Quick Take

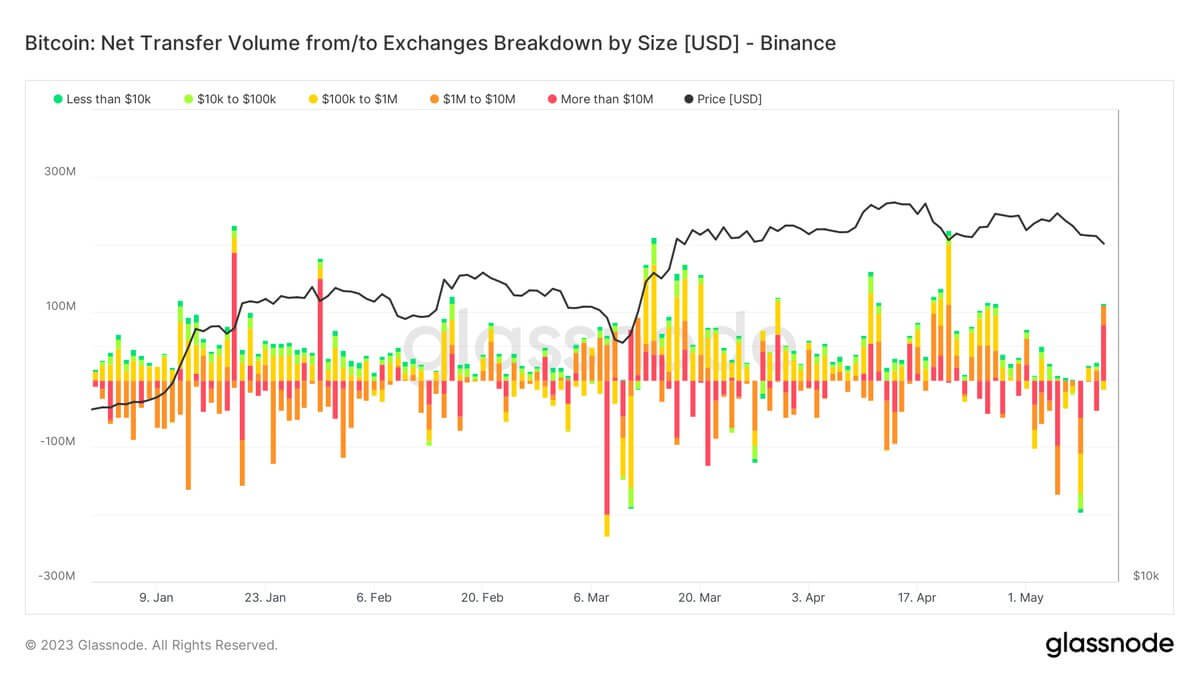

- In aggregate, $120 million worth of Bitcoin was dumped onto the market yesterday.

- Mainly from Binance whales — where most of the selling pressure came from.

- In the grand scheme of things, this is not a lot of sell pressure but the issues stem from an illiquid market — price is susceptible to aggressive moves.

- The move down earlier this week resulted from an 8% drop in open interest, resulting in a liquidation cascade.

The post Bitcoin drops to $26K as the result of Binance whales selloff appeared first on CryptoSlate.