Binance’s spot trading volume reportedly declined nearly 70% during the second quarter after the exchange reintroduced fees for its most liquid Bitcoin (BTC) pairs, per data from Kaiko.

In March, the exchange abandoned its Binance USD (BUSD) zero-fee trading for TrueUSD (TUSD) due to the regulatory challenges facing the BUSD stablecoin.

Soon after, its spot trading volume declined to its second-lowest month since 2021, indicating that the exchange users left the platform after the incentives were canceled.

Regulatory woes affect volume

Besides the fee reintroduction, the increased regulatory pressure across multiple jurisdictions, including the United States, Europe, and Nigeria, during the second quarter affected Binance’s performance.

During this period, the U.S. Securities and Exchange Commission (SEC) alleged that the exchange violated federal securities law and offered crypto securities tokens to Americans. This resulted in the embattled crypto exchange’s U.S. subsidiary, Binance.US, market share dropping to 1% amid its liquidity issues.

In Europe, the exchange lost its Euro payment partner and exited several markets within the region, including Austria, the Netherlands, Germany, and Cyprus. Amid these exits, a Binance spokesperson said the firm’s focus was ensuring compliance with Europe’s forthcoming Markets in Crypto Assets (MiCA) regulations.

Around this period, Binance had to issue a cease and desist letter to an unaffiliated ‘scam’ entity, “Binance Nigeria Limited,” which the Nigerian SEC had declared illegal.

Spot trading volume down across board

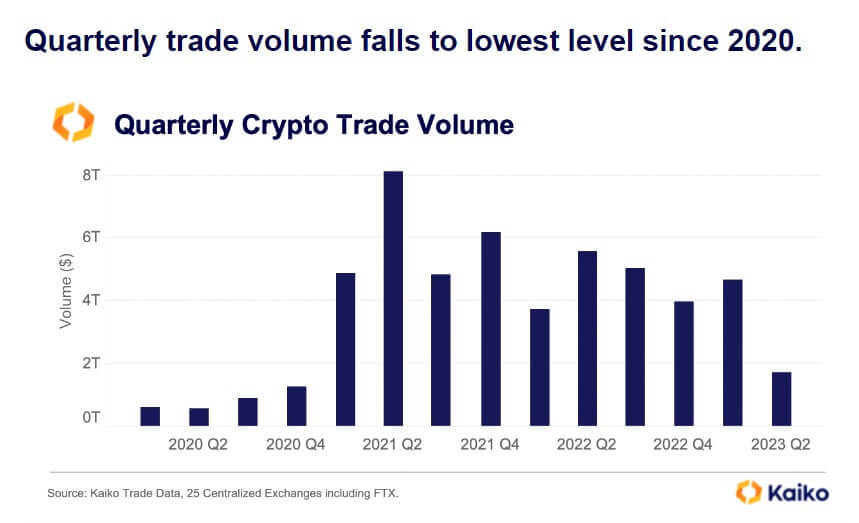

Meanwhile, Kaiko noted that the decline was not restricted to Binance alone as spot trading activities on other exchanges like Coinbase, Kraken, OKX, and Huobi fell by more than 50% during this period.

This would indicate that spot trading volumes across exchanges have fallen to their lowest levels since 2020.

The post Binance spot trading plunges 70% following regulatory pressures and reintroduction of Bitcoin fees appeared first on CryptoSlate.