The volatility of Bitcoin price has always been a hot topic in crypto, as BTC fluctuates rapidly because of various factors such as regulatory changes and market sentiments. As Bitcoin continues to gain mainstream adoption, the anticipation for its next move is at an all-time high.

Bitcoin enthusiasts and investors alike are eagerly anticipating the next move of the world’s most popular cryptocurrency, as it stands at a critical crossroad.

While the long-term outlook for Bitcoin’s price remains bullish, the short-term trend is yet to be determined, leaving many wondering if the digital asset will manage to surpass its major obstacle of the $30,000 resistance level.

Will It Be A Correction Or Breakout?

As the market holds its breath, all eyes are on the demand and buying power, the ultimate determinants of Bitcoin’s fate. Will the buyers come in strong and push Bitcoin past its hurdle, or will the cryptocurrency market witness a correction?

In the context of cryptocurrency, a correction refers to a temporary price decline in the value of a particular cryptocurrency or the entire cryptocurrency market, following a period of rapid growth.

Corrections are a natural part of market cycles, and they can be triggered by a variety of factors, such as market sentiment, news events, or changes in regulation.

During a correction, cryptocurrency prices may drop significantly, leading to a market downturn and a decrease in overall trading volume. However, corrections are often seen as healthy for the market, as they help to remove excess speculation and stabilize prices over the long term.

Bitcoin Price Inches Upward

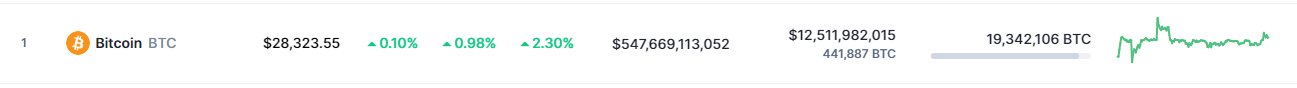

Now, Bitcoin’s latest price update reveals a modest 0.98% rally in the last 24 hours, pushing the cryptocurrency’s value to $28,323, according to CoinMarketCap.

Despite the seemingly slow progress, Bitcoin has also managed to maintain a steady 2.30% climb over the past seven days, hinting at the potential for a more significant surge in the near future.

Meanwhile, Bitcoin’s 4-hour timeframe chart reveals an ascending trendline that has been in place for several months and is presently propping up the price.

The cryptocurrency’s current predicament, however, is that it appears stuck between the ascending trendline, which began at the $28,000 range, and the $30,000 price region.

The significance of this crucial range cannot be overstated, as a substantial move above or below it will likely eliminate any lingering uncertainty and determine Bitcoin’s mid-term outlook.

It’s a subtle yet encouraging sign for Bitcoin holders and traders, who are always on the lookout for any movement in the volatile crypto market.

Weekly Analysis Predicts Bullish Movement For BTC

Bitcoin’s daily technical analysis does not offer much insight into the cryptocurrency’s trend direction, but the weekly outlook paints a decisively bullish picture.

This optimistic forecast is supported by several factors, including the weekly time frame, which suggests that Bitcoin’s price is set to climb toward its long-term resistance at $31,500.

Meanwhile, it’s essential to note that this bullish forecast could be invalidated if Bitcoin experiences a weekly close below $24,600.

If that happens, the cryptocurrency’s price could fall back toward the $20,000 mark. As always, the crypto market is volatile and unpredictable, and traders and investors should proceed with caution.

-Featured image from CoinPedia