In the wake of fabricated news asserting the U.S. Securities and Exchange Commission (SEC) green-lit Blackrock’s Ishares spot bitcoin exchange-traded fund, short positions worth $78.92 million were cleared out. This sum represented 57% of the overall $136.29 million in short positions erased in the last 24 hours.

Misleading Report on SEC Decision Shakes Bitcoin Market, Erasing Millions in Short Bets

On Monday, the crypto-focused media outlet Cointelegraph disseminated false information via social media platform X and its Telegram channel, triggering a more than 10% spike in bitcoin (BTC) value against the U.S. dollar.

The digital currency briefly touched $29,900 per coin before plunging to $28,100 per unit once the news was debunked. Cointelegraph, despite issuing an apology, was too late to prevent the market upheaval that resulted in the obliteration of $78.92 million worth of short positions.

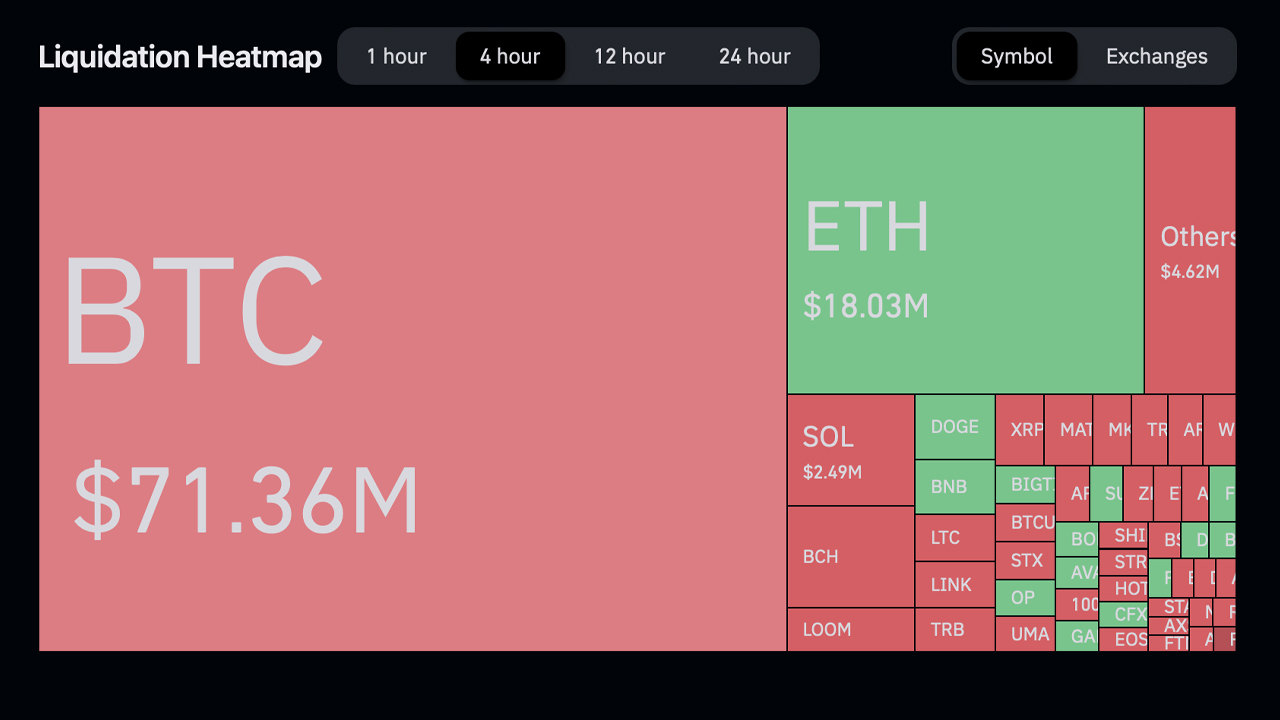

Data from Coinglass reveals that in the past four hours, BTC short positions accounted for $71.36 million of the liquidated shorts. Around $2.49 million in Solana (SOL) short positions were also liquidated, among others.

The $78.92 million represented a staggering 57% of the day’s total short positions liquidated in the last 24 hours. In the same four-hour timeframe, long positions in Ethereum (ETH) exceeding $18 million were also liquidated.

Following the exposure of the counterfeit news, short positions on Bitfinex dropped drastically. Concurrently, long positions on Bitfinex saw a surge before the false news was confirmed, but have since declined.

The fallacious news event led to a significant number of traders being liquidated, potentially deflating the speculation surrounding the actual decision. The most substantial liquidations came from BTC, ETH, XRP, BNB, and SOL.

What do you think about all the short traders who were wiped out over the fake news? Share your thoughts and opinions about this subject in the comments section below.