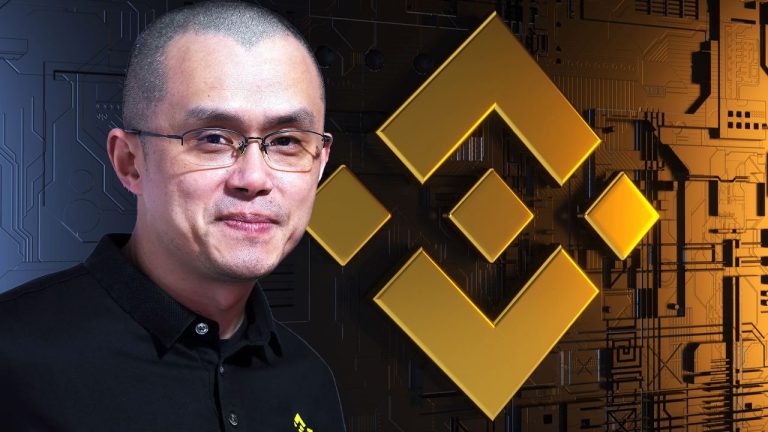

Binance founder and CEO Changpeng Zhao (CZ) has reportedly lost nearly $12 billion from his wealth amid declining crypto trading volumes this year. According to Bloomberg’s estimates, the world’s largest trading platform for digital assets has seen a 38% decrease in revenues.

Bloomberg Estimates CZ’s Wealth at Over $17 Billion in a Challenging Year for Binance

The Bloomberg Billionaires Index has cut its estimate of Binance’s revenues by 38% based on data showing that trading volumes on the platform decreased in 2023. This has erased $11.9 billion from the fortune of Changpeng Zhao, the exchange’s founder and chief executive.

In a report this week, Bloomberg said that CZ’s wealth has dropped to $17.2 billion. The news agency also noted it’s using spot and derivatives trading data from the crypto tracking services Coingecko and Coinpaprika to calculate Binance’s revenue.

In the first quarter of this this year, the leading crypto trading platform’s market share reached 62% of total crypto trades on exchanges. The report attributes the increase to the offering of zero-fee trading of popular pairs. When the promotion expired, Binance’s share dropped to 51% at the end of Q3, Bloomberg explained, quoting research firm Ccdata.

Binance is not the only major player in the industry affected by the crypto market which has suffered from high-profile collapses, like that of crypto exchange FTX, regulatory uncertainty, and rising interest rates in the fiat world that have increased the attractiveness of other investments. In the third quarter, the spot trading volume on Coinbase, America’s leading crypto exchange, fell 52% from a year earlier.

Besides declining trading volumes, has been dealing with heightened regulatory pressure as well. In the U.S., both the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) sued the crypto giant for alleged violations of securities and derivatives laws.

Regulators also accused the cryptocurrency exchange of circumventing rules to allow U.S. users to access its platform, lacking adequate money-laundering controls, inflating trading volumes, and mishandling customer funds.

This year, the trading volumes and market share of Binance’s American arm shrank when it announced it’s transitioning to a crypto-only platform that would no longer process U.S. dollar transactions. Bloomberg’s wealth index slashed its value to zero. In March 2022, Binance US had been valued at $4.7 billion and in January of that year, CZ’s net wealth had peaked at an estimated $96 billion.

Do you expect CZ’s wealth to increase with the end of the crypto winter? Tell us in the comments section below.