The BRICS Bank’s vice president and chief financial officer has shed light on the economic bloc’s aspiration to develop a common BRICS currency. His remarks followed recent reports suggesting that Russia has confirmed the BRICS’ plan to introduce a gold-backed common currency, with an official announcement expected to be made during the forthcoming BRICS leaders’ summit.

‘Gold-Backed BRICS Currency’ Gains Attention

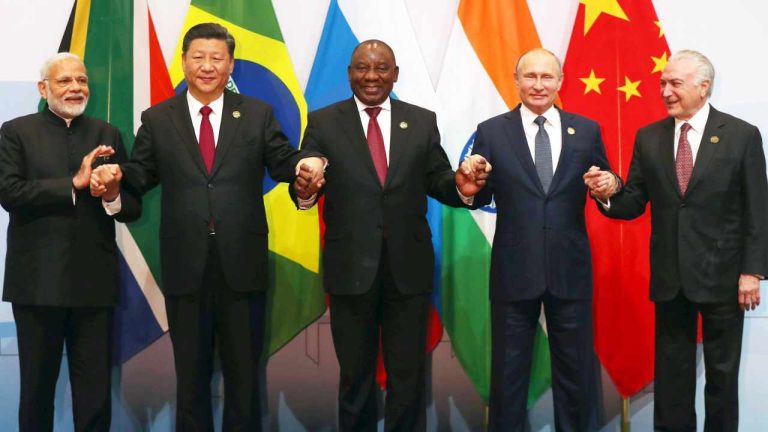

The subject of a common BRICS currency has gained significant attention as the BRICS leaders’ summit approaches and an increasing number of countries pursue de-dollarization. The BRICS comprises Brazil, Russia, India, China, and South Africa. Their leaders’ summit will take place in South Africa from Aug. 22 to 24.

On Tuesday, RT reported that the BRICS is set to introduce a new trading currency backed by gold which will be discussed at the August leaders’ summit. The news outlet cited a tweet by the Russian Embassy in Kenya made on Monday, stating: “The BRICS countries are planning to introduce a new trading currency, which will be backed by gold. More and more counties recently express desire to join BRICS.”

The BRICS countries are planning to introduce a new trading currency, which will be backed by gold.

More and more counties recently express desire to join BRICS.https://t.co/lMKTd4FlnT— Russian Embassy in Kenya/Посольство России в Кении (@russembkenya) July 3, 2023

RT’s coverage has sparked a wave of headlines suggesting that Russia has made an announcement regarding the establishment of a gold-backed common currency for the BRICS nations. However, the tweet by the Russian Embassy in Kenya links to an article published on April 24 discussing the BRICS potentially backing its common currency with gold. There is no indication of any new information about a common BRICS currency.

BRICS Bank’s Official Says Common Currency Is a Medium to Long-Term Ambition

Leslie Maasdorp, vice president and chief financial officer of the New Development Bank, also known as the BRICS Bank, shared some information about the economic bloc’s common currency plan in an interview with Bloomberg on Wednesday. The New Development Bank was established by the BRICS nations to mobilize resources for infrastructure and sustainable development projects in emerging markets and developing countries.

He explained that while BRICS members are pushing for the use of national currencies, shifting away from the U.S. dollar, the BRICS does not have an immediate plan to create a common currency to challenge the dominance of the USD. Noting that the BRICS Bank has the U.S. dollar as its anchor currency, he described:

The development of anything alternative is indeed a medium to long-term ambition.

Some have suggested that the Chinese yuan could replace the U.S. dollar as the world’s dominant currency. While acknowledging that the yuan has been gaining traction as a trading currency, Maasdorp said that it is “a very long way from becoming a reserve currency.”

The BRICS Bank’s vice president concluded: “It’s going to take a very long time for currency movements to take shape so any discussion of alternate currencies is indeed a much more medium and longer-term aspiration.”

Maasdorp insisted, “No one is suggesting right now that BRICS will form an alternate currency,” emphasizing:

All we are suggesting is that we need to deepen the use of local currencies of our member countries and over time that is going to strengthen our ability to immunize or insulate our economies from the devaluation of our currencies if we borrow in dollars, for example. But, there is no suggestion right now to create a BRICS currency in that sense.

The remarks made by the BRICS Bank’s chief financial officer align with the statements made by India’s External Affairs Minister S. Jaishankar, who reportedly said earlier this week that there are no plans for a new BRICS currency. Instead, the focus remains on enhancing the respective national currencies within the BRICS framework.

Do you think the BRICS will introduce a common currency soon? Let us know in the comments section below.