Michael Burry, renowned investor, and hedge fund manager, has once again made headlines with his significant short position in the traditional market, which could impact the nascent crypto industry if his bet is to materialize.

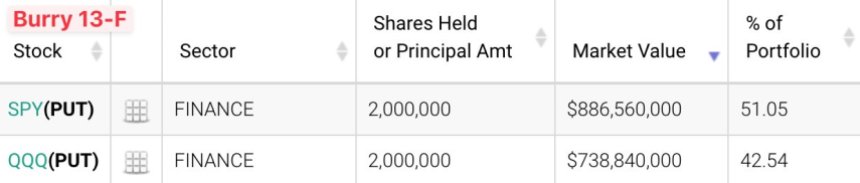

Burry, known for accurately predicting the subprime mortgage crisis, recently went mega-short with over $1.6 billion in S&P 500 (SPY) and Nasdaq 100 (QQQ) puts. These indexes often record a high correlation with the crypto market as they attract similar investors.

Burry’s $1.6 Billion Short Signals Potential Implications For Crypto Market

Burry’s track record as an astute investor lends weight to his latest bet. By predicting and profiting from the subprime mortgage crisis, he gained a reputation as an investor capable of identifying market trends before they unfold.

It is important to consider that Burry has established himself as a prognosticator who is often ahead of the curve and is willing to wait for the anticipated market changes to come to fruition.

On this matter, Yan Alleman, co-founder of Glassnode, has supported Burry’s approach, suggesting that while the short-term effects may not be immediately evident, the long-term payoff is likely to be significant.

Alleman also highlighted the potential impact of the US Dollar Index (DXY) on the cryptocurrency market, specifically Bitcoin.

According to Alleman, the recent renewed strength of the DXY could exert pressure on Bitcoin. The DXY measures the value of the U.S. dollar against a basket of major currencies.

On The Verge Of A Final Leg Up?

As Burry predicts, a drop in the DXY could result in a significant surge in crypto assets, including Bitcoin, as investors seek alternative stores of value. This surge would represent a final leg up before a presumed deep correction across financial markets.

While the correlation between the DXY and Bitcoin has been subject to debate, the potential consequences of Burry’s short position on the market cannot be ignored.

If his prediction were to come true, it could trigger a domino effect, leading to a substantial downturn in traditional markets and a subsequent surge in crypto assets.

Nevertheless, the implications for Bitcoin and the broader crypto market in such a scenario are twofold. On the one hand, Bitcoin has often been hailed as a digital store of value and a hedge against traditional market downturns.

Burry’s short position on the market could reinforce this narrative, attracting more investors to Bitcoin as a safe haven asset.

On the other hand, the cryptocurrency market’s extreme volatility could magnify the potential crypto bloodbath if Burry’s bet materialized.

A sudden surge in selling pressure for Bitcoin and other cryptocurrencies, coupled with a widespread market correction, could result in a sharp decline in the crypto market, causing substantial losses for investors who entered the market at its peak.

As the market unfolds in the coming weeks and months, all eyes will be on Michael Burry’s $1.6 billion short position and its potential impact on traditional markets and crypto.

Only time will tell if Burry’s bet proves prescient once again or if the market defies his expectations, leaving investors to navigate the ever-changing landscape of investment opportunities.

As of the current writing, Bitcoin (BTC) is trading at $29,300, indicating a marginal 0.3% decline over the past 24 hours. The cryptocurrency has continued to be in a consolidation phase since the start of August.

Featured image from iStock, chart from TradingView.com