Since August 11, 2023, the number of unique digital wallets storing the iris-scanning cryptocurrency worldcoin (WLD) stood around 468,466. But in the weeks since, ownership of the fledgling crypto has expanded by over 26% to 591,633 wallets. However, worldcoin’s value has moved in the opposite direction — plummeting over 35% against the U.S. dollar in the past 30 days. Currently, the digital asset trades at 62% below its all-time high price.

Vast Majority of WLD Tokens Held by Top Wallets

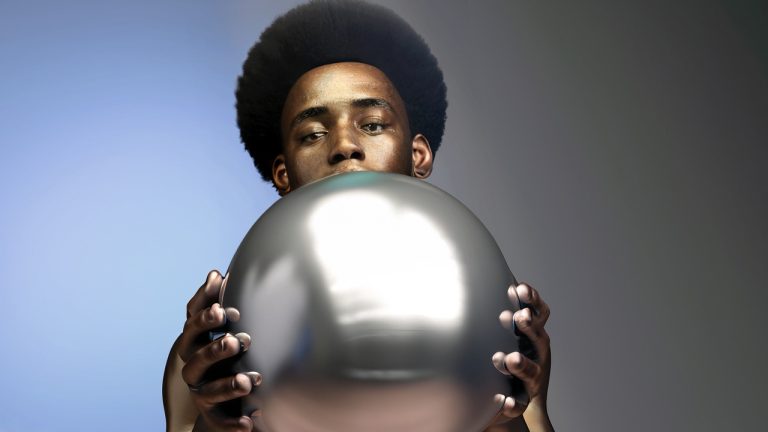

The brainchild of Openai CEO Sam Altman, worldcoin (WLD) burst onto centralized crypto exchanges in late July 2023. The cryptocurrency aims to verify users’ identities by scanning their irises. The project also plans to address financial inequality and online identity authentication through its World ID feature.

On its July 24 debut, WLD struck its zenith of $3.30 per token. But since that apex, the price has nosedived. Now fluctuating between $1.20 and $1.38, worldcoin recently plunged to an all-time low of $1.02 per coin on September 5. Though WLD wallets have proliferated 26% since August 11, crossing 591,633 unique addresses as of September 7, the pace has downshifted.

From July 24 until August 18, new wallets mushroomed. But in the weeks since then, expansion has decelerated to a crawl, with addresses swelling just over 11% in that period. This slowdown suggests worldcoin’s initial burst of skyrocketing adoption has eased into a steadier, more modest climb. Moreover, while there are close to 600,000 WLD wallets, the top 100 control 93.82% of the entire supply of 176.89 million WLD.

The 100 addresses commanding most of the supply hold 165.96 million worldcoin tokens. The Worldcoin contract address operated by the development team commands 95.87 million WLD or 54.2% of the supply. Worldcoin also owns the second largest wallet, holding 30.98 million tokens or 17.51%.

The largest crypto exchange by trade volume, Binance, occupies the third spot, with 12.05 million WLD or 6.81% of supply. Other big holders include the market maker Wintermute, alongside crypto exchanges such as Bithumb, Okx, and Gate.io.

Despite Worldcoin’s mission to advance financial equality, so far, WLD ownership remains strikingly centralized. For Worldcoin to truly promote financial inclusion as intended, ownership must diffuse from the founders, exchanges, and market makers into the hands of everyday users.

What do you think about the Worldcoin project and the centralization and distribution factors, considering the top wallets hold most of the coins? Share your thoughts and opinions about this subject in the comments section below.