Tether’s USDT supply reached 74 billion for the first time since May 2022, according to CryptoSlate’s data.

Over the past 30 days, Tether’s supply added roughly 5 billion as its stablecoin rivals like Binance USD (BUSD) and USD Coin (USDC) faced regulatory scrutiny and banking issues. This resulted in investors ditching these embattled stablecoins for the relative safety of USDT.

For context, USDT’s supply grew by 10% in the current year while USDC, BUSD, and DAI supplies shrank.

Meanwhile, USDT’s market dominance has reached 56.4%

USDT seeing more whales transactions

Blockchain analytical firm Santiment reported that Tether has recently seen more whale transactions.

According to Santiment, the stablecoin witnessed eight $1 billion transactions over the past year

Santiment added that Tether’s supply on exchanges dropped by 28.9% to a 10-month low as investors showed more trust in it following the struggles of USDC.

Crypto investors flee to USDT

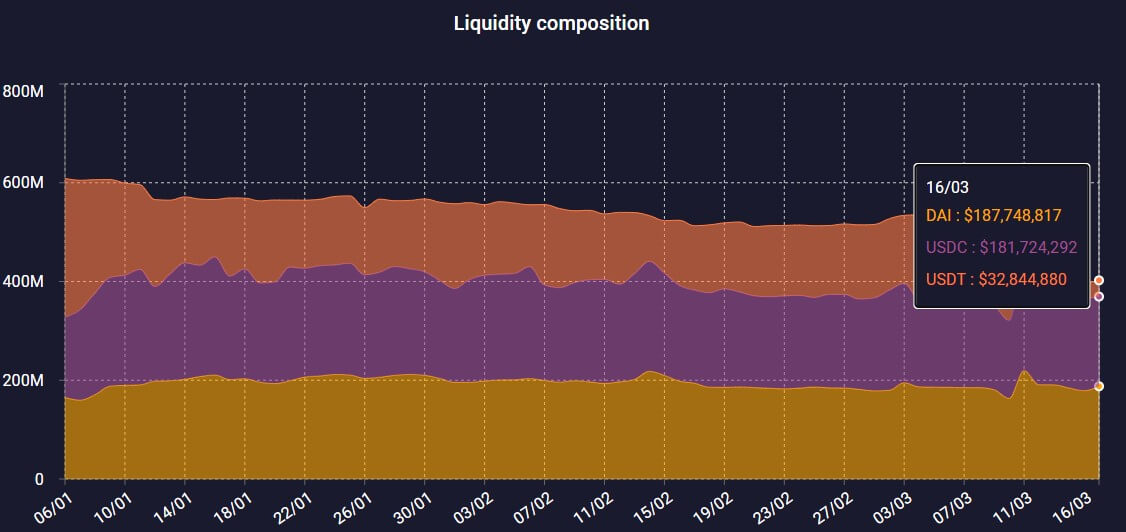

Curve 3pool’s dashboard corroborates Santiment’s data as its liquidity pool is heavily imbalanced.

According to the dashboard, USDC and DAI account for over 90% of the pool, while USDT makes up just 8.61%. This means that crypto investors prefer holding USDT as against the other stablecoins.

The imbalanced pool shows the stablecoin preferences of crypto investors during market volatility because it is supposed to hold equal balances of all three stablecoins.

FUD still surrounds Tether

Despite crypto investors’ recent faith in the stablecoin, concern remains over its opaque reserves.

In 2021, the stablecoin issuer settled with New York authorities over its dollar reserves backing. Tether also saw a rise in the number of hedge funds betting against it after Terra’s algorithmic stablecoin, UST, collapsed.

At the time, USDT honored around $10 billion in redemptions over two weeks as investors feared the stablecoin could collapse.

Besides that, the collapse of several crypto firms also birthed questions of if Tether was exposed to any of them.

However, Tether’s CTO Paolo Ardoino has insisted that the stablecoin issuer has no exposure to any of these firms, including the distressed crypto-friendly banks. A recent statement from the firm added that it has been the target of “outdated, inaccurate, and misleading coverage and allegations.”

The post Tether’s circulating supply reaches 10-month high of $74B appeared first on CryptoSlate.