A wave of regulatory pressure rippling through the U.S. crypto market has pushed traders away from Bitcoin (BTC) and Ethereum (ETH) and towards the seeming safety of stablecoins.

This shift aligns with the emergence of a burgeoning political movement in the U.S. aiming to impose stringent controls on the crypto and mining sectors. Proponents of the new regulation argue that the disruptive nature of cryptocurrencies demands a tighter regulatory grip to ensure stability and security in the financial ecosystem.

On the other hand, critics express concerns that heavy-handed regulation could stifle innovation and drive the industry offshore. This polarizing debate has created an atmosphere of uncertainty that is reshaping trading behaviors.

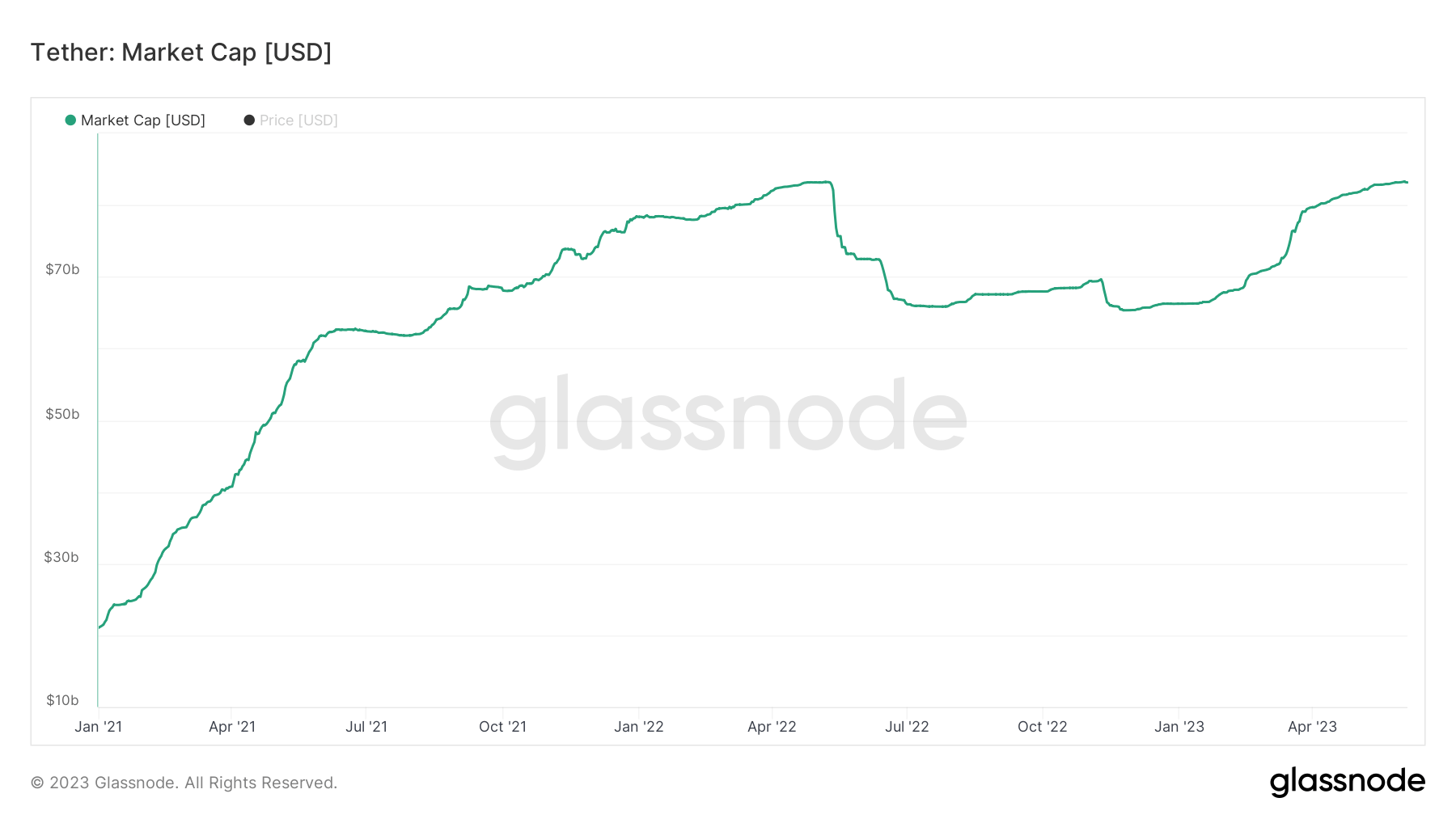

These regulatory pressures seem to be nudging traders toward the stability of stablecoins. This is distinctly observed in the behavior of Tether’s USDT, whose supply reached an all-time high of $83.2 billion on June 3rd. Around $17 billion of this figure has been added to Tether’s market cap in 2023 alone.

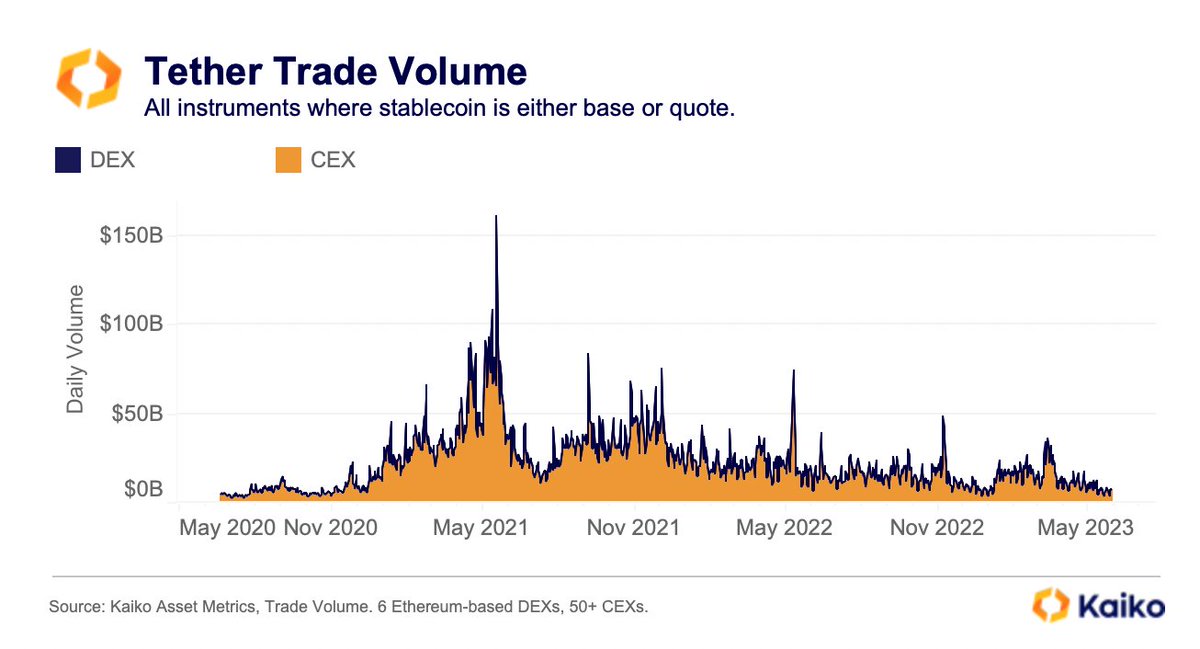

However, despite Tether’s growing market capitalization, its trading volume is experiencing a downward trend. Data from Kaiko showed that on both CEXs and DEXs, daily USDT volume averaged around $7 billion in May, reaching multi-year lows. This seeming contradiction indicates that while the overall supply is increasing, active trading of the asset is decreasing.

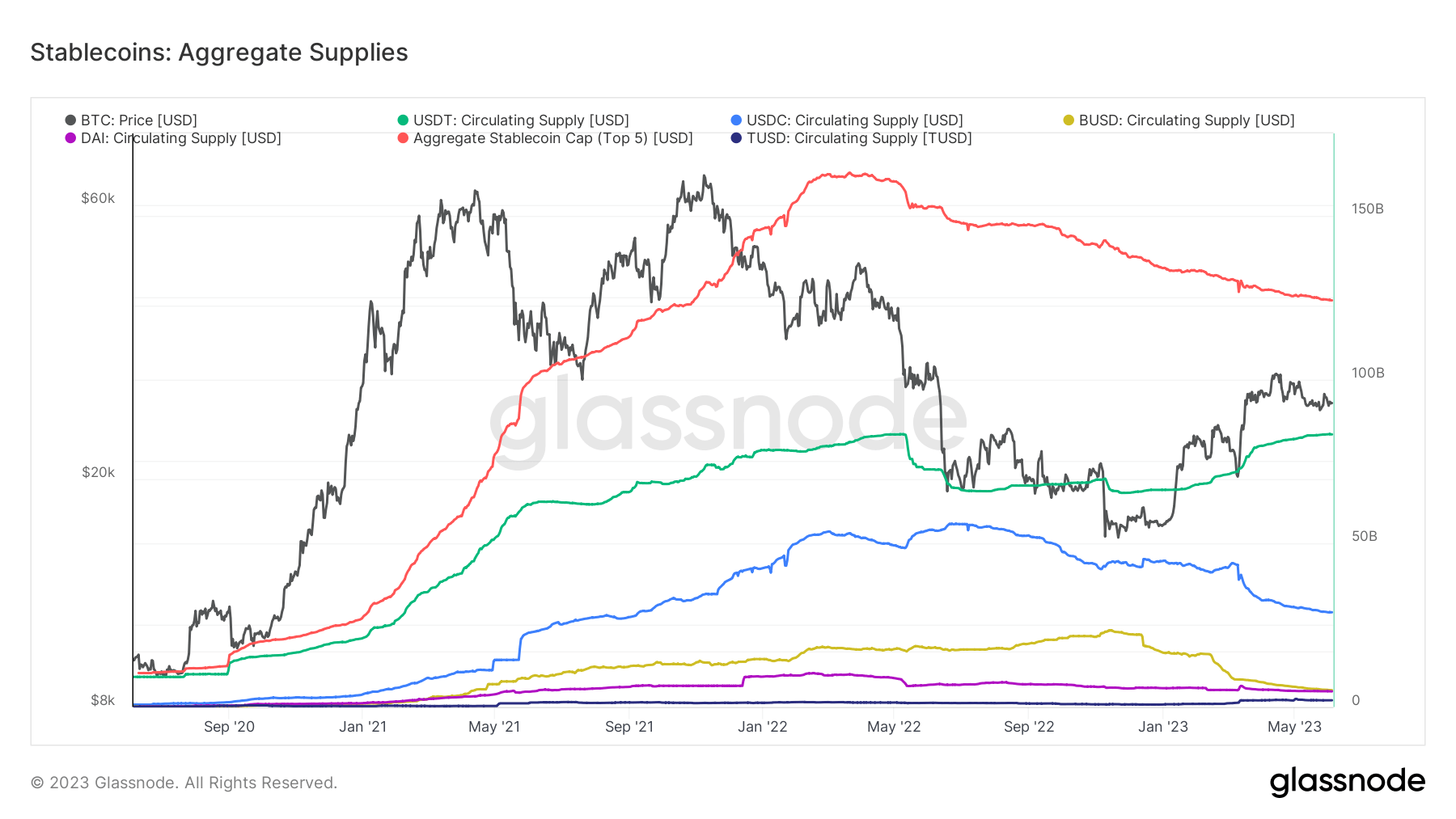

Conversely, other significant players in the stablecoin market, USDC, and BUSD, witnessed their supply drop to multi-year lows.

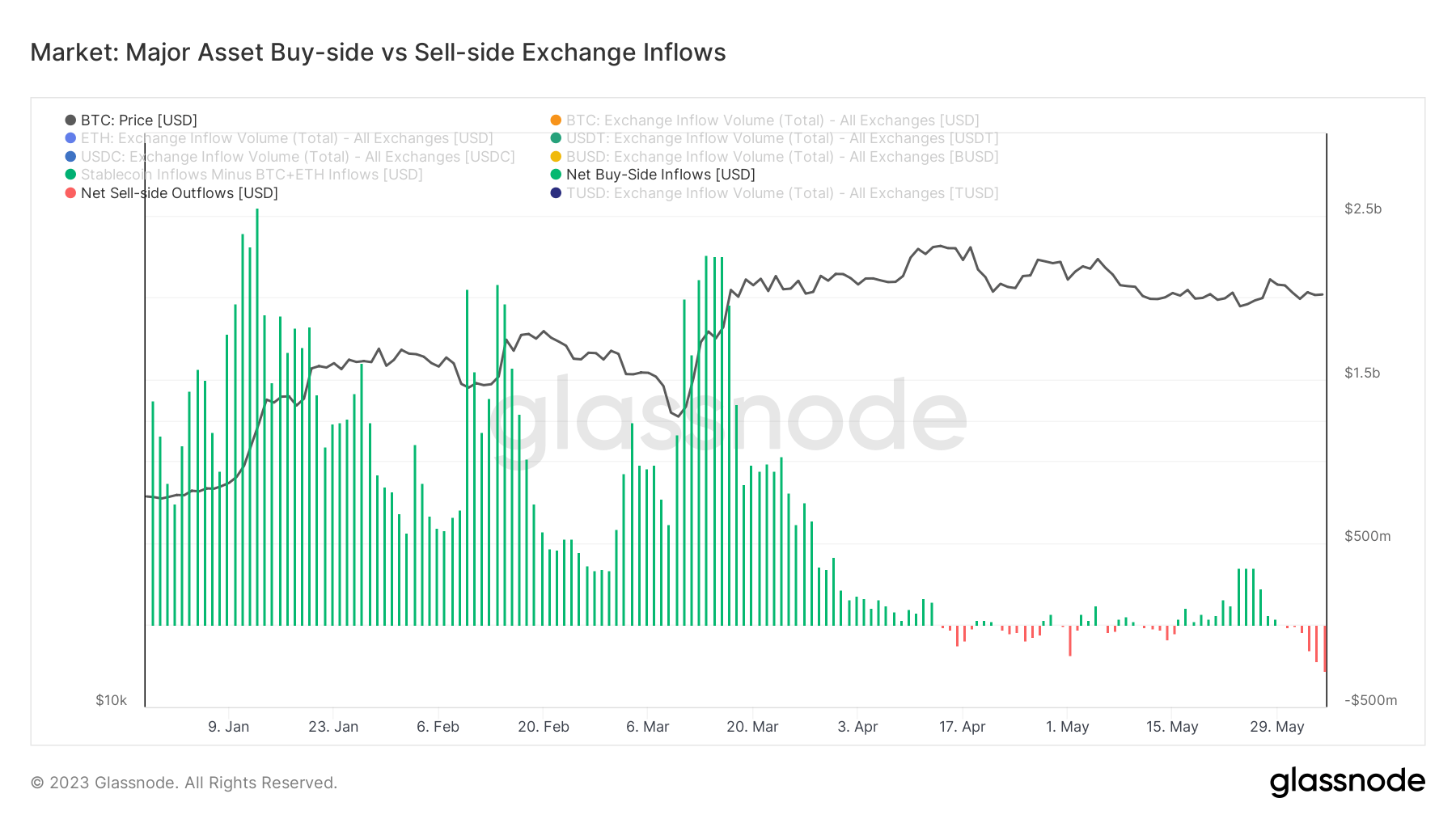

Analyzing exchange inflows reveals an exciting trend. Since April, demand for stablecoins on exchanges has weakened, with BTC and ETH inflows compensating for this. Despite the sustained inflow, the two cryptocurrencies have been mainly trading sideways or experiencing adverse price action, indicating that most inflows are likely sell-side.

Stablecoins, being non-interest bearing and exempt from capital gains taxes, offer a certain allure to traders. Their nature doesn’t generate the taxable events integral to trading BTC or ETH, which is particularly attractive to U.S. traders starting to feel the squeeze of increased regulatory scrutiny and potential enforcement actions.

The post Traders turn to stablecoins as regulatory pressure in the US ramps up appeared first on CryptoSlate.