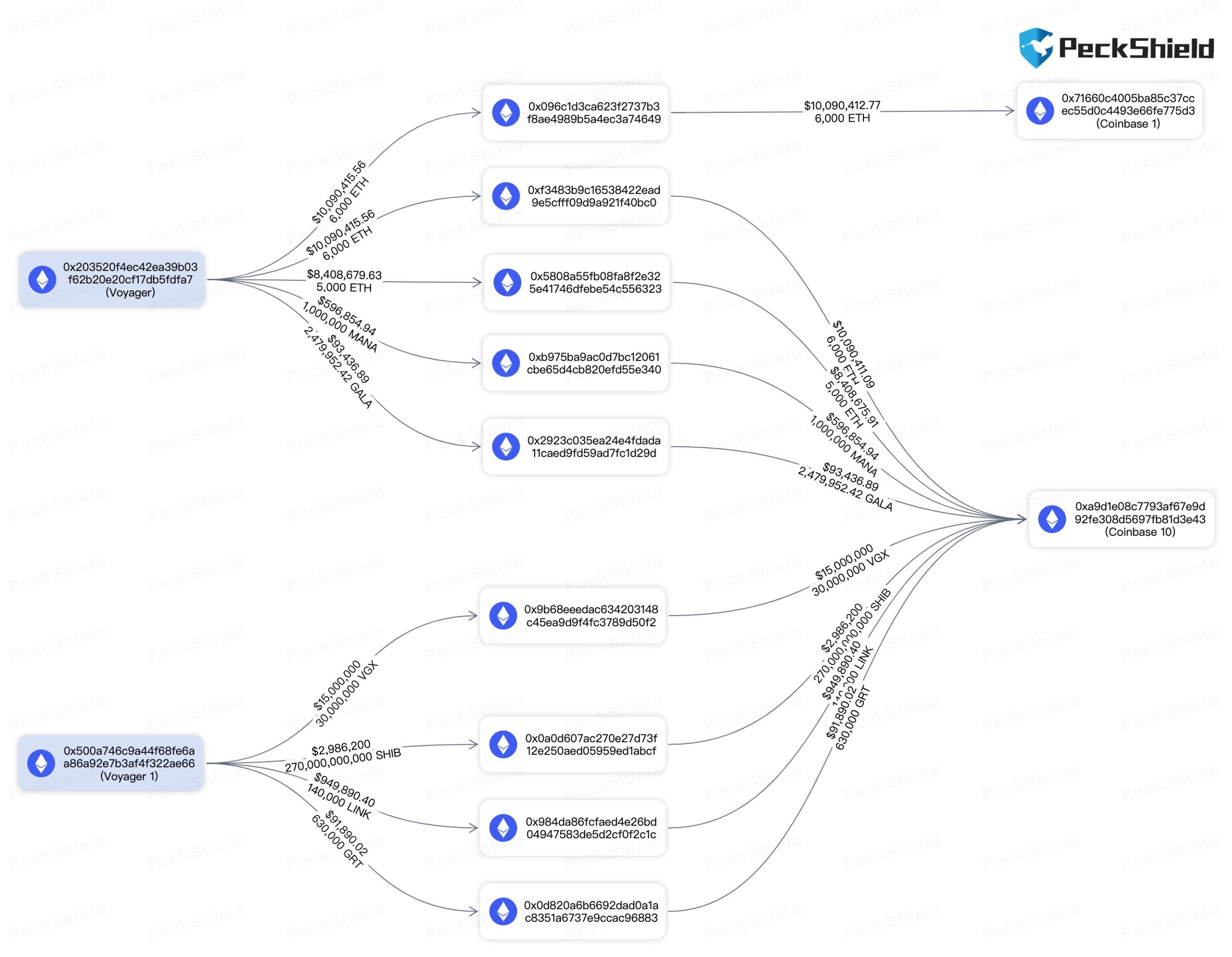

Blockchain security firm PeckShield reported today that Voyager-labeled addresses transferred $27.7 million worth of cryptos to Coinbase within the last 12 hours. Among them were 270 billion SHIB, the equivalent of about $3 million, as well as 17,000 ETH (about $19 million) and 12 million VGX (about $4 million).

Etherscan.io data shows that Voyager initially sent the 270 billion SHIB to an unknown wallet before moving it to a Coinbase-associated wallet called “Coinbase 10.”

Voyager Still Holds Quite A Lot

After the transfer, the wallet associated with the bankrupt crypto lending platform still holds 3.39 trillion SHIB worth $38.37 million. Thus, an end to the selling pressure on SHIB does not seem to be in sight for the time being, with Voyager at least not dumping all of its Shiba Inu on the market at once, probably causing a massive price drop.

As NewsBTC reported, this is not the first time Voyager has transferred some of its Shiba Inu to Coinbase to (presumably) sell the token. According to Arkham, Voyager has sold more than $350 million worth of crypto assets from its on-chain holdings in the last six weeks.

For this, the crypto lender has used Binance US, Coinbase and direct OTC trading with Wintermute to clear its books. Since the beginning of March only, Voyager has sent a total of $138.88 million in over 25 different crypto assets to market makers and exchanges.

Voyager Digital has been selling off $350M+ worth of crypto-assets from its on-chain holdings over the past 6 weeks.

Here's Arkham's deep dive into which assets are being liquidated and exactly where capital is moving. pic.twitter.com/lFCrZ7pMXG

— Arkham (@ArkhamIntel) March 9, 2023

The top 3 largest liquidated assets in the last three months were Ethereum ($181.74 million), SHIB ($67.54 million) and VGX ($28.82 million). The liquidation process began in January, when $36.27 million worth of MATIC was moved to exchanges. Since then, however, the rate of sales has increased significantly.

In February, $183.37 million worth of crypto assets were liquidated from Voyager addresses during the month. According to Arkham, about only 3-4% of the total liquidation volume was transacted directly over-the-counter with Wintermute addresses. The majority was likely sold on the market.

Shiba Inu Price Retests Key Support Again

The recent Voyager sell-off comes at a time when the SHIB price has managed to turn the $0.00001086 mark back into support over the past four days. Today, a retest of this crucial support appears to be on the table for SHIB.

If SHIB holds this support, a renewed push towards the 200-day exponential moving average (EMA) would be possible before resistance at $0.000012 comes into focus. If SHIB falls below the support, a drop towards $0.00000965 seems to be likely.