The Bitcoin price has once again risen above $26,000, responding to the extremely bullish macro environment. If the rally continues and a breakout above the current key resistance on the daily chart is confirmed, the Bitcoin price could be in for a bullish weekend.

The macro environment has changed radically in the last week. First and foremost, the US Federal Reserve (fed) has turned on the money printer again to bail out US banks. Within the last week, the Fed added a whopping $300 billion in assets to its portfolio, offsetting quantitative tightening (QT).

This amount is record-breaking. The only time the Fed added a larger amount was shortly after the March 2020 crash caused by COVID ($500 billion). In addition, bond yields have crashed by over 25%. The Consumer Price Index (CPI) has also fallen to 6.0% on an annual basis, in line with expectations.

Due to these events, the expected interest rate rand pace of hikes have radically changed in the last week, from further tightening and “higher for longer” to imminent easing.

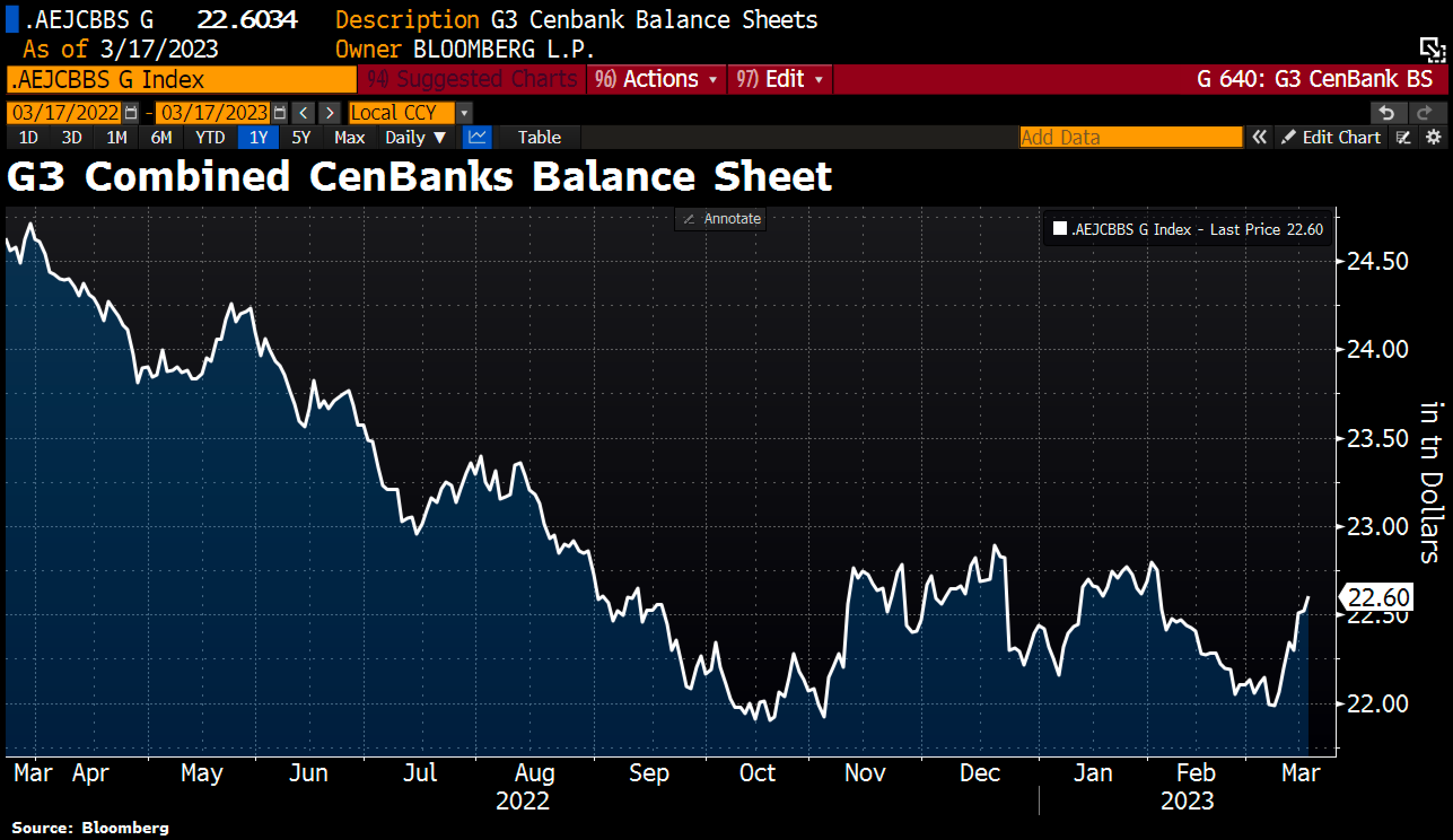

German journalist and author Holger Zschaepitz also drew attention today to the fact that quantitative easing (QE) is taking place around the world and is driving stock markets (and thus Bitcoin) up:

It’s the liquidity, stupid! This chart shows why stocks are rising in the midst of the banking crisis. Central banks are again pumping billions in liquidity into the market. The combined balance sheet of the 3 leading CenBanks rising again.

Bitcoin Price Ahead Of Starting A Major Rally?

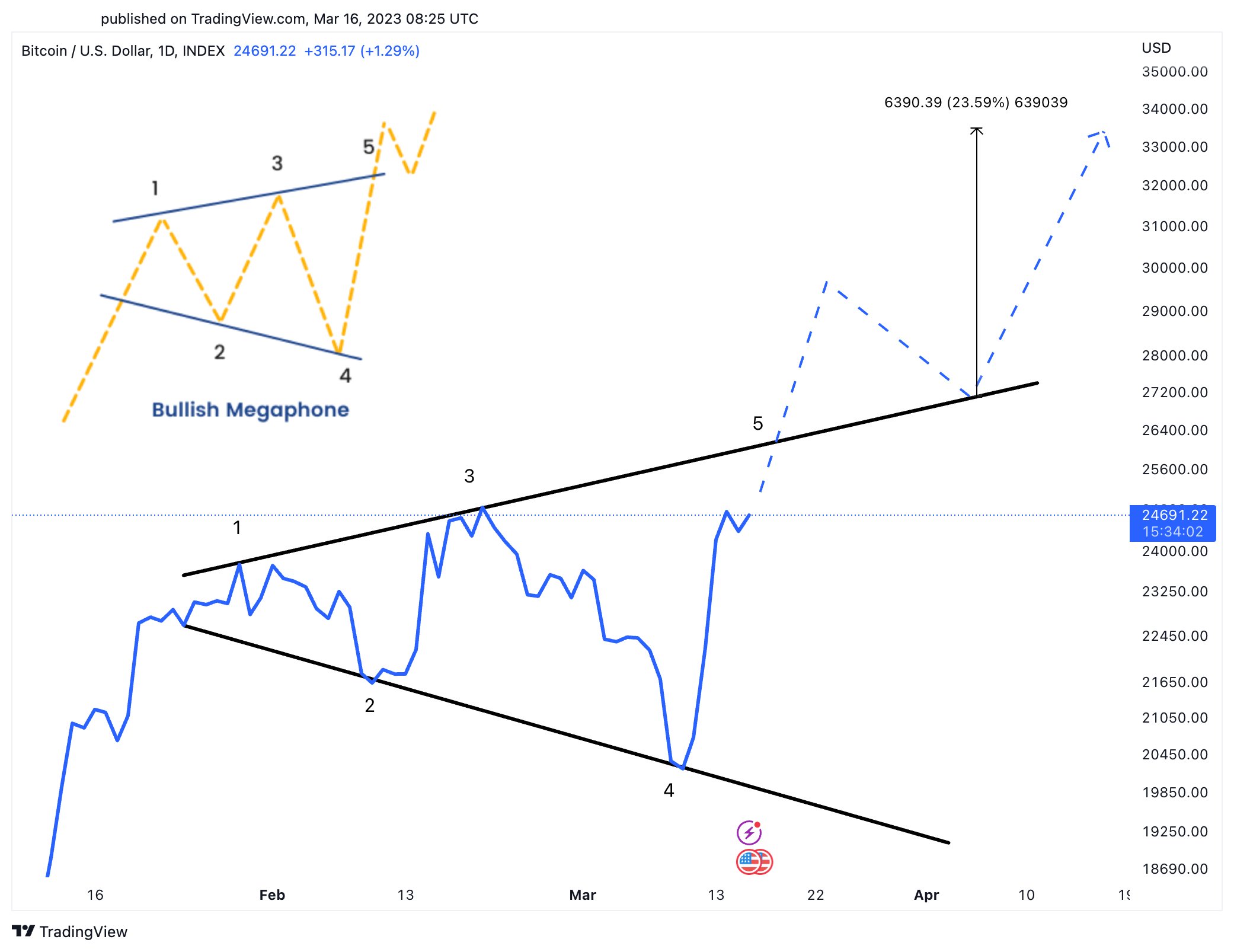

Analyst Martinez shared the chart below and stated, “If this bullish megaphone is the governing pattern behind BTC price action, we could be about to witness another bullish weekend!”

Founder of Eight Global and analyst Michaël van de Poppe calls Bitcoin’s current move “great” as the price has broken through the key resistance area at $25,000 and is attacking the yearly highs. He added:

On lower timeframes, I’m watching whether $25.9K can sustain today for support. If it can’t, harsh correction might be it. If we can, $28K-30K is next -> potential shorts.

Renowned analyst Bob Loukas also expects a move towards $28,000. “$BTC seems to be chipping away at overhead resistance at the $25k range in an early cycle move. Feels like a move to $28k-$32k will be next, once cleared.”

Referring to the chart below, the analyst “exitpump” discusses that Bitcoin has managed an impulsive breakout after several attempts with large volume. In addition, the perps’ buying delta is much larger this time as the shorts have been liquidated and now only the longs are going for it. “Want to see limit buyers chasing the price,” the analyst added.

However, there are also cautionary voices warning of another setback. Greeks.Live states 46,000 BTC options with a put-call ratio of 1.11, a maximum pain point of $23,000 and a face value of $1.18 billion are about to expire.

Meanwhile, analysts from The Kobeissi Letter explain that “nothing adds up.” Among other things, they state that tech stocks are rising as if a recession has been avoided. Oil prices are falling as if we were in a recession. Regional banks are down as if the banking system has collapsed. Big banks are rising as if the banking system is fine.

“We are at a major pivot point all around the board, especially with Fed policy in question. Next few weeks are big,” the analysts concluded.

At press time, the Bitcoin price was at $26,447 and (shortly) exceeded $26,500 for the first time in over 9 months.