Quick Take

- One week from the fallout of SVB, with “higher for longer” calls for interest rates to tame four-decade-high inflation, the Fed has capitulated.

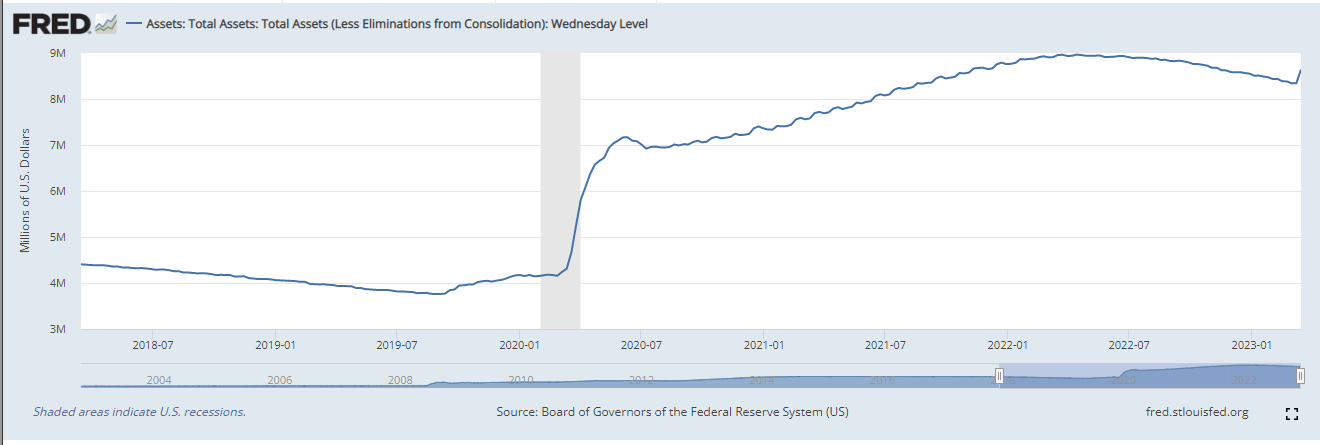

- The fed balance sheet has expanded by over $300 billion this week.

- In layman’s terms, BTFP allows institutions to swap devalued assets for full-value cash (money coming from nowhere).

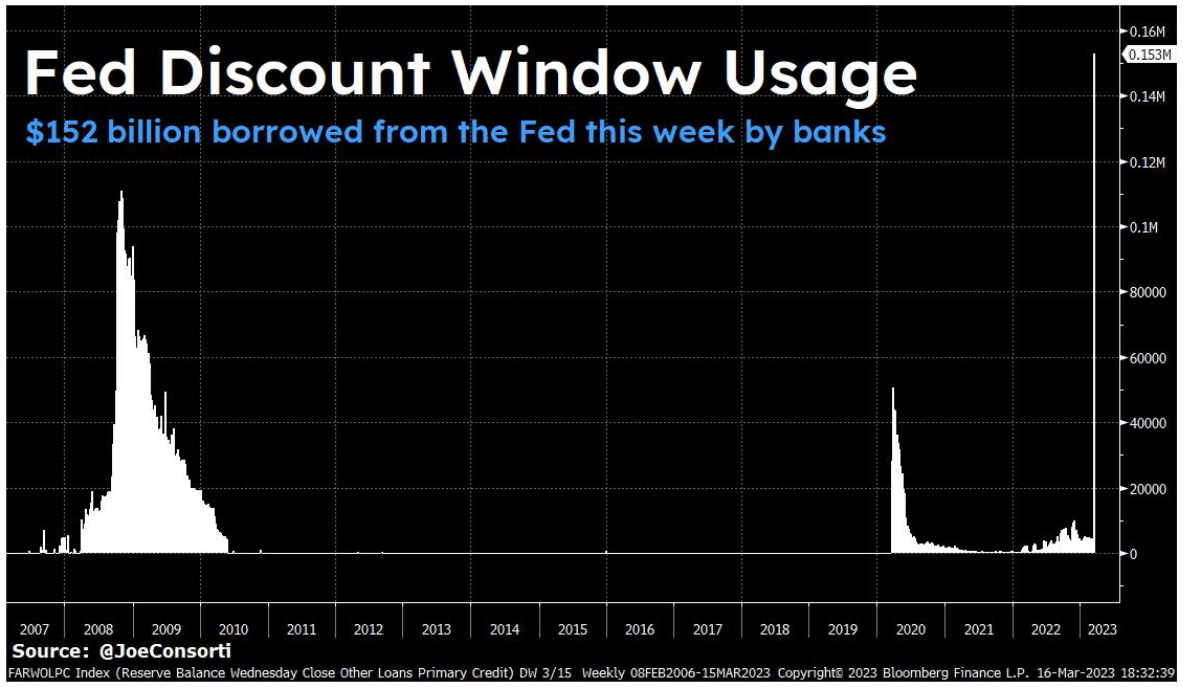

- In addition, the fed’s discount window went parabolic to $148 billion this week, the highest level since 2008.

- Again in layman’s terms, distressed banks calling for Fed liquidity.

- The Fed balance sheet has jumped to $8.69 trillion — wiping out half the quantitative tightening they have been doing for the past year.

- As I said yesterday, Bitcoin sniffs out any liquidity in the market. As a result, Bitcoin is above $26,000.

Balance Sheet Growth

- Approximately +$148.3 billion – net discount window borrowing.

- Approximately, +$11.9 billion – the new Bank Term Funding Program

Subtotal: $160.2 billion

- Approximately +$142.8 billion – borrowing for banks seized by FDIC Total:

This totals = $303 billion

The post Stealth QE: Feds balance sheet grows $300B, Bitcoin breaks $26,000 appeared first on CryptoSlate.