Stacks, the blockchain platform that promises to bring smart contracts to Bitcoin, has outperformed most altcoins in the top 50 roster in the market today. While other cryptocurrencies struggled to make significant gains yesterday, the tables have turned today as Stacks’ native token rises to new heights.

This spike in value has left many investors wondering if Stacks is poised to become the next big thing in the world of blockchain technology.

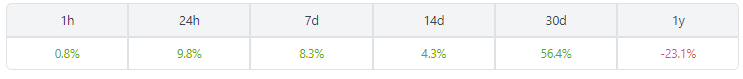

STX Price Rallies In Last 7 Days

The price of STX at Coingecko has bounced back strong, rallying 10% in just 24 hours. The current price of $0.843249 per token indicates a renewed interest in this cryptocurrency. In the last week, STX has proven its resilience, maintaining a 9% run to lead other major altcoins.

As investors and traders keep a close eye on the market, STX’s sudden surge may be a sign that it is once again a viable investment opportunity. Whether this trend will continue, however, remains to be seen.

Meanwhile, Ethereum has gained 1.5% in value and is currently trading at $1,860. Last week, the second-largest cryptocurrency hit a peak price of over $1,950, which was the highest it has been in eight months.

Additionally, altcoins such as Avalanche, Cardano, Dogecoin, Litecoin, MATIC, Polkadot, Ripple, Shiba Inu, Solana, and Tron have all experienced slight gains above 1%.

Although LDO performed poorly yesterday, it has since rebounded and is now sitting at $2.42 after a 4.4% increase in value today.

STX Bullish Perception Prevails Despite Some Bearish Sentiment

The current perception of STX is generally positive, with a bullish tendency prevailing among investors. According to a recent assessment by LunarCrush, there was a 95% increase in bullish sentiment between 2 April and the time of the analysis. This indicates a strong interest in the token and its potential for growth.

However, there was also an increase in bearish sentiment towards STX during the same period, with a growing number of posts expressing cynicism about the token’s future prospects. This suggests that while many investors are optimistic about STX, others are more cautious.

In addition to its price action, STX has also seen significant growth in its Total Value Locked (TVL), which measures the amount of unique smart contract deposits in a protocol. However, the rapid increase in TVL has slowed down since 25 March.

Despite this, STX remains a top choice among traders, as evidenced by its 24-hour 230% rise in trading volume. This high volume indicates significant buying and selling activity, highlighting the token’s attractiveness to investors.

-Featured image from Kraken Blog