The divergence between Bitcoin’s price and the sentiment surrounding it might signify an oncoming bearish trend in the future. Negative feelings and comments about Bitcoin seem to be outweighing the positive ones, potentially leading to a shift in its trajectory.

This surge in negative sentiment contradicts the surges in Bitcoin’s price and trading activity witnessed in recent days. Despite its current value at $34,100, a downturn in overall sentiment regarding BTC has emerged.

Interestingly, the correlation between Bitcoin and gold has remarkably elevated positive sentiment around the leading cryptocurrency, as it is increasingly perceived as a hedge against economic uncertainty.

At the time of writing, Bitcoin was moving toward the key $35k level with a 0.7% increase in the last day, and a solid 11.4% in the last week, according to figures by Coingecko.

Bitcoin: Appeal Increasing As Form Of Investment

Although a recent drop in sentiment about BTC has been observed – at least during the timeframes when the crypto started bouncing back and forth between the $34K level – it was gaining popularity as an investment overall.

Bitcoin’s connection with gold had reached the highest level since the banking crisis broke out earlier this year, recent data have shown.

Since the start of this year’s banking crisis, data shows that the link between Bitcoin and gold has skyrocketed. This trend is notable because it shows a growing correlation between Bitcoin and gold.

BTC’s correlation to gold is the highest that it’s been since the banking crisis earlier this year pic.twitter.com/tF5juTJx1k

— Will Clemente (@WClementeIII) October 28, 2023

This suggests a possible shift in investor behavior toward safe-haven assets like precious metals and digital currencies in times of economic turmoil.

Amidst the present economic unpredictability, traders are aggressively looking for ways to protect their investment. Gold has always been the conventional safe haven investment choice during times of unrest.

As uncertainty looms large, traders and investors are diversifying their strategies beyond the conventional reliance on gold. This evolving mindset reflects a growing interest in alternative asset classes, including cryptocurrencies like Bitcoin, marking a shift away from the traditional perceptions of wealth protection.

More traders are now setting their sights on the alpha crypto as the next big thing in investment

The Role Of Miners And Stability Of Bitcoin

The scarcity of Bitcoin is increasingly becoming a focal point that experts believe could have a significant impact on its future price trends. As the creation of new Bitcoins slows due to the escalating mining difficulty, the overall supply of Bitcoin is affected.

The rising mining difficulty, a reflection of the increased computational effort required to mine new Bitcoins, not only affects the supply but also influences the stability of Bitcoin.

The recent surge in mining difficulty has made the process of creating new coins more challenging. Consequently, this factor could have a profound effect on the overall supply of Bitcoin in the market, potentially leading to increased scarcity.

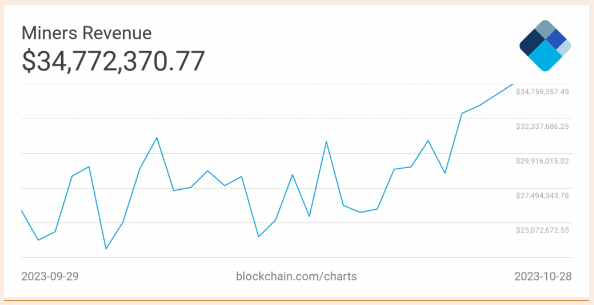

Source: Blockchain.com

Stabilizing The Crypto Market

The relationship between miner profitability and selling pressure underscores a crucial aspect of Bitcoin’s stability. As miner revenues rise, the reduced willingness to sell holdings diminishes the overall market selling pressure, which is pivotal for the stability of Bitcoin.

As Bitcoin gains traction as a hedge against economic instability, the ongoing debate centers on its potential to surpass gold as the new go-to safe-haven asset. The comparison between Bitcoin and gold unfolds, signaling a shift towards Bitcoin’s prominence in the dynamic financial landscape.

Featured image from Shutterstock