XRP is now witnessing a surge in network activity as prominent holders of the cryptocurrency make their moves.

The latest findings from Lookonchain, a renowned data analytics firm, shed light on the purchase and sale patterns of XRP whales on the Binance Smart Chain (BSC), signaling a potential rise in selling activity within the market.

Ripple’s triumph over the SEC has undoubtedly injected a fresh wave of confidence into the XRP community. With the regulatory cloud dissipating, investors and holders are now eager to capitalize on the newfound clarity surrounding the token’s status.

As a result, the actions of these notable whales have become a focal point of interest for market observers and enthusiasts alike.

XRP Whales’ Purchasing Habits Revealed: Insight From Lookonchain

Based on analysis by Lookonchain, the transactional behavior of four influential whales has come to light. Each of these whales demonstrates distinct patterns in their purchasing habits, shedding light on their strategies within the crypto market.

1/ Did whales sell $XRP as the price of $XRP rises?

Let’s check the top 4 whales of $XRP on the #BSC.

pic.twitter.com/cwkXIcK6s2

— Lookonchain (@lookonchain) July 15, 2023

One of the whales, known as “0xf522,” has amassed a staggering 25 million XRP, equivalent to $18 million, between April 22 and November 24, 2022. Interestingly, this particular whale has refrained from selling any of their holdings thus far.

Another notable participant, identified as “0x513d,” acquired 10 million units of the coin at an average price of $0.45 per token. Following the recent surge in XRP’s value, this whale has deposited 5.4 million XRP, worth around $4.3 million, into Binance.

Related Reading: Shiba Inu Encounters Familiar Resistance, Prompting Concerns About Bull Run

By taking advantage of the recent price rally, “0x513d” demonstrates a more proactive approach, capitalizing on the upward momentum of XRP.

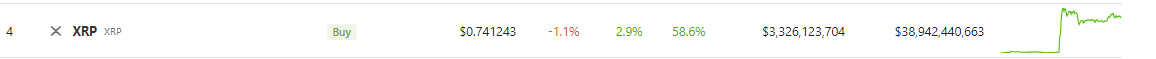

At present, Coingecko displays XRP’s price at $0.7412, reflecting a 2.9% rally within the past 24 hours alone. Over the course of the previous seven days, XRP has experienced a remarkable surge of 58.6%.

Ex-Ripple Chief Affirms Company’s Limited Market Influence Amid XRP’s Surge

Meanwhile, Matt Hamilton, the former Director of Developer Relations at Ripple, clarified on Twitter that Ripple’s influence on the market is relatively constrained when considering the global daily sales volume of XRP.

Ripple are the single largest holder of XRP with something like 48B XRP. Most of it is held in escrow contracts that release each month. Ripple sell a small portion of that and put the rest back in new escrow contracts.

— Matt Hamilton (@HammerToe) July 16, 2023

This assertion holds true even in light of the recent surge in XRP’s value following the resolution of the Ripple-SEC case.

He stressed that the price movements of XRP are primarily governed by market forces and the performance of Bitcoin (BTC), underscoring the interplay between these factors in shaping the cryptocurrency’s trajectory.

Hamilton explicitly stated that Ripple does not have authority over either XRP or the XRP Ledger (XRPL), ensuring any misunderstandings are clarified. In order to stress this notion further, he proposed the potential scenario where Ripple’s complete XRP holdings could be eradicated if the XRP community deemed it appropriate.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Blockchain News