France’s banking and insurance regulator, the Autorité de contrôle prudentiel et de résolution (ACPR), has published a summary of its findings from a public consultation on regulating decentralized finance (DeFi.)

The consultation received significant engagement from global DeFi stakeholders, providing valuable insights to inform potential regulatory approaches in Europe.

According to the ACPR, the two-month consultation enabled a deeper understanding of DeFi’s risks and opportunities. While DeFi is often described as “decentralized,” the regulator argues that “disintermediated” may be more accurate given the concentration of infrastructure with major cloud providers, representing a potential operational vulnerability.

The consultation also revealed broad support for certifying smart contracts, core to DeFi protocols, with suggestions around proportionality and incident reporting. Regulating intermediaries and user interfaces likewise received widespread consensus.

Most participants advocated continuing deployment on public blockchains while strengthening resilience. The feedback will help shape the ACPR’s contributions to European regulatory discussions following the Markets in Crypto-Assets (MiCA) legislation, focused on issues like:

- Rules governing blockchain reliability critical to DeFi.

- Smart contract certification frameworks.

- Governance and conduct standards for DeFi platforms.

According to the ACPR, regulating infrastructure, smart contracts, and businesses would allow DeFi to develop while protecting consumers. Crypto-native and incumbent financial institutions submitted feedback alongside auditors and consultants, providing diverse perspectives.

While MiCA provides a foundation, the regulator believes further rules are needed for the unique nature of DeFi and tokenized finance. The consultation enabled the compiling of specific recommendations to expand the regulatory perimeter.

DeFi centralization problem continues.

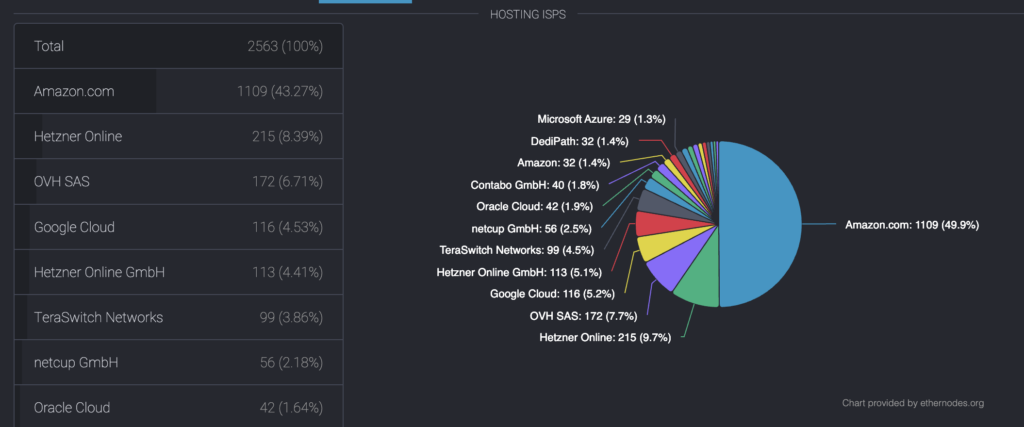

The ACPR’s sentiment that DeFi has a hardware centralization problem is shared by some within the crypto community itself, as the data shows. In July 2022, CryptoSlate reported that Amazon AWS facilitated around 32% of Ethereum nodes at the time, with 47% of total nodes running through major US internet and cloud providers. Analysts at the time argued the network’s reliance on companies like AWS could still allow coordinated attacks across providers to disrupt operations.

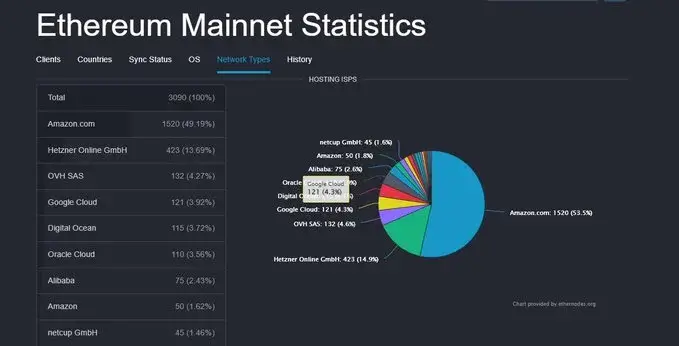

The below charts show the distribution of Ethereum nodes by provider in July 2022 and on Oct. 12, 2023. Currently, 52.3% of nodes run on hosting services, a 5.3% increase.

According to the most recent data, Amazon now has the majority of hosting hodes after increasing its market share by roughly 6% over the past 15 months to 49.19% from 43.27% in July 2022.

UPDATE: The figures on ethernodes charts do not appear to match those in the tables. The data analyzed follows the table.

The post French regulator calls out DeFi centralization as AWS gains 6% in ETH node market share appeared first on CryptoSlate.