The ADA price has moved in tandem with the rest of the crypto market after a small rally but Cardano whales continue to threaten this positive price action. According to recent data, the balances of large ADA whales have continued to decline, suggesting that they may be selling off their substantial holdings.

Cardano Whale Balances See Large Drop

Over the last month, the balances of Cardano’s largest holders have been on a decline. This has occurred as the price of ADA has fallen but with each small recovery, these whales seem to be taking advantage of the market to sell at a profit.

The significant drop in balances over time has been noticed in the wallets holding between 1 million and 10 million ADA have fallen. This assertion is backed up by data from IntoTheBlock which shows a large decline in the holdings of these large holders.

Toward the end of September, addresses holding between 1 million and 10 million ADA held a total of 5.63 billion tokens. However, going into October, their balances began to drop by the millions. By October 15, their total balance was sitting at 5.41 billion, representing a drop of 220 million tokens.

At the same time that this was happening, larger whales holding between 10 million and 100 million ADA have been increasing their balances. Their holdings increased from 11.81 billion ADA to 12.26 billion ADA toward the end of September. It then saw a small reversal but in August, their holdings settled at 12.16 billion tokens, representing a 300 million increase.

This would suggest that while the 1 million to 10 million cohort had been selling, the 10 million and 100 million cohort had seized the opportunity to buy. This ended in a transfer of over 300 million ADA to these already massive whales, increasing their dominance in the market.

ADA Holders Plunge Further Into Losses

Amid the sell-offs from the 1 million to 10 million ADA cohort, Cardano holders continue to feel the impact of the bear market. Unlike the rest of the top 10 largest cryptocurrencies which have maintained a good profitability ratio, ADA has performed horribly.

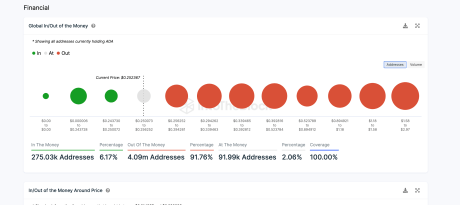

According to data from IntoTheBlock, only 6% of the almost 4.5 million ADA holders are seeing profit. A whopping 4.09 million addresses are sitting in losses, accounting for 91.76% of the total holder base. In contrast, 2.06% (91,990) addresses are breaking even.

ADA is currently trading at $0.25, a 91.84% drop from its all-time high price of $3.10, according to Messari. However, it remains the 8th-largest cryptocurrency with a market cap of $8.88 billion.