The community was ecstatic when Bitcoin prices spiked to around $30,000 on October 16 following unconfirmed reports that the United States Securities and Exchange Commission (SEC) had approved the country’s first spot Bitcoin Exchange-Traded Fund (ETF).

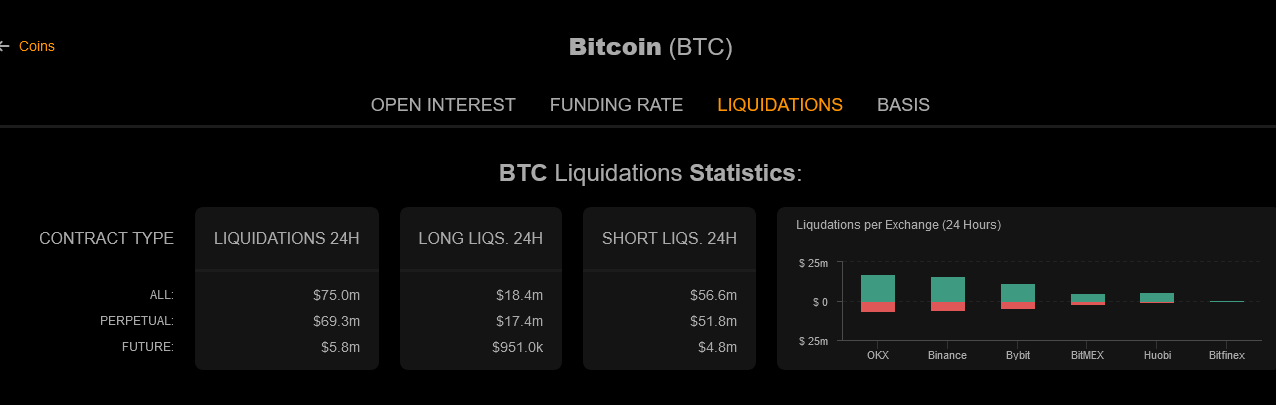

When the moment of fear of missing out (FOMO) had subsided, and alleged reports of the stringent agency approving the complex derivative turned out to be fake, prices swung wildly, almost wiping out gains made. As a result, over $74 million derivatives positions from across multiple crypto exchanges, mostly OKX, Binance, and Bybit, had been forcibly closed in liquidation.

Over $74 Million Of Bitcoin Positions Liquidated

At the time of writing, Bitcoin is trading at around $28,200, almost $2,000 down from October 16 highs, highlighting the level of volatility, especially in the BTC markets. Following the rally and sharp retracement, data from Coinalyze shows that $56.6 million short positions were liquidated.

At the same time, $18.4 million of long positions were closed. A big chunk of shorts, roughly $51 million, were from perpetual futures offered by exchanges like OKX, Binance, and ByBit.

Most traders were liquidated on OKX, with a big percentage shorting the price action. Specifically, $17.6 million of shorts were forcefully closed, with $6.24 million of longs closed. Similar positions in Binance and Bybit were also unwound.

The aggregated amount highlighted represents traders who aim to take advantage of price movements using leverage. With perpetual contracts, traders can go long (buy) or short (sell), using up to 100X leverage in some exchanges.

Leverage allows traders to increase their position sizes by borrowing funds from the exchange. In turn, the exchange will close a position if prices move against the trader, confiscating the collateral they had placed before opening.

Spot Bitcoin ETF Hopes

The rumor that the SEC had approved the Bitcoin ETF applied by BlackRock, one of the world’s largest asset managers, has been denied. As of mid-October, the SEC has yet to greenlight any spot Bitcoin ETFs from firms, including Fidelity. The SEC has been under increasing pressure to approve the product.

Approving a spot Bitcoin ETF by the SEC would be a breakthrough for crypto. Notably, it might simplify how institutions gain exposure to Bitcoin in a regulated manner. The broader community remains bullish on BTC in the coming months.

Coupled with the fact that the network will slash network rewards by half in 2024, some analysts expect prices to break above immediate resistance at around $32,000 following a spot BTC ETF approval.