On-chain data shows Bitcoin and the other top assets are observing a high amount of loss-taking currently. Here’s what this could mean.

Investors Of Bitcoin & Other Top Coins Are Capitulating Currently

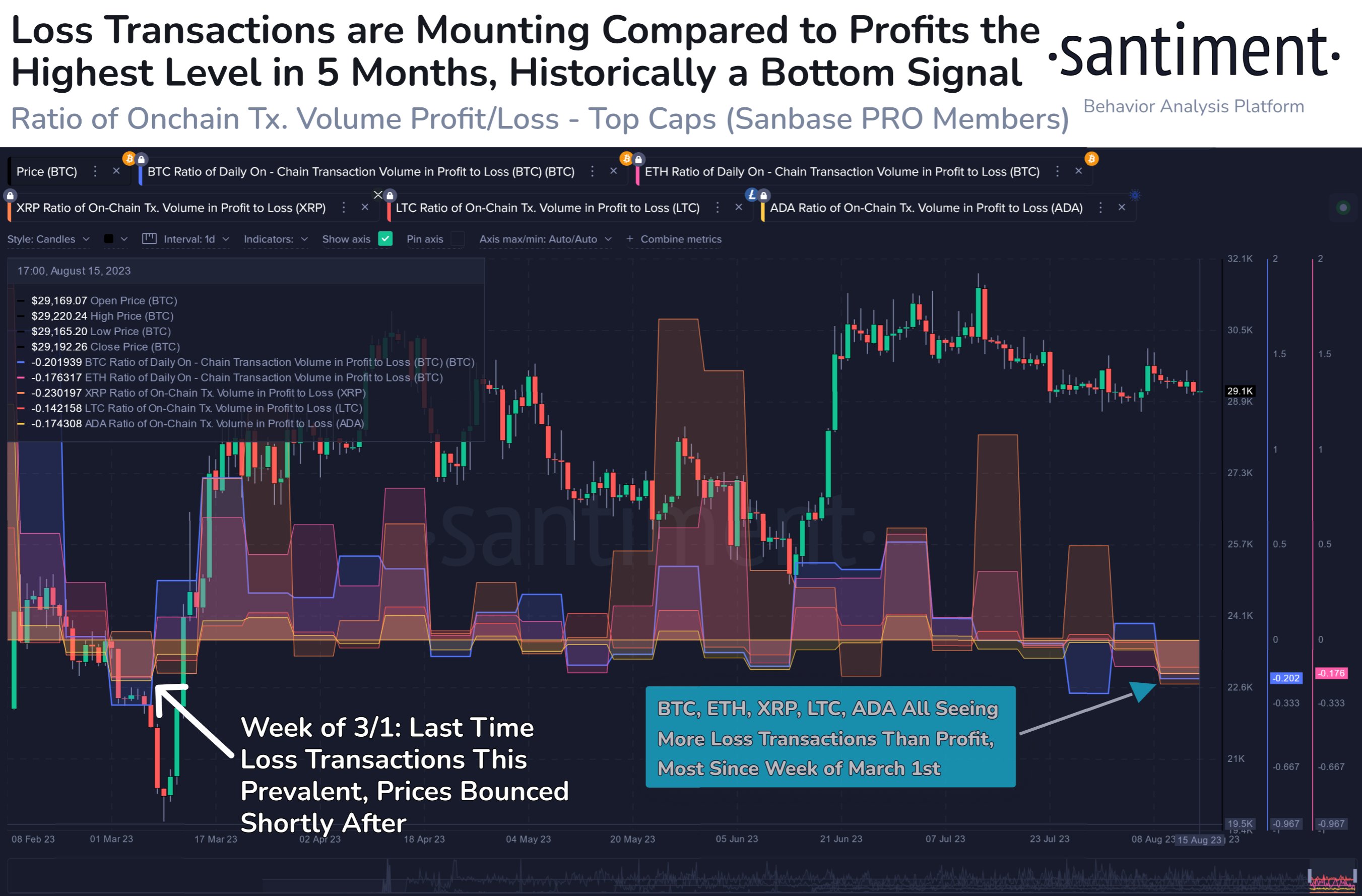

According to data from the on-chain analytics firm Santiment, the current trader capitulation that the largest assets in the market are seeing may be a bottom signal.

The indicator of interest here is the “ratio of daily on-chain transaction volume in profit to loss,” which, as its name already implies, tells us how the profit-taking volume for any given coin compares with its loss-taking volume right now.

When this metric has a positive value, it means that the profit-taking volume is higher than the loss-taking volume currently. Thus, such a trend implies that the market as a whole is harvesting profits at the moment.

On the other hand, the indicator having negative values suggests loss taking is the dominant behavior among the traders of the cryptocurrency in question right now.

In the context of the current discussion, the assets of relevance are Bitcoin (BTC), Ethereum (ETH), XRP (XRP), Litecoin (LTC), and Cardano (ADA).

Here is a chart that shows the trend in the ratio of transaction volume in profit to loss for these assets over the last few months:

As displayed in the above graph, the indicator’s value for all these top assets has dipped inside the negative territory recently. This high loss realization from the investors has come as the market as a whole has been unable to amass together any significant rally.

From the chart, it’s visible that these assets have seen the investors capitulate at different points throughout the year, but the current capitulation event has an interesting feature that was missing from these previous instances: the loss-taking is currently happening for all these large cryptocurrencies.

It would appear that traders as a whole have finally started to give up on the market after experiencing endless consolidation, as they are ready to take losses in order to make their exit.

The scale of the loss-taking itself is also extraordinary, as the only other time this year that the loss volume overtook the profit volume to this degree was way back in March.

Historically, capitulation from investors has made bottoms more probable to form. And from the above chart, it’s visible that the March capitulation also leads to Bitcoin hitting a bottom.

The likely reason behind this pattern is that the investors who exit in losses are generally the weak hands, who had a low conviction in the asset, to begin with. In capitulation events, the coins that they sell at losses are picked up by the more resolute investors, and hence, the market gains a stronger foundation for building up rallies.

It’s possible that the high loss taking that Bitcoin and the others are experiencing currently may also lead to a bottom, if the historical precedence is anything to consider.

BTC Price

At the time of writing, Bitcoin is trading around $29,100, down 2% in the last week.