Terra Classic has made a significant move in the world of cryptocurrency with the passing of the LUNC Proposal 11487, and it’s leaving many wondering: what does this mean for the future of LUNC prices?

The proposal’s successful passage signifies a positive step towards achieving Terra Classic’s vision of a more decentralized and sustainable blockchain network. It also highlights the importance of community participation in shaping the future of the cryptocurrency.

With almost half of the voters showing their support, it’s clear that this decision has the potential to make a lasting impact on the Terra ecosystem.

LUNC Proposal To Gauge Interest In USTC Repeg Strategy

The proposal aims to ascertain whether the LUNC community was in favor of moving forward with the USTC Repeg proposal and the accompanying Agora discussion strategy. This proposal is critical in helping the Terra ecosystem recover its former glory, which was damaged by the USTC crash last year.

$LUNC & $USTC outperforming the markets today! Looking good!

Perhaps it’s hype for the #USTC re-peg proposal? pic.twitter.com/pfx0vE4AsG

— Classy

(@ClassyCrypto_) April 29, 2023

To stabilize the value of USTC, the proposed divergence mechanism will impose fees on trades that deviate from the targeted peg. According to the proposal, the fee will vary from 0% when the peg is reached to 100% at a 50% deviation from the peg.

Now that the proposal has been approved, the L1 team will establish an actual timetable and implement the mechanism in four stages.

LUNC Price Reaction

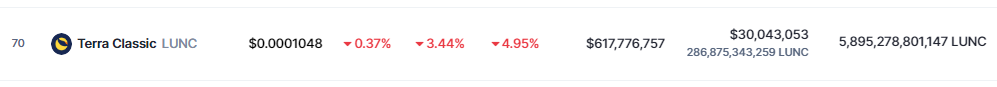

According to data by crypto market tracker CoinMarketCap, LUNC’s price registered a decline of 3.44% in the last 24 hours, trading at $0.0001048 at the time of writing. The crypto is down nearly 5% in the last seven days.

Despite the positive sentiment of the crypto community towards the Terra ecosystem during the voting process of the proposal, the growth of LUNC and USTC was short-lived.

The charts of both cryptocurrencies turned green on April 28, but the situation went south over the following days. The Terra ecosystem is currently struggling to maintain its positive momentum, and the decline in LUNC’s price is indicative of this struggle.

LUNC Outlook Post-Approval Of Proposal 11487

With the approval of Proposal 11487, the LUNC community has demonstrated its commitment to the stability and growth of the Terra ecosystem. The new divergence mechanism proposed is expected to stabilize the value of USTC and help the Terra ecosystem regain its former glory.

While the recent decline in LUNC’s price is a cause for concern for some investors, the implementation of the new mechanism is likely to restore investor confidence in the Terra ecosystem.

As the L1 team works towards implementing the mechanism in four phases, investors can look forward to a more stable and robust Terra ecosystem.

-Featured image from Unsplash