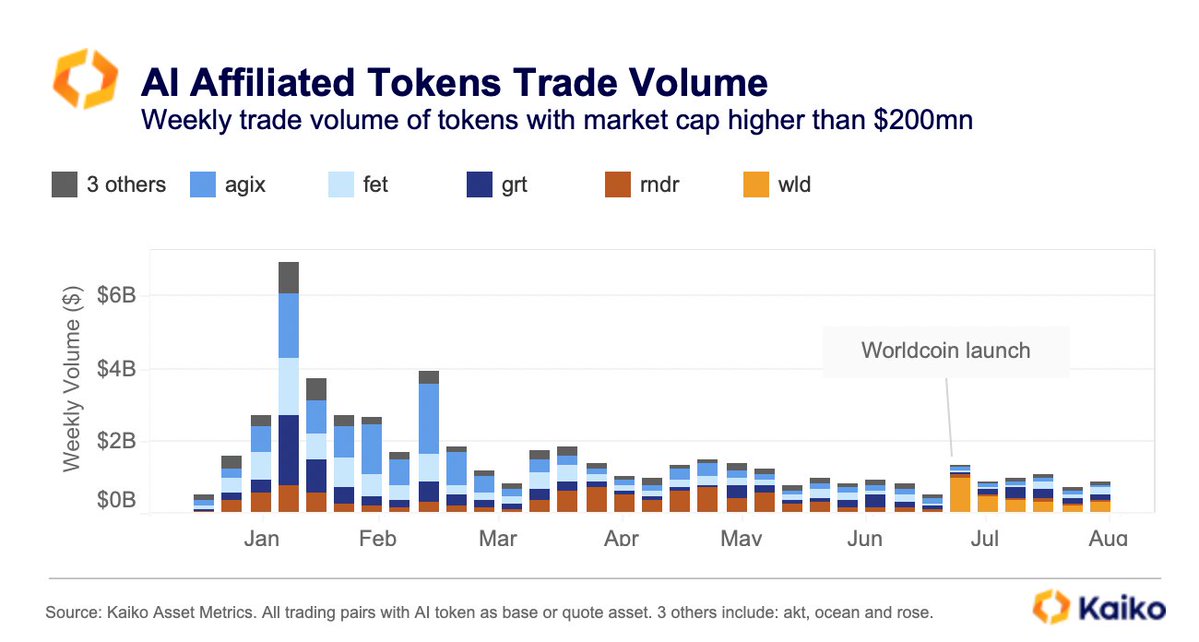

At the outset of the year, artificial intelligence (AI) cryptocurrencies embarked on a rising journey, recording substantial gains and witnessing a surge in global trade activity. However, as we now traverse the course of time, the AI crypto landscape has undergone a significant downturn. According to insights from Kaiko, the weekly trading volume linked to tokens associated with AI has notably dwindled, casting a shadow over the sector’s earlier exuberance.

AI Crypto: From Meteoric Rise to Subdued Global Trade Volumes

Artificial intelligence (AI)-based cryptocurrency assets have encountered a noticeable downturn from their earlier prowess in early 2023. At the present moment, the AI crypto domain stands at a valuation of $2.28 billion, marking a substantial retreat of approximately $1.72 billion since February 2023.

Within this week, a somber tale unfolds, as eight out of the top ten AI-focused cryptocurrency tokens have grappled with losses. The digital token numeraire (NMR), in particular, has seen a sharp decline, plummeting by 37.47% over the past seven days.

In the hierarchy of AI-based cryptos, the foremost contender, graph (GRT), has dipped by 2.62%, while the second-largest AI token by market capitalization has witnessed a decline of 5.46% in the same timeframe. This week, two tokens, namely dkargo and phala network, exhibited a noteworthy ascent of 1.27% to 2.05% when measured against the U.S. dollar.

However, the broader AI-centric crypto spectrum has faced a collective decline of 5.74% over the last seven days, with a 3.37% dip recorded within the past 24 hours. Delving into the analytics provided by the crypto firm Kaiko, we find that the trade volumes of AI-centric cryptocurrencies have been notably subdued throughout the month of August.

“Despite Worldcoin ‘s controversial launch at the end of July, the weekly trade volume for AI-affiliated tokens remained subdued in August,” Kaiko shared on the social media platform X. Most of the surges in trade volume for AI-related coins occurred during the months of January and February 2023.

As of September 10, 2023, the statistics reveal a stark contrast, with a 24-hour trade volume of $159.11 million in AI-crypto transactions. This is a marked departure from the $1.6 billion in 24-hour trade volume that was recorded on February 9, 2023.

As AI-based cryptocurrencies navigate the turbulent waters of 2023, they stand as a testament to the volatile nature of the crypto market. While their early-year successes painted a rosy picture, the subsequent downturn serves as a reminder of the challenges and uncertainties inherent in this ever-evolving digital landscape.

What do you think about the performance of AI-centric coins in 2023? Share your thoughts and opinions about this subject in the comments section below.