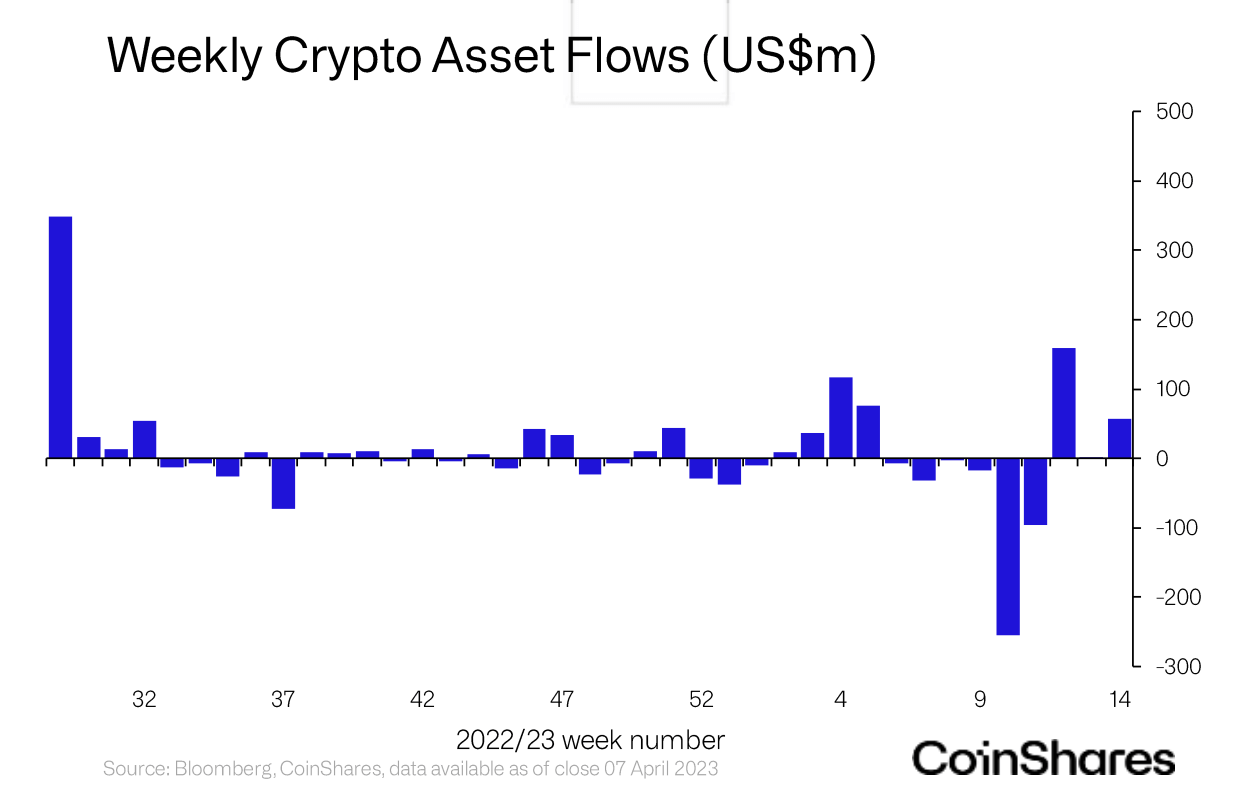

The crypto investment products market recorded $57 million in inflows during the week of April 3, according to CoinShares’ report.

This inflow brought the crypto investment products market into a net inflow position year-to-date, as the CoinShares report noted.

Up until the week of March 20, the crypto investment products market has been recording outflows for six weeks straight. The total losses during this time added up to $408 million.

The largest outflow during these six weeks was recorded in the week of March 6, when the market lost $255 million, which accounted for 1% of the market at the time.

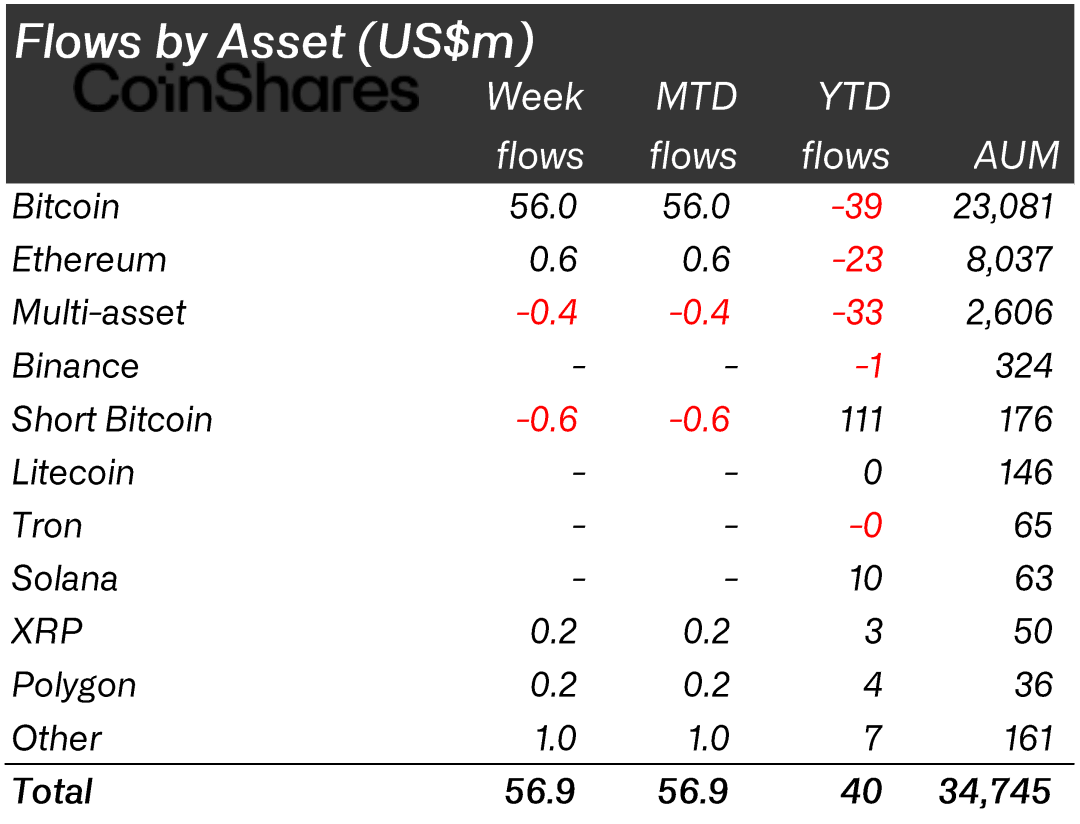

Flows by asset

Bitcoin (BTC) based investment products nearly accounted for all the inflow recorded during the week. Of the $57 million worth of inflows in total, BTC products saw $56 million in inflows.

Ethereum (ETH) based products contributed the second largest amount, seeing $600,000 in inflows. Ripple (XRP) and Polygon (MATIC) also contributed $200,000 in inflows each.

Meanwhile, short-BTC-based products and multi-asset products recorded outflows worth $600,000 and $400,000, respectively.

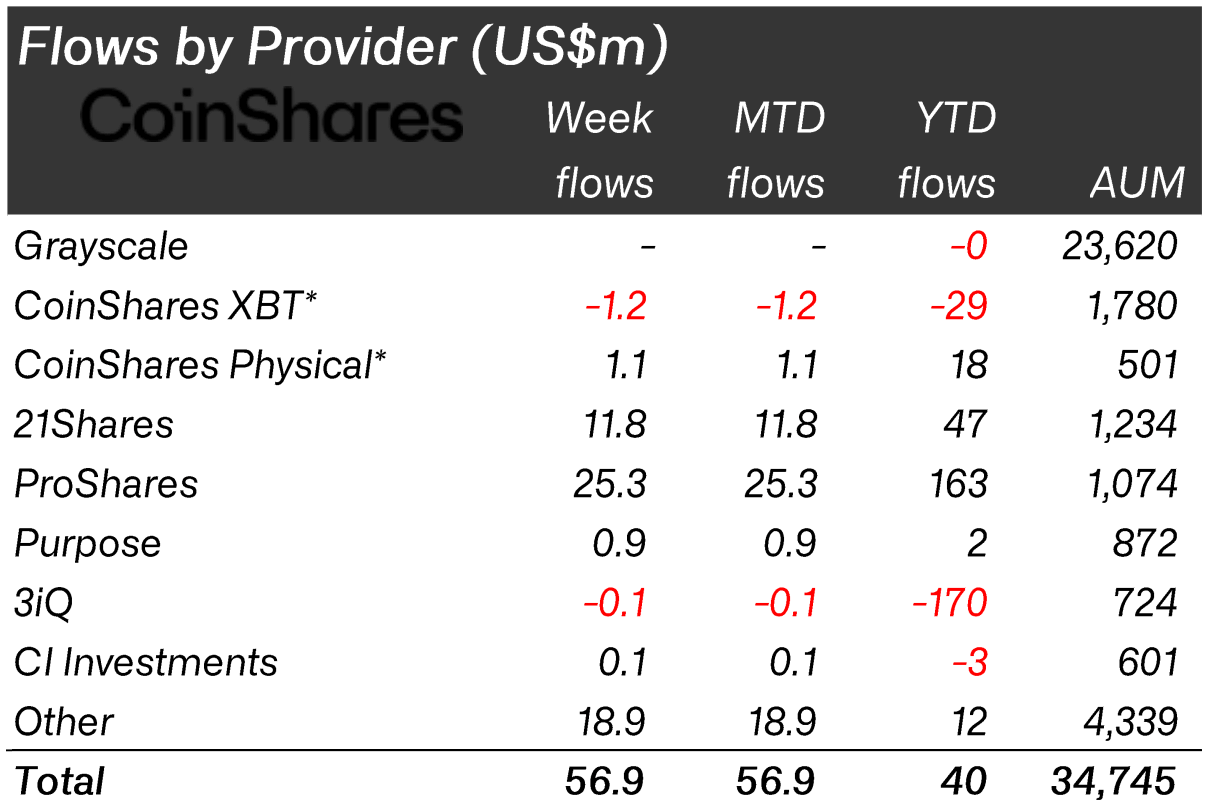

Flows by provider

When the flows are categorized by the provider, ProShares come forward as the organization that recorded the most significant inflow at $25.3 million — accounting for over 44% of the total amount.

21Shares followed ProShares as the second largest contributor to inflows with $11.8 million. Even though CoinShares Physical recorded $1.1 million in inflows, CoinShares XBT saw $1.2 million in outflows — which brought CoinShares’ final score to $100,000 in outflows.

Meanwhile, Purpose and CI Investments recorded $900,000 and $100,000 in inflows — while 3Qi saw $100,000 in outflows.

US leads in inflows

According to the numbers, the U.S. is responsible for adding $26.8 million in inflows — accounting for nearly 50% of the total amount.

Germany and Switzerland followed the U.S. by contributing the second and third most significant share in inflows with $16.6 million and $12.8 million, respectively. Canada also contributed $2.2 million in inflows as the fourth in line.

Meanwhile, Sweden and Brazil recorded $1.2 million and $300,000 in outflows, respectively.

The post Crypto investment products market reaches YTD net inflow appeared first on CryptoSlate.