Bankrupt crypto exchange FTX now has control of several blue-chip non-fungible tokens (NFTs), including Bored Ape, Azuki, Otherdeed, and Mutant Ape.

Coinbase director Conor Grogan tweeted this on April 26, noting that Bored Apes NFTs and several others belonging to the bankrupt firm were transferred to its multi-signature wallet. Grogan added that Hape Prime NFTs bought by Alameda for $100,000 were also moved to the same wallet.

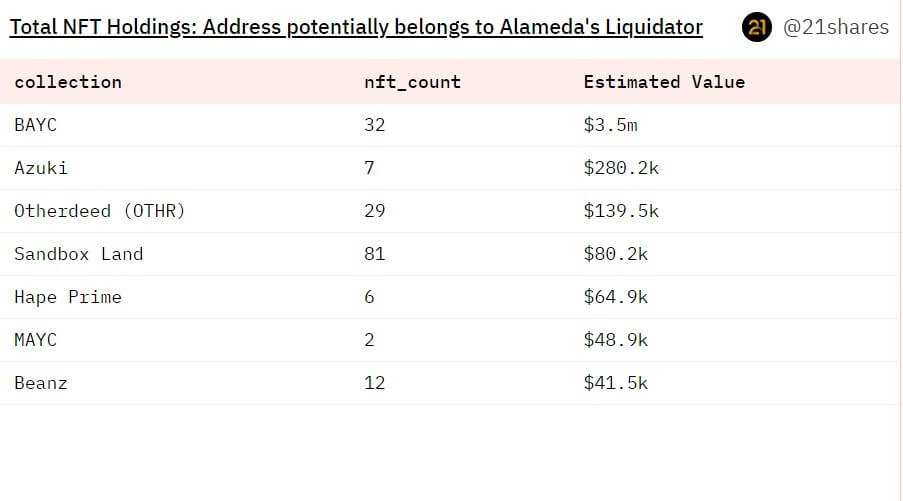

Dune analytics data shows that the FTX estate holds 32 BAYC, 7 Azuki, 29 Otherdeed, 81 Sandbox Land, 6 Hape Prime, 2 MAYC, and 12 BEANZ — cumulatively worth over $4 million.

According to available information, FTX bought most of these NFTs in 2021 while working on its NFT marketplace. At the time, it purchased 101 Bored Apes from Sotheby’s for $24.4 million; all the Apes were deposited on FTX US and listed for a lower price than the OpenSea floor price to attract more users.

Several people used this price disparity to acquire the NFTs from the FTX platform at a discount.

What next for FTX’s NFTs?

With FTX’s bankruptcy experts consolidating all the NFTs into one wallet, many believe the next step might be liquidating the assets.

However, any liquidation might hurt the floor price of these collections — which have already slipped significantly.

21co researcher Tom Wan believes FTX might not liquidate the assets directly but auction them like bankrupt Three Arrows Capital. In February, 3AC liquidator Teneo revealed it would sell some of the NFTs belonging to the bankrupt crypto hedge fund.

Consolidation efforts continue

Meanwhile, FTX’s management has continued consolidating the bankrupt firm’s assets belonging to the bankrupt firm.

The firm agreed to sell LedgerX for $50 million and would also explore the sale of its European business.

Besides that, increasing speculations exist that the exchange could explore reopening its operations. However, its executives have not decided whether such a reopening is viable.

The post FTX takes control of NFTs worth over $4M appeared first on CryptoSlate.