Drawing upon the latest statistics, ten nations are grappling with inflation rates surpassing 40% as of October 2023, while four countries are enduring inflation rates in excess of 100%. A look into the data curated by the International Monetary Fund’s World Economic Outlook reveals that the Venezuelan bolivar is weathering significant inflation at a rate of 360%, closely followed by the Zimbabwean dollar at a rate of 314.5%.

10 Nations Grapple With Soaring Inflation, Surpassing 40% and Shaking Economies

Numerous fiat currencies have faced challenges throughout 2023, resulting in a depreciation when measured against others. In essence, this inflation translates to a diminished capacity to purchase goods and services with the same amount of money, directly linked to decreased purchasing power. Inflation significantly influences consumers, and it equally disrupts businesses, leading numerous companies to collapse. Moreover, hyperinflation is typically characterized by monthly inflation rates that soar above the 50% mark.

As of October 2023, data from the International Monetary Fund (IMF) highlights that Venezuela is experiencing the world’s highest inflation rate at 360%. Situated at the northern tip of South America, the country has long been at the top of global inflation charts, with the Venezuelan bolivar persistently struggling against diminishing purchasing power. Zimbabwe’s dollar is also grappling with triple-digit inflation, registering at 314.5%, as per the IMF’s data.

This landlocked nation in Southern Africa has been wrestling with escalating inflation for a considerable period. In Sudan, nestled in Northeast Africa, the Sudanese pound is enduring an inflation rate of approximately 256.2%. For an extended duration, the country’s currency has been on a downward spiral, marked by significant devaluations and fluctuations in recent times. Meanwhile, in the southern hemisphere of South America, Argentina is facing its own economic turmoil with an inflation rate soaring to 121.7%.

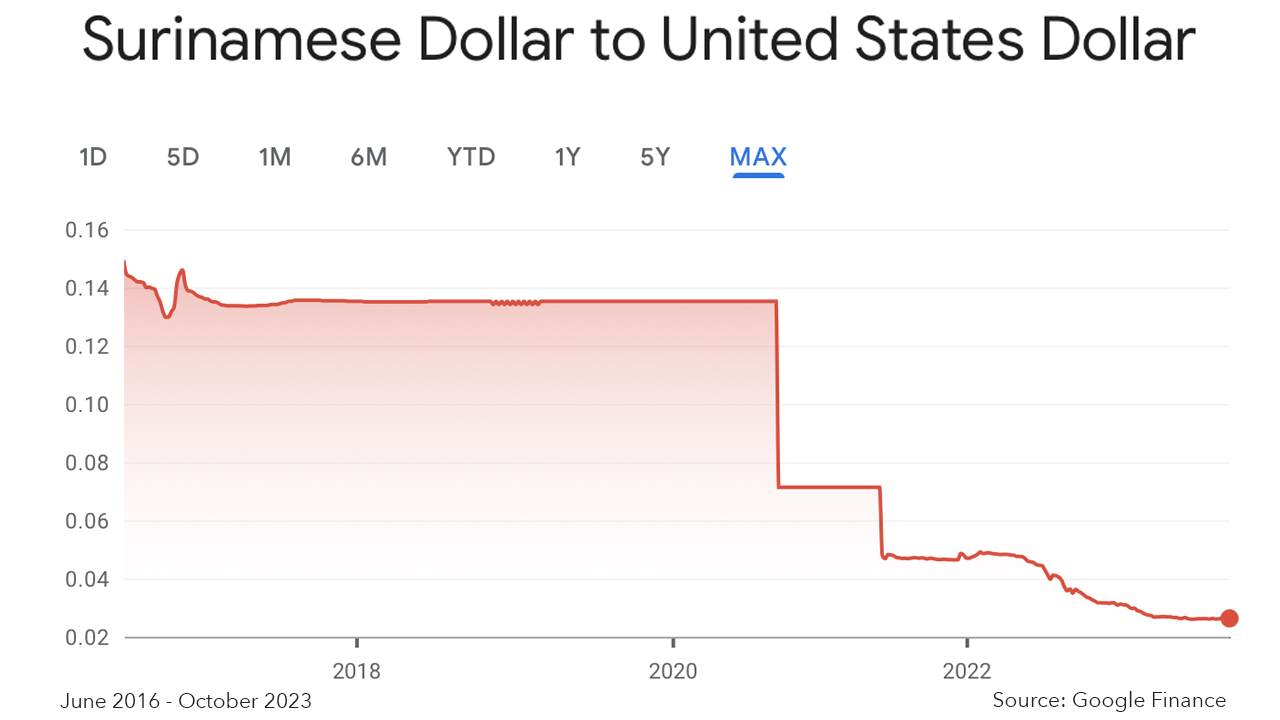

Argentina’s inflation saga is extensive, with a significant driver being the swift increase in money supply. Over the previous year, the Argentine peso has witnessed a substantial decline in purchasing power. On the other hand, Suriname, the smallest sovereign nation in South America, is experiencing an inflation rate of 53.3% as of October 2023. The inflationary pressures in Suriname stem from a myriad of factors, including rampant money creation, fiscal imbalances, and external disruptions. Notably, the Surinamese dollar (SRD) underwent a 228% devaluation from August 2020 to October 2021.

Meanwhile, Turkey, straddling the borders of Southeast Europe and West Asia, is contending with an inflation rate of 51.2%. This economic challenge is fueled by Turkish President Recep Tayyip Erdogan’s unconventional stance favoring low interest rates. Turkey’s economic narrative has been punctuated by numerous instances of rapid and prolonged inflationary periods. Venezuela, Zimbabwe, Sudan, Argentina, Suriname, and Turkey presently top the global charts with the six highest inflation rates.

Finding Refuge in Barter Systems and Digital Currencies

Completing the list of the top ten nations grappling with the highest inflation rates are Sri Lanka (48.19%), Iran (47%), Haiti (43.6%), and Sierra Leone (42.9%), with Ghana closely following in the 11th spot, experiencing an inflation rate of about 42.2% as of October 2023. Residents in each of these countries are adopting various strategies to mitigate the effects of inflation.

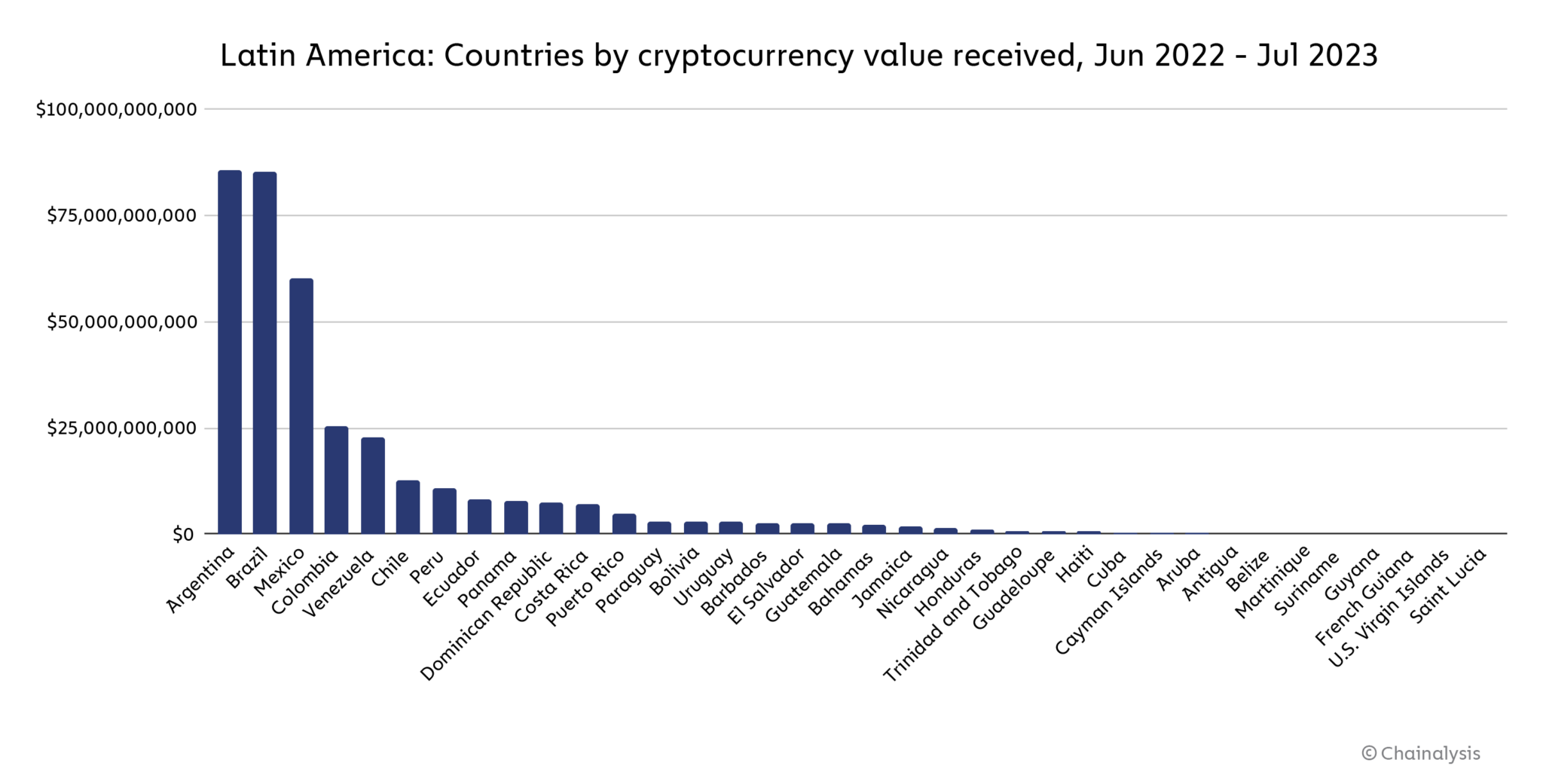

These include engaging in barter systems, trading goods and services directly rather than relying on their weakening national currencies, and increasingly turning to digital currencies like bitcoin (BTC) and stablecoins. Numerous reports underscore the prevalent use of cryptocurrency in the regions most affected by inflation. In Venezuela, USDT is a popular means of settlement.

“Venezuela has had one of the worst ever hyperinflation rates at over 1 million percent,” one citizen told Chainalysis in an October 2023 report. “Cryptocurrency, particularly stablecoins, has helped many Venezuelans overcome this.”

Both the general populace and financial institutions in Zimbabwe are increasingly exploring crypto assets. In Argentina, economic uncertainty has led residents to lean on crypto assets and stablecoins, while in Sudan, there has been a noticeable shift toward digital currencies. Additionally, besides the U.S. dollar, the Turkish lira is gaining traction as one of USDT’s leading trading pairs globally. These borderless financial assets offer individuals a viable alternative, empowering them to preserve their wealth against an inflating fiat currency.

What do you think about the ten countries with inflation above 40%? Share your thoughts and opinions about this subject in the comments section below.