Operation Choke Point 2.0 has deprived the crypto industry in the United States of crucial fiat payment channels. As NewsBTC reported, the liquidity of the Bitcoin market is near historic lows, but what about altcoins such as Litecoin (LTC), Chainlink (LINK) and XRP?

To that end, Kaiko, a digital asset data provider, has released a new study. For traders, the research is a must-read to assess how volatile each crypto asset is based on its liquidity. And the study has a few surprises in store.

Besides BTC, Which Cryptocurrencies Are Most Liquid?

At the beginning of the report, Conor Ryder, research analyst at Kaiko, notes that market depth is at a 10-month low because of OCP 2.0 and due to market makers having to pull their orders from exchanges. “[S]o it is essential investors can accurately evaluate the liquidity of each individual asset to gain an understanding of how much short term volatility to expect,” Ryder explains.

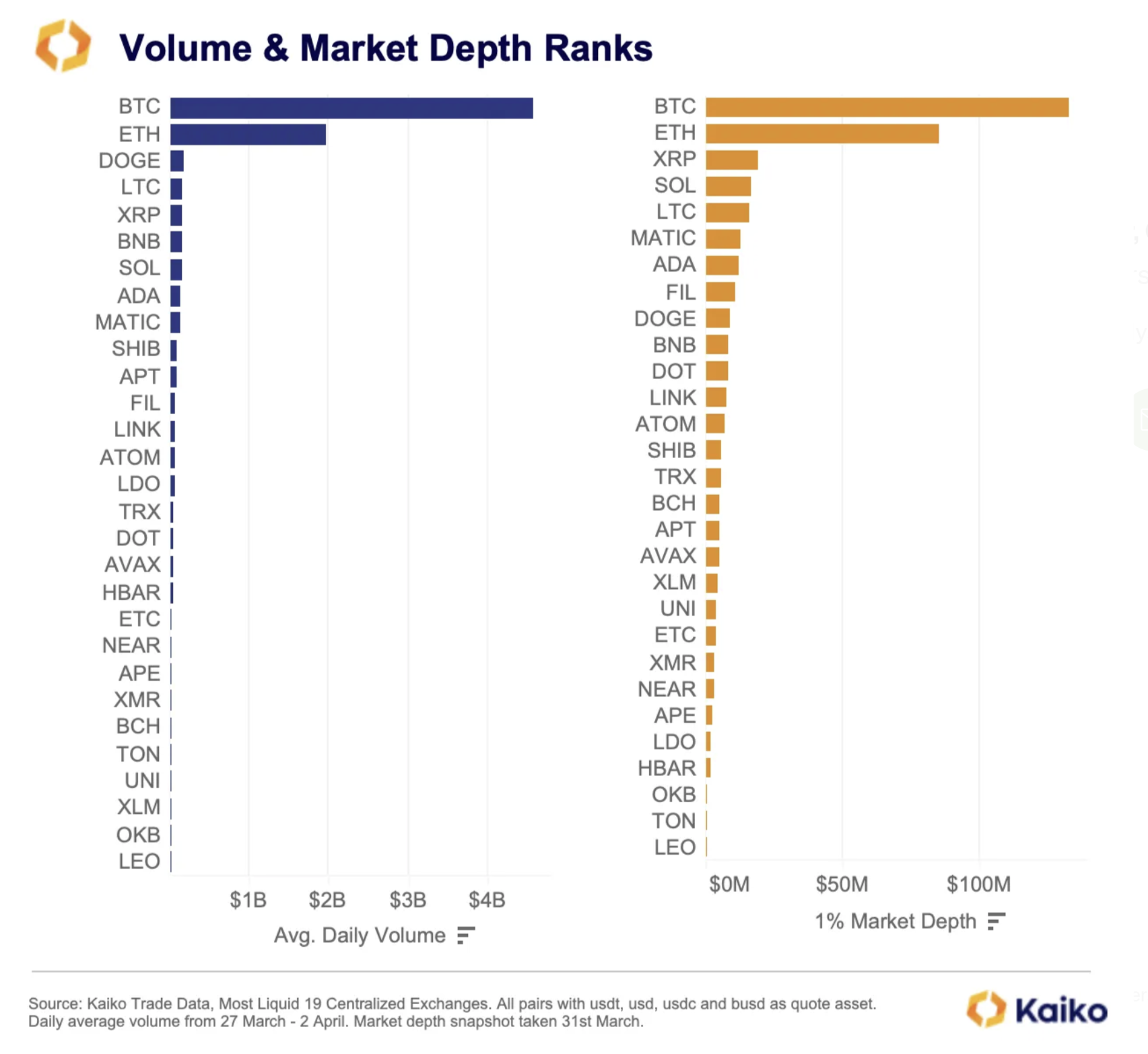

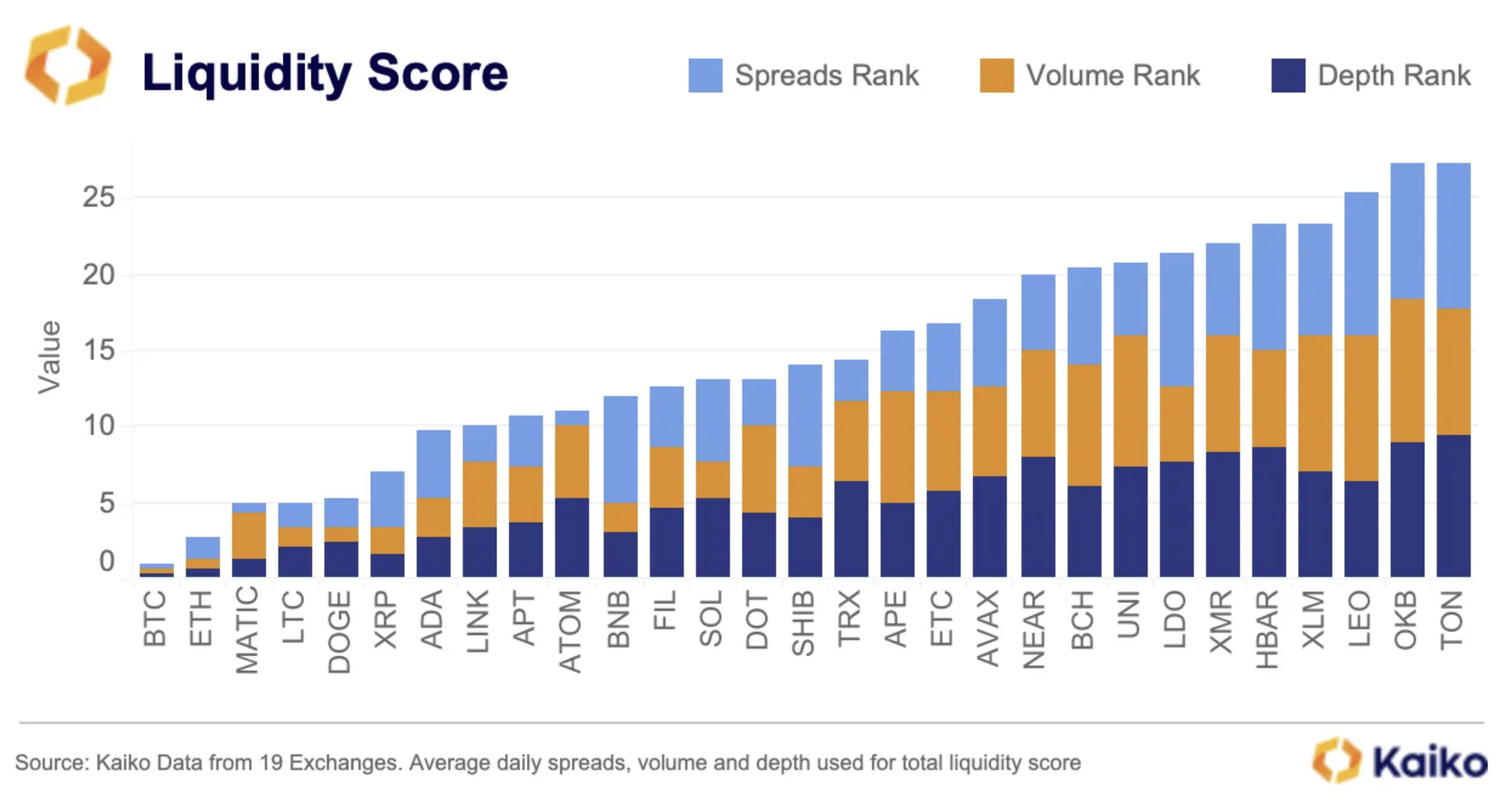

Overall, Kaiko examined data on the 29 largest cryptocurrencies by market capitalization, excluding stablecoins and wrapped tokens. To define a liquidity rank, three criteria are used: volumes, market depth and spreads.

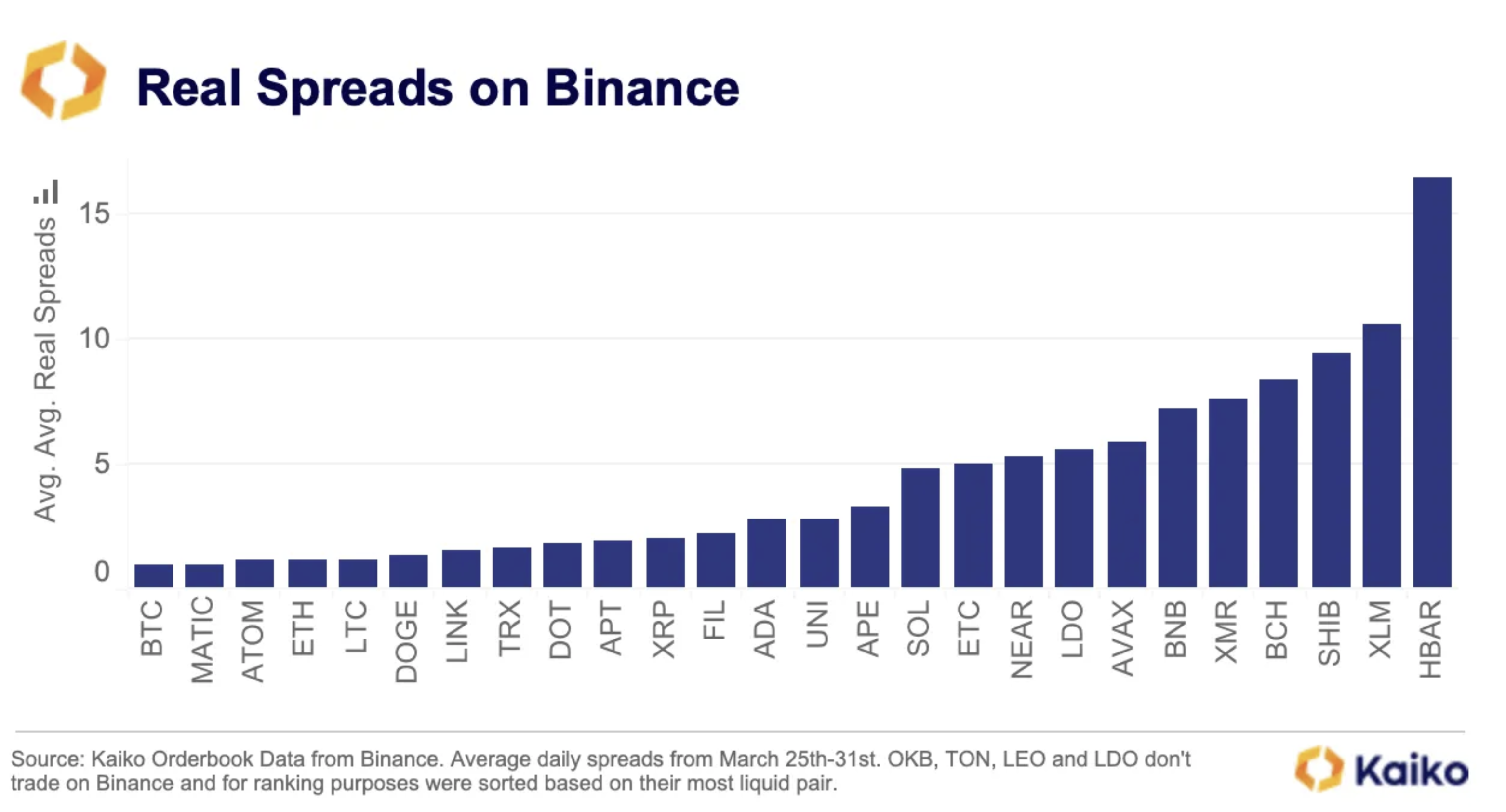

For volume and market depth, data from all active USD, BUSD, USDT and USDC pairs on 11 of the most liquid centralized exchanges were combined. For spreads, Kaiko uses only data from Binance, the most liquid exchange with the widest range of markets.

In terms of volumes, Dogecoin and Litecoin were the most conspicuous cryptos in the first quarter of 2023. As the chart below shows, DOGE ranks an impressive third behind BTC and ETH, ahead of several tokens with larger market capitalizations.

Litecoin ranks 4th, despite having only the 11th largest market cap (excluding stablecoins). “The cautionary note with LTC volumes is that earlier this year I found some examples of LTC wash trading on Bitforex so the volume figure alone is not enough to conclude that LTC is particularly liquid,” the analyst states.

Chainlink also outperforms its rank by market capitalization and lands in 13th place by trading volume after all.

In terms of market depth, XRP and Solana stand out positively in the subsequent places behind BTC and ETH. Litecoin is again in a very good fifth place, while LINK ranks a respectable 12th. BNB, on the other hand, is a negative surprise.

“BNB depth is surprisingly low again, considering it is the native token of the most liquid exchange, remaining in tenth despite being the third largest non-stablecoin token,” notes Ryder, who also discusses that the lower the market depth, the easier it is for larger market orders to influence the price.

In traditional finance, spreads are the most commonly used indicator for assessing the liquidity of a market. Generally, the smaller the spread, the more liquid the market.

In this category, Polygon (MATIC) and ATOM impress, ranking ahead of Ethereum (ETH). Disappointing, on the other hand, are once again BNB, which gets a 21st place in terms of spreads on its own exchange, and Solana, which ranks 16th, despite being the 8th largest non-stable token by market cap.

How Do Litecoin, LINK and XRP Fare Overall?

There are definitely surprises in the ranking of the overall liquidity, which results from the three liquidity ratios mentioned above. In general, the rule is that the smaller the amount of a metric to its score, the better its liquidity.

Behind Bitcoin and Ethereum, MATIC and Litecoin occupy the best places and are thus less susceptible to the influence of larger orders. XRP lands in 6th place, Chainlink in 8th, making them also generally prone to less volatility. Ryder also highlights Aptos:

APT liquidity far exceeded its market cap, implying that it is one of the most liquid tokens relative to its size and should benefit from less volatility as a result.

LEO and BNB, on the other hand, give Kaiko’s analyst cause for concern. The market capitalization of the two exchange tokens is far excessive in relation to their liquidity – ” a similar situation to FTT who’s illiquidity played a role in the collapse of FTX.”

At press time, the Litecoin price stood at $90.30. Thus, LTC is still writing higher lows in the 4-hour chart, maintaining its upward trend.