Cardano weathered the storm of a tumultuous April, marked by market turbulence and regulatory challenges, and emerged with a glimmer of growth. Despite the obstacles, the blockchain platform’s native cryptocurrency, ADA, managed to hold its ground and even make some notable gains along the way.

The recently released monthly report for April by Cardano has shed light on some intriguing developments regarding the network’s activity. The update offers insights into various aspects of Cardano’s performance during the month of April, presenting a comprehensive overview of the platform’s progress.

Here’s what’s up with Cardano:

Network Activity Shows Positive Growth Despite Challenges

Cardano’s latest monthly report for April indicates that the network experienced a healthy uptick in transaction activity, with a 2.49% increase to 65.6 million transactions and a 1.19% growth in the number of wallets.

The report reveals that simple transactions made up the majority, accounting for 49% of total transactions, while smart contract transactions grew by 30% and metadata made up the rest. The report suggests that Cardano’s increasing utility is driving significant growth.

#Cardano On-chain Stats

Let’s keep growing #CardanoCommunity!

pic.twitter.com/6Ct5iGW67k

— Cardano Foundation (@Cardano_CF) May 1, 2023

However, despite the positive network activity, ADA’s price has seen a decline in the past 24 hours, trading at $0.3875, a drop of 0.34%. The cryptocurrency’s bearish performance has continued, with a further drop of 2.43% in the past seven days.

It remains to be seen how Cardano’s growth in network activity will affect ADA’s price in the long term.

ADA Positive April 1st Half Followed By Market Decline

Meanwhile, aside from the network activity growth, Cardano’s monthly report also highlighted ADA’s impressive performance in the first two weeks of April, with a 23% price gain. However, the cryptocurrency then experienced a significant decline, losing almost all of the gains it had made.

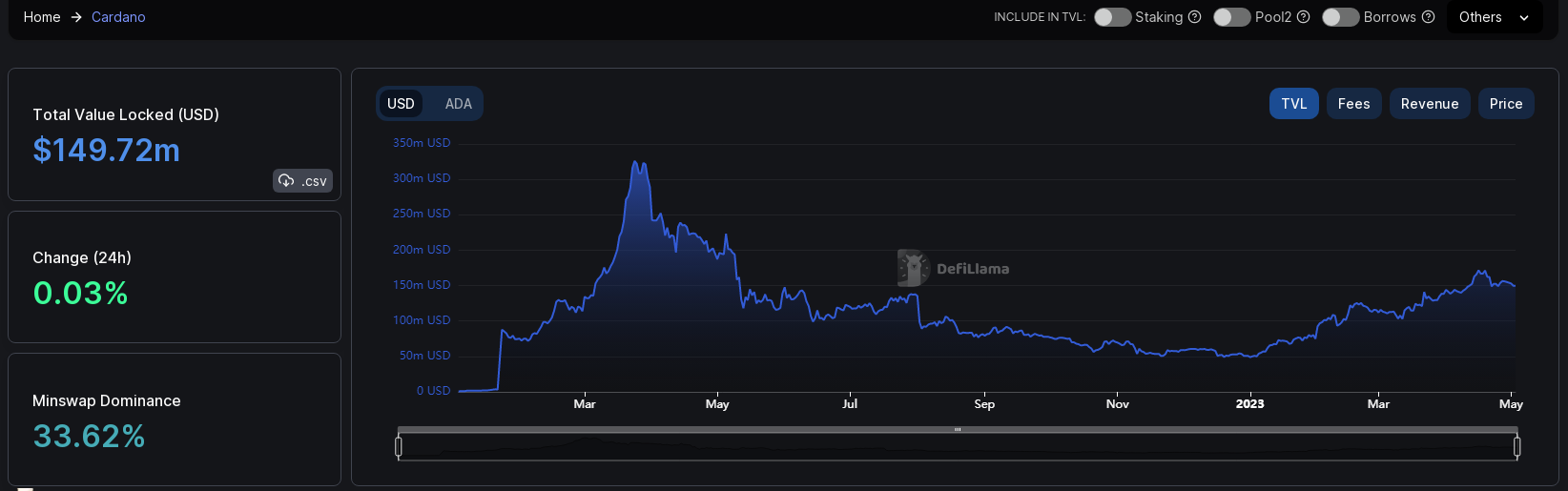

Despite this, Cardano’s total value locked (TVL) experienced a healthy increase, growing from a low of $138.61 million at the beginning of April to a high of $171.3 million. The TVL did experience a dip in the latter half of the month, settling at $152.90 million, but remained above its April low. Its current TVL is at $149.72 million.

Investors should keep an eye on the potential for an extended downside if the support level proves weak. An unstable support level could lead to a retest of the mid-term support range of $0.35-$0.36.

At the time of writing, ADA’s RSI had slipped below the mid-level, and the MFI showed signs of outflows, indicating potential further declines in the short term.

-Featured image PrimeStone