A recent Gallup Poll reveals a significant decline in the percentage of Americans favoring real estate as their preferred long-term investment, despite its continued popularity. Conversely, the Gallup survey indicates that the perception of long-term investments in gold has experienced an almost twofold increase compared to the previous year’s poll on the same topic.

Gallup Poll Reveals Preference for Real Estate and Crypto Slides, While Bias Toward Gold Nearly Doubles

Gallup, Inc., the analytics and advisory company headquartered in Washington, D.C., recently unveiled its latest Gallup Poll on long-term investments on May 11, 2023. With a history dating back to 1935, Gallup has been conducting public opinion polls worldwide.

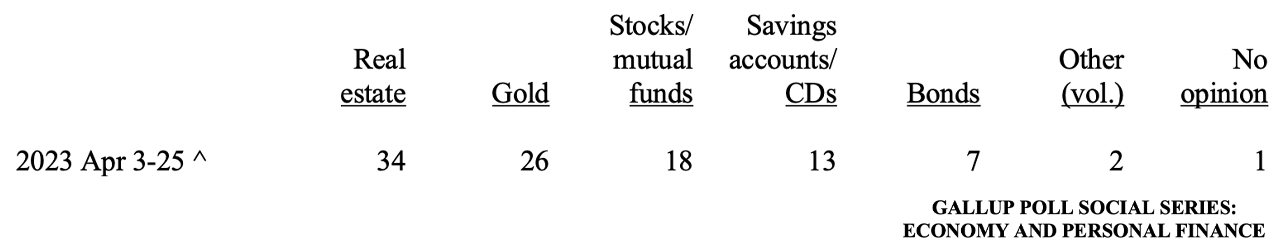

The poll, conducted from April 3 to April 25, 2023, delves into various investment options such as real estate, gold, stocks, bonds, and crypto assets. The results were derived from telephone interviews held during the same period, involving a randomly selected sample of 1,013 adults aged 18 and above residing in the United States.

Gallup’s latest poll revealed that real estate emerged as the favored long-term investment, but the allure of this asset has experienced a significant decline among Americans. The percentage of respondents favoring real estate plummeted from 45% last year to a current figure of 35%.

Lydia Saad, the author of the Gallup Poll report, highlighted that this current proportion aligns with the typical selection rate observed between 2016 and 2020, “before housing prices skyrocketed during the pandemic.” Saad further explained that the housing market’s appeal has waned over the past year, as higher interest rates have subdued investor enthusiasm.

While the perception of U.S. stock indices has largely remained stagnant compared to the previous year, there has been a slight dip from 24% in 2022 to the current 18%. On the other hand, the appeal of gold as a long-term investment has experienced a noteworthy surge since last year.

Gold has soared from 15% to 26%, surpassing stocks and claiming the position as the second most favored long-term investment, according to Gallup’s respondents. “Today’s preference for stocks is on the low end of the 17% to 27% range of Americans choosing it since 2011,” Saad detailed.

According to the Gallup Poll author, in the previous year, 8% of surveyed Americans favored crypto assets as their preferred long-term investment. However, the appeal of choosing cryptocurrency for long-term investments has dwindled to 4%. Saad attributed this decline to the FTX contagion and the price slump experienced by bitcoin (BTC) in 2022, which have dampened enthusiasm for crypto assets.

The survey also highlighted an interesting trend: when cryptocurrencies were included as an option in the poll, participants were less inclined to select stocks, but their preference for stocks increased when crypto assets were not among the choices. While crypto assets outperformed bonds as a long-term investment option last year, bonds garnered a score of 7% in the latest poll.

What are your thoughts on the shifting landscape of long-term investment choices revealed by the Gallup Poll? Share your insights and let us know which investment options intrigue you the most in the comments section below.