Digital asset investment products experienced a significant outflow of funds this week, totaling $55 million, according to the weekly report by CoinShares.

Analysts, including James Butterfill, believe the market’s reaction is due to the disappointment from recent media reports indicating a delay by the US Securities & Exchange Commission in approving a US spot-based ETF.

Bitcoin, the leading digital asset, reversed the previous week’s inflows, recording outflows of $42 million. At the same time, short-Bitcoin positions saw outflows for nearly the 17th week in a row, except for minor inflows totaling $2k. Ethereum followed the Bitcoin trend, experiencing $9 million worth of outflows.

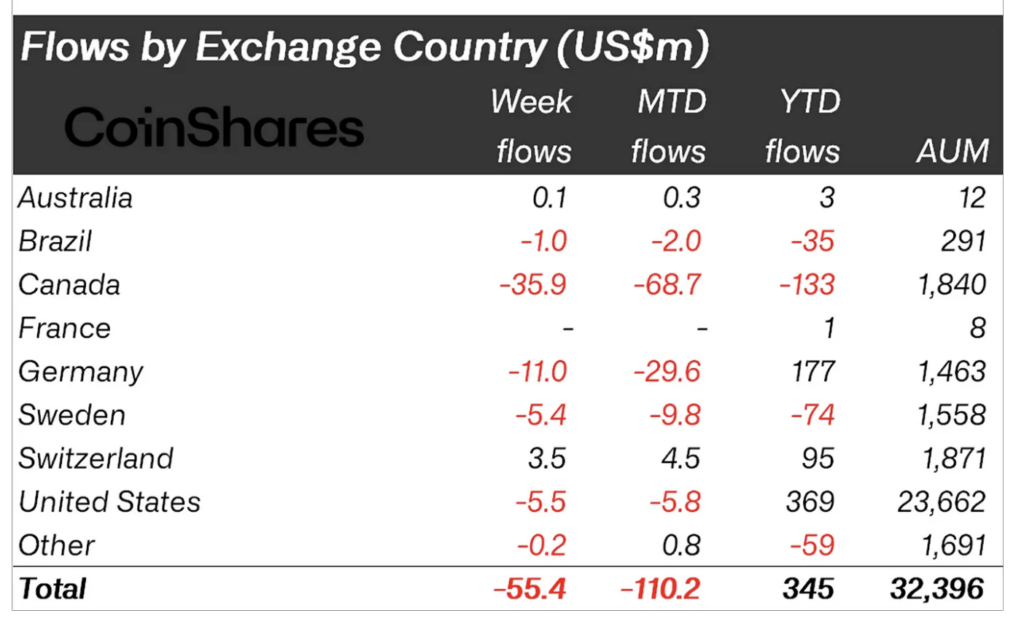

Altcoins were not spared from this sell-off, with Polygon, Litecoin, and Polkadot seeing respective outflows of $0.9 million, $0.6 million, and $0.5 million. The outflows were broad across product providers but primarily focused on Canada and Germany, which experienced US$35.9 million and $11 million in outflows, respectively.

Switzerland and Australia, however, reported minor inflows totaling $3.5 million and $0.1 million, respectively.

The figures take month-to-date outflows to $110 million for August. However, year-to-date numbers show $345 million in inflows.

The total assets under management (AuM) declined by 10% due to last week’s panic, settling at $32.3 billion at the week’s end. The report emphasizes that market volumes remain below average due to seasonal effects, making prices vulnerable to large trades.

The post ETF delay disappointment triggers $55M outflow from digital assets – reports appeared first on CryptoSlate.