On-chain data shows the Cardano activity-related indicators are still at high values, despite the price going downhill recently.

Cardano Volume And Social Dominance Are Still At Notable Levels

Cardano didn’t have the best of times in August, as the cryptocurrency’s price only saw decline, and so far, September hasn’t proved to be anything different, with the asset continuing to traverse sideways near the same $0.25 low that it had dropped to at the end of last month.

Here is a chart that shows the price action ADA has witnessed recently:

From the graph, it’s visible that ADA is currently retesting the same lows that it had during a couple of times last month. These two previous retests had been brief and the asset had found quick rebounds at them.

This time, however, Cardano has seen an extended stay at the level, suggesting that the coin is no longer finding sufficient support. Based on this weakness, it’s possible that ADA could plunge lower in the coming days.

Some positive signs, however, may be visible in the underlying metrics of the cryptocurrency, as the on-chain analytics firm Santiment has pointed out in a new post on X.

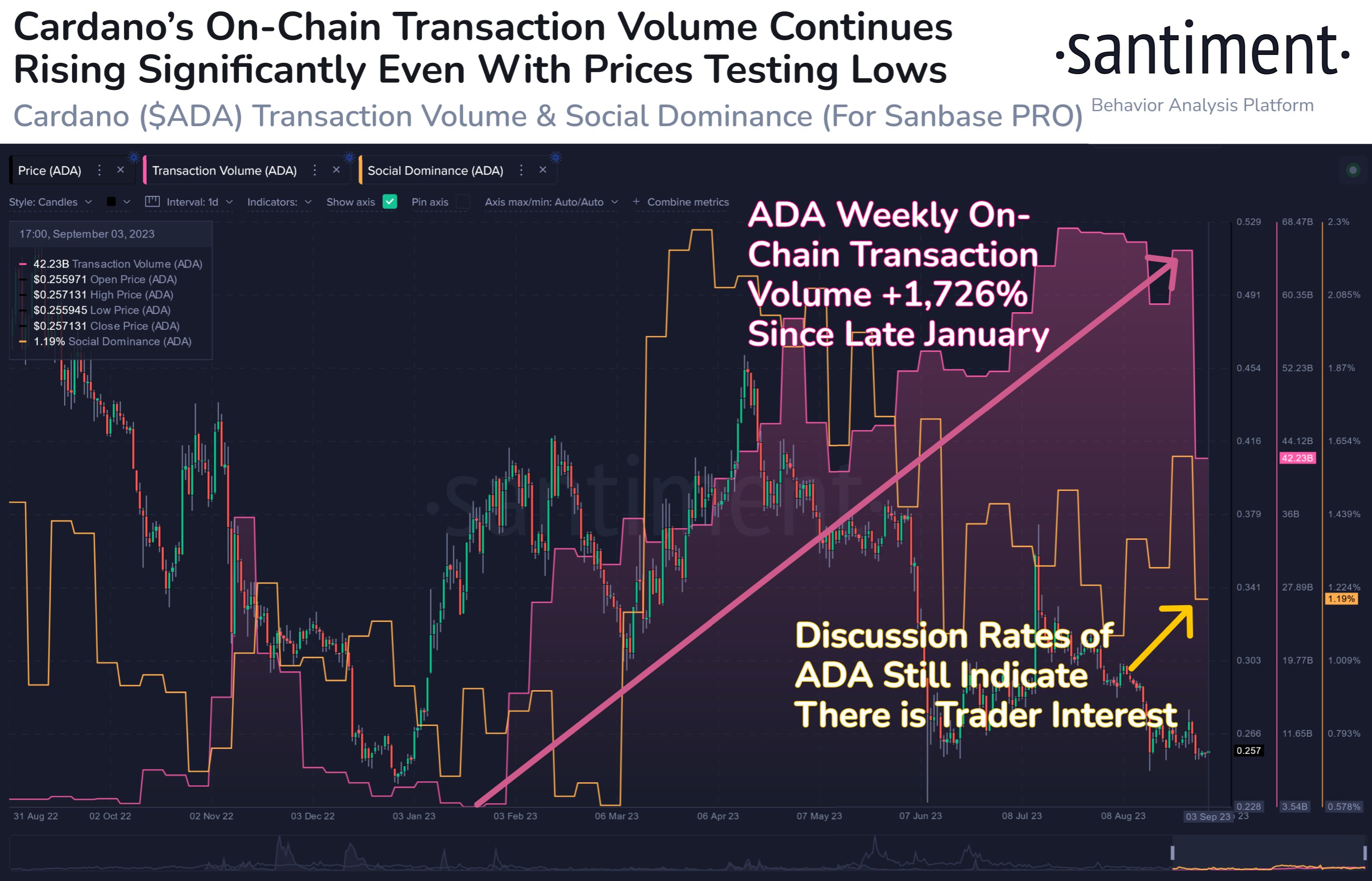

There are mainly two indicators of interest here: the transaction volume and the social dominance. The below chart shows the trend in both of these metrics for ADA over the past year.

The transaction volume here naturally refers to the total amount of Cardano that the users are moving around on the blockchain every week. This indicator has observed a 1,726% increase since late January, implying that the holders have been finding more utility on the network.

Interestingly, the transaction volume has only continued to go higher, despite the price of the cryptocurrency struggling recently. These current high volumes can be a positive sign for the asset, as they indicate that the traders haven’t yet given up on it.

It’s usually much more worrying when the price continues to decline alongside dropping volumes, as it implies that the interest in the coin among investors is disappearing and with it, momentum that could help a potential rebound.

Currently, though, there still appears to be plenty of interest backing Cardano, as the social dominance would also confirm. This indicator basically tells us how the social media talk related to ADA compares against the discussions related to the top 100 assets.

As is visible in the graph, this metric is still at relatively high levels (even if it has gone down a bit compared to earlier in the year), implying that Cardano continues to make up for a non-negligible part of the social media talk related to the sector.

“Utility plays an important role in any bounce, and this combined with adequate ADA social dominance, is still promising,” explains Santiment.