David Hoffman, a crypto analyst and Ethereum influencer, has picked out a concerning disconnect in Solana relating to the number of SOL issued and the fees the network captures. Taking to X, the social media platform, Hoffman said Solana distributes roughly $1.8 million worth of SOL daily while only capturing a fraction in fees at approximately $40,000.

Solana Overpaying For A Higher Bandwidth?

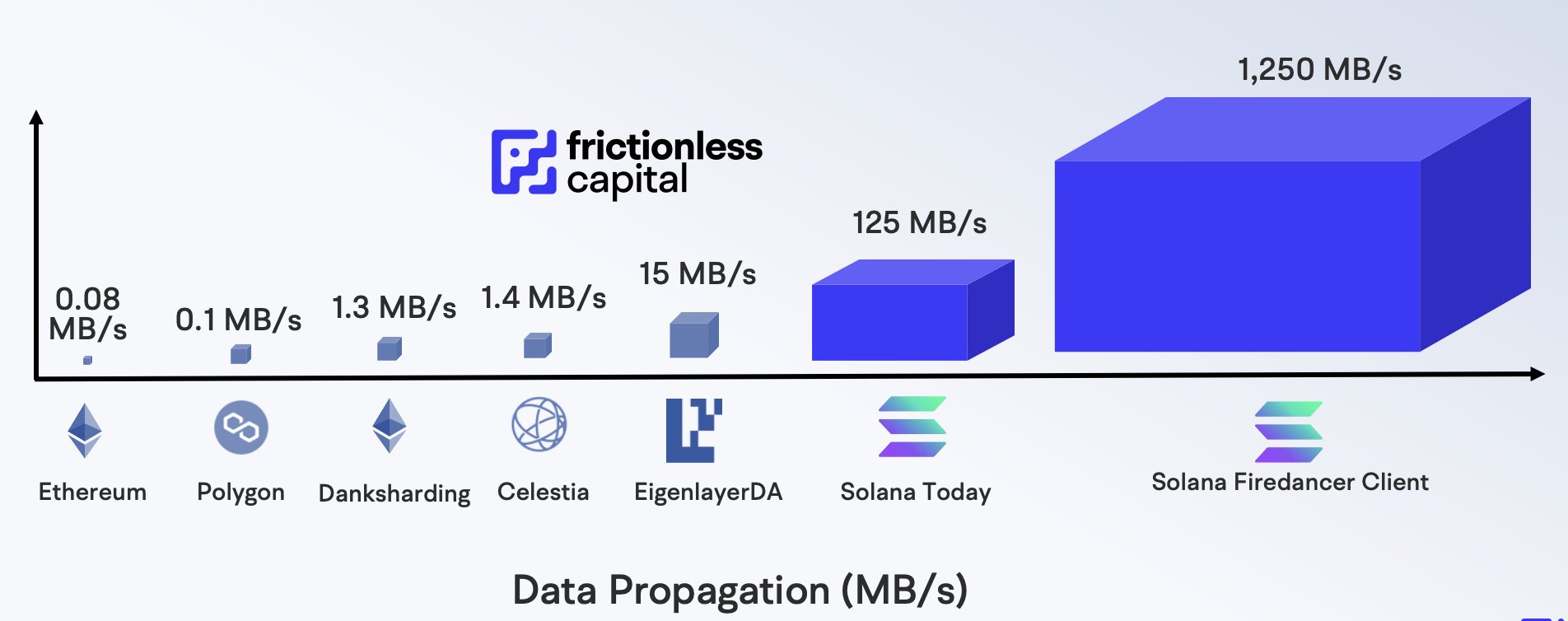

Hoffman’s breakdown implies that Solana, unlike other popular networks like Bitcoin or Ethereum, is paying exorbitantly for the cost of bandwidth. In blockchain, bandwidth is the amount of data that can be transferred every second. This figure varies with legacy networks, including Ethereum and Bitcoin, having some of the lowest in the sphere.

Solana, like Ethereum, supports smart contracts, but the processing speed is higher, making the network more scalable. Looking at other metrics, including TPS, Solana has over 4,800, while Ethereum can only process 15 at peaks.

Moreover, bandwidth data shows that Solana can process 125 MB of data at spot rates on average, while Ethereum performs dismally, only processing 0.08 MB every second. In public networks, bandwidth directly impacts the network’s TPS, influencing scalability. The higher the bandwidth, the more a blockchain can process transactions.

Ethereum’s scalability has other far-reaching implications, especially on fees created, directly influencing revenue. To illustrate, when there is a spike in activity, Ethereum tends to struggle, forcing gas fees higher and helping the network to churn even more revenue on behalf of validators.

On the other hand, Solana’s high TPS can translate to relatively low transaction fees, meaning validators collect lower revenue, regardless of the state of demand. This correlation seems to be the basis of Hoffman’s argument since a blockchain’s bandwidth is directly influenced by the number of validators deployed.

Ethereum Generates 70x In Daily Fees Than Solana

Data confirms that Ethereum generates the highest fees in crypto. Fees paid are directly influenced by activity and scalability, with users having to pay more for on-demand block space in Ethereum.

As of September 26, Ethereum and Bitcoin—first-generation blockchains—generated $2.8 million and over $869,000 in fees. Meanwhile, Solana collected around $39,000 in fees, roughly six times less than those churned by the BNB Chain and considerably less than protocols launched in Ethereum. Uniswap v3 on Ethereum churned over $569,000 in fees.

Solana developers plan to launch the Firedancer validator client that promises 10X bandwidth. The new client plans to increase performance, adopting a new transaction processing model and unique data structures. Whether it will find adoption is yet to be seen. However, if it gains traction, Solana will have higher bandwidth and scalability, lowering fees.