New research shows bitcoin investors are rotating from long-term holders to short-term speculators, indicating the cryptocurrency market is recovering from the lengthy bear market.

Study Indicates Crypto Winter Recovery as Long-term Holders Give Way to Short-term Speculators

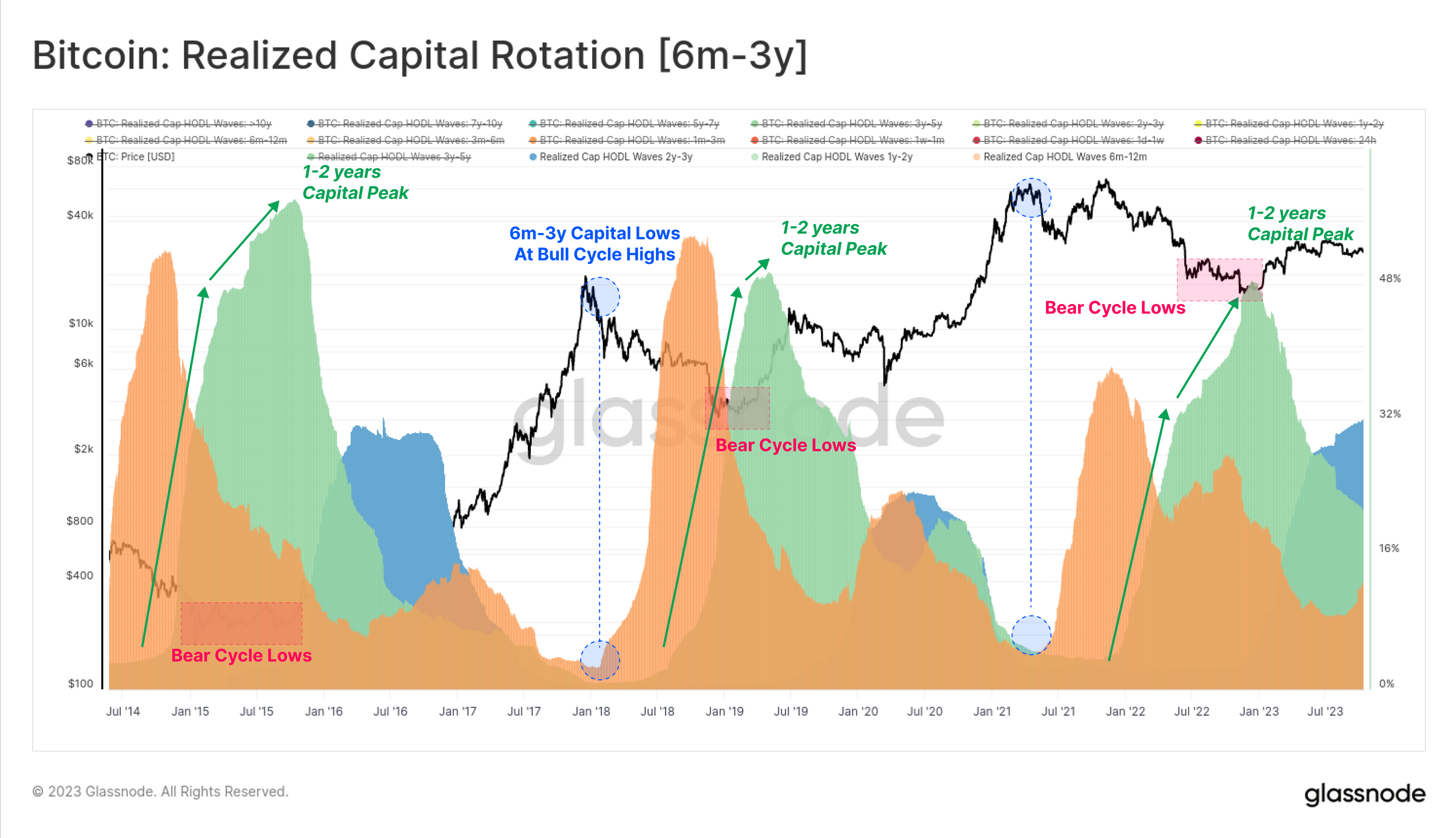

A recent report by the onchain analytics firm Glassnode examines how bitcoin (BTC) changes hands between investors over time. The study tracks the ebb and flow of coins moving from long-term holders who accumulated bitcoin during the bear market, to short-term speculators trying to profit on price swings.

Glassnode utilizes a metric called “realized capital” to measure the total amount paid historically to acquire all existing bitcoins. This offers a view into when coins last moved between investors. Glassnode then segments the bitcoin supply into “age bands” showing the distribution of dormant coins held for various time periods.

“During market uptrends older coins are spent and transferred from long-term holders to newer investors,” the report states. “During market downtrends, speculators lose interest and gradually transfer coins to longer-term holders.”

The report identifies coins held for 1-2 years as a key long-term holder cohort. This group’s holdings peak during bear market bottoms as conviction buyers accumulate. In contrast, bitcoins held less than a month represent short-term speculators. Their share of the bitcoin supply surges during bull markets as new money flows in.

By comparing the holdings of each group, Glassnode’s models show where the market sits in its cycle. The current structure resembles the recovery phase after a major bear market bottom, similar to 2016 and 2019. Bitcoin’s price has rebounded from lows, but long-term holders still control over 80% of the supply.

“The bitcoin supply remains strongly dominated by the HODLer cohort, with a super-majority of coins now being older than 6-months,” the report concludes.

In addition to tracking coin age, Glassnode also models the profitability of short and long-term holders based on their average cost basis. This gauges the financial incentive to sell versus hold at different price levels. Here again, the firm’s models indicate the market may have entered an early bullish phase where long-term holders are in profit, but short-term traders are near break-even.

What do you think about the recent Glassnode report about bitcoin changing hands? Share your thoughts and opinions about this subject in the comments section below.