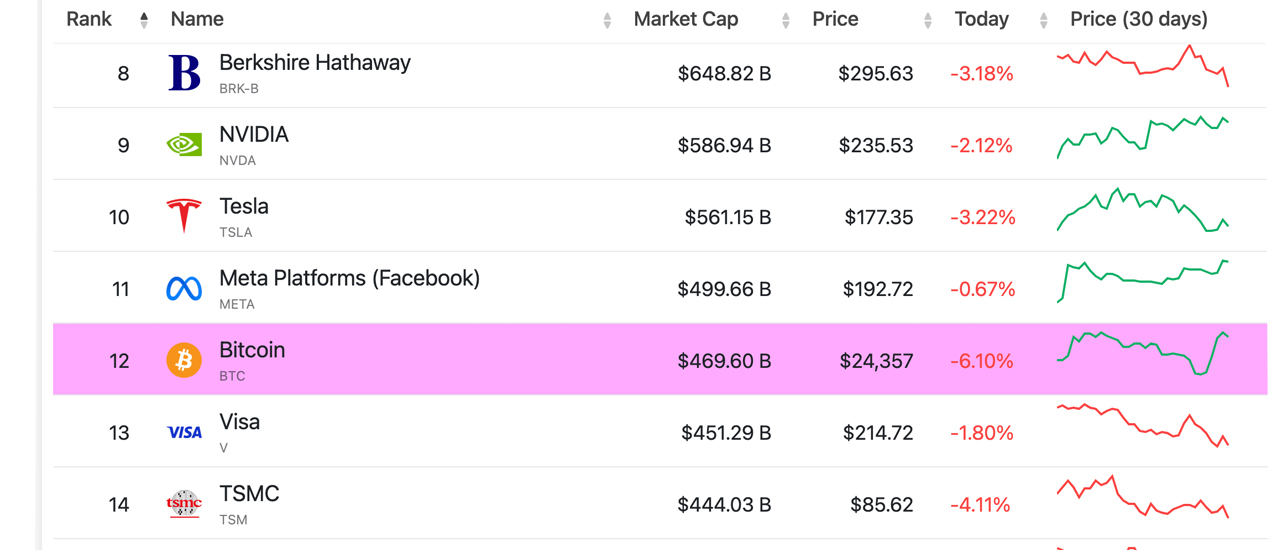

After dropping below $26,000 per unit, the price of bitcoin, the leading digital asset by market capitalization, is still up 9.6% since last week. However, its price has decreased by 6.5% in the last 24 hours. Out of the 7,316 companies, crypto assets, precious metals, and exchange-traded funds worth more than $82 trillion in value, bitcoin is the 12th largest asset worldwide by valuation.

Bitcoin’s Market Capitalization Compared to Other Top Assets: Leading Crypto Climbs Above Visa, But Lags Behind Meta

Crypto assets, specifically bitcoin (BTC), have increased in value this week following the collapse of three major U.S. banks. Over the past 24 hours, bitcoin (BTC) has dropped 6.5% against the U.S. dollar. However, weekly metrics indicate that BTC is up 9.6% week over week. Most of BTC’s increase occurred on March 14, when it jumped above the $26K zone to precisely $26,533 at around 9 a.m. (ET) on Tuesday. As of 2:35 p.m. on March 15, bitcoin is exchanging hands for $24,357 per unit.

Despite the decrease in value against the U.S. dollar, bitcoin has become the 12th largest valuation in the world, surpassing the market capitalization of payments giant Visa. On Wednesday afternoon, BTC had a market valuation of $469.60 billion, which is $18.31 billion more than Visa’s. However, the crypto asset’s market valuation is still below that of Meta (formerly Facebook), which is currently at $499.66 billion. For bitcoin to become the 11th largest asset by valuation in the world, its market capitalization needs to increase by $30.06 billion, surpassing that of Meta.

Currently, the top ten assets by market valuation include gold, Apple, Microsoft, Saudi Aramco, silver, Alphabet (Google), Amazon, Berkshire Hathaway, Nvidia, and Tesla. Gold, the leader of the group, has a market capitalization of around $12.81 trillion. While BTC represents 42.7% of the crypto economy’s $1.1 trillion in value, it only accounts for 3.67% of gold’s overall market valuation. Bitcoin’s market valuation would need to increase by approximately $12.34 trillion to surpass gold’s market capitalization. However, bitcoin’s market valuation is currently closer to silver, which is valued at $1.245 trillion as of Wednesday afternoon.

Therefore, as of today, bitcoin’s market capitalization is approximately 37.7% of silver’s market valuation. To surpass silver’s market capitalization, bitcoin’s market valuation would need to increase by approximately $775.4 billion. In October 2021, BTC’s market capitalization ran up against silver’s overall valuation, but at that time, silver’s capitalization was $1.31 trillion. Regarding contending with tech giant Apple’s net worth, BTC’s market valuation accounts for 19.69% of Apple’s. For bitcoin to exceed the California tech giant’s net worth, it would need to increase its market valuation by another $1.917 trillion.

What do you think about bitcoin’s seven day market performance and the crypto asset becoming the 12th largest asset by market cap worldwide? Share your thoughts about this subject in the comments section below.